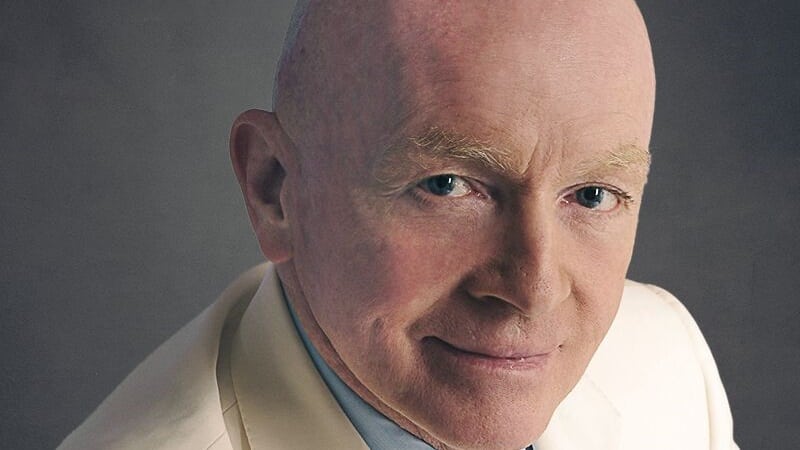

Mark Mobius does not expect to see meaningful inflows into his emerging markets funds until markets are up at least 30%, despite an improving picture for many ‘problem countries’ like Argentina and Brazil that have spooked investors this year.

Speaking on the first day of Bloomberg’s Buyside week, the emerging markets veteran blamed timing and “bad sentiment” for not being able to raise more money for his debut investment trust post-Franklin Templeton. Mobius had been looking to raise between $100m and $400m but only managed to scrape together enough to meet the lower end of his target.

Similarly, Mobius said he doesn’t anticipate seeing any money coming into his Sicav vehicle, which launched a week before the trust listed on the LSE, “in any great extent” until markets are up between 30% and 50%.

Emerging markets irony

Mobius said the “irony” is weeks later “we’re out of the bottom of many of these markets” with countries like Brazil and Argentina rebounding following critical elections and Turkey also perking up slightly following the release of US pastor Andrew Brunson, who had been held by the government for two years for his alleged involvement in a 2016 attempted coup.

“It’s the story of our life. Frankly when things are down, money doesn’t come in”.

Mobius said the asset class remains unloved despite sharp recoveries in recent emerging market pain points because investors have been focusing too much on the index.

“If the index is affected by a downturn in China, then everybody says, ‘Oh, emerging markets are down, better forget about them’. Meanwhile Brazil is recovering or maybe Turkey will recover dramatically and they miss that opportunity.”

Trade war will get nastier in the short-term

In the short-term he expects the situation between the US and China to get “a little more nasty” before it gets better.

Mobius said “there is no question” the Trump administration will continue to put pressure on China by raising tariffs and levelling accusations about election meddling for at least “another half year or so”.

China will counter this by weakening the renminbi in a “gradual and very controlled way”. “If Trump adds a 25% tariff that’s how much the renminbi will weaken”.

However, he said America’s $300bn deficit “which puts every other country to shame” will mean the standoff ultimately ends in an agreement “that will make everybody feel comfortable globally”.

In the meantime, Mobius said investors should not write off Chinese companies, many of which are strategically positioned to withstand a weaker renminbi.

“I keep on reminding people in such cases there are winners and losers. There are many companies that are in a very strong position because of the way they position themselves in regard to the currency. Many of them have already moved manufacturing out of China to other parts of the world.”