Investing in real assets has been part of Sanlam’s multi-asset strategy since its launch, but it was a request from an institutional client for a standalone product that inspired Mike Pinggera to carve out an independent strategy two years ago.

Pinggera joined Sanlam from Insight Investment in January 2013, just ahead of the Multi-Strategy Fund launch. At Insight, he led the multi-asset group and, before that, spent 20 years at Credit Suisse in roles including head of special mandates and head of trusts and charities.

The £410m Multi-Strategy Fund is an absolute return vehicle that uses thematic and systematic strategies to target equity-like returns, defined as Consumer Price Index (CPI) plus 4% per year over rolling five-year periods. Thirty per cent of the mandate is allocated to real assets and so launching a standalone strategy was a natural next step.

“It was an institutional investor who about two years ago said, ‘I like the absolute return fund but I could use the real asset strategy on its own in a much greater portion of my global allocation’, and hence we carved real assets out.”

Investing in ‘the pillars of a functioning economy’

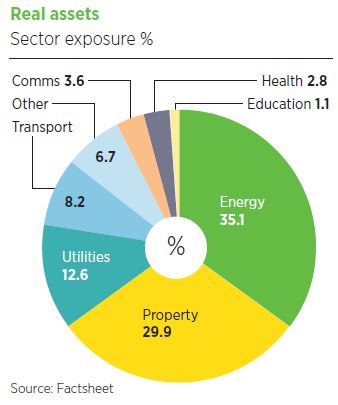

The £282m Real Assets Fund was launched in August 2018, and it also targets CPI plus 4%. The process is based on what Sanlam calls “the pillars of a functioning economy”, which Pinggera lists as education, housing, transport and healthcare. On top of that, the strategy invests in energy, food and water.

These themes can be broken down further to infrastructure, including schools, roads and hospitals; renewable energy, including wind, solar, hydro and anaerobic digestion; and specialist property, including private rental housing, student accommodation, distribution centres and data storage centres.

The team then supplements these main areas if it unearths opportunities in more niche areas such as music rights, which Pinggera says is fast approaching becoming a £1bn market cap industry.

“There’s nothing particularly unique here,” he says, “we’re not claiming to have identified any great new mega trend that other people aren’t aware of. But we felt given the level of intervention by the authorities and the amount of uncertainty present in the world, it made sense to concentrate on areas where we had just a much greater certainty of return.”

Once the team of four has identified headline themes, it is a case of undertaking “old-school fund management” and hunting for ideas that fit the bill. Ideas that stand out tend to have contractual income streams, preferably with inflation linkage, which Pinggera says is an attractive characteristic in today’s capital markets.

The market backdrop is completely different to when infrastructure funds first launched

“The first listed infrastructure vehicles came to the market in 2006, so they’re not new. But, of course, in 2006, the yield on bonds was much higher than it is today. What’s happened through the passage of time is the characteristics of these types of investments have become more attractive as government bond yields and bond yields have compressed elsewhere.”

Pinggera doesn’t see this trend going away. “UK 10-year bonds are yielding 10 basis points, and five-year bonds are negative already,” he continues. “If you look across my portfolio, the average weighted contract duration is about 10 years, with a portfolio yielding about 3.9%. But that means over a 10-year holding period, which is a reasonable time frame, you’ve got 40% income as opposed to a government bond where you’ll get 1%.”

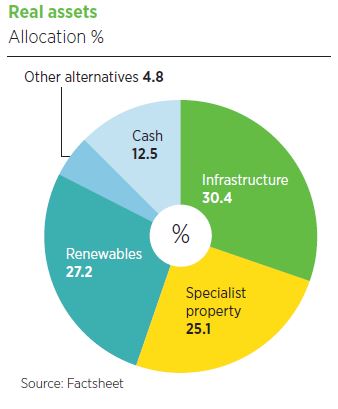

Liquidity has been such a big talking point of late, especially regarding property, after open-ended vehicles were forced to freeze trading because of issues valuing underlying holdings. Specialist property accounts for 25% of Pinggera’s portfolio, but he’s quick to point out everything the fund owns is a listed company.

“I’m agnostic in terms of structure,” he says. “I’m happy to buy Reits and investment companies. We look at the underlying assets of the business as opposed to the structure.

“We are not a fund of funds so we would never invest in an open-ended vehicle. That means we’re facing the stock market for liquidity, as opposed to trying to create units versus the underlying assets. With regard to the difficulties in property funds, I’m an innocent bystander.”

Liquidity is also controlled by the fact the fund does not own more than 3% of any company. Pinggera explains his intention is to invest small stakes in companies in their fledgling state when they are in the growth phase and grow with them as they raise fresh capital.

“We never take large positions in small companies, but we do take initial positions. Then hopefully if the management team delivers on its expectations and on our expectations, that will grow over time,” he says. “I guess it’s good liquidity 101: don’t own too much of one business.”

Student accommodation versus supermarkets during Covid-19

Asked if March’s sell-off hit any of the fund’s holdings, Pinggera refers to FTSE 250 student accommodation provider Unite, which cancelled its dividend that month on the expectation all of its revenue would stop. However, as the weeks and months passed, it found more students than expected remained in place.

“They’re now looking to reinstate the dividend in the next academic year, so there was a pause but it wasn’t as bad as people thought.”

Supermarkets at the other end of the spectrum collected 100% of their rent on time and raised fresh capital to purchase new assets, he adds.

“Property hasn’t been an area of distress for us. In fact, the best-performing asset in the portfolio year to date is a property company, a data centre business, which is up 36%.”

According to Pinggera, infrastructure, which accounts for 30.4% of the portfolio, has been a “steady” performer during lockdown but this has been eclipsed by renewable energy, 27.2% of the portfolio, which is “strong”.

“One of the big winners of the lockdown has been the environment – blue skies in Mumbai, clear waters in Venice, not least the weather in the UK. The impact that global pause had on the environment was clear for everyone to see and there’s been a big shift up the agenda in terms of that environmental focus. So renewables have really done quite well.”

The worst sell-off in Pinggera’s three-decade career

The fund has returned 20.09% since inception, compared with 8.69% from UK CPI plus 4%, and 7.66% from the IA Specialist sector average. The fund is down 2.2% year to date, according to FE Fundinfo data, compared with the IA Specialist sector average of -2.7%.

But while Pinggera prefers to see the fund’s performance on a screen as a green number, he’s content with how the fund came through the “brutal” sell-off.

“I’ve been in the markets 31 years and that was the worst because of the speed of the sell-off. If I consider just how bad it was and then I look at where we are today, I’m happy.”

In the midst of the sell-off Pinggera found reassurance in a lesson he’s learned over the past 30 years: the moment corporate communication starts flowing through to the market is when you can start to pick which companies have done well and which could have problems.

“Up until the point a company comes out and tells you, ‘This was our rent collection’, ‘This was our position’ or ‘This is what our view is on the dividend’, everything is just a guess,” he says. “We felt relaxed because we had a view that corporate communications would start to normalise the portfolio, and I’m pleased to say that’s what happened.”

According to Pinggera, this is exactly how things played out during the credit crisis. When the initial listed infrastructure vehicles were launched they were uncontested. But when the crisis hit, the shares sold off rapidly and languished for a couple of months until these companies made their next quarterly announcements.

“This is where they said, ‘Those schools, roads, hospitals and libraries we own are all still there, they all paid their rent and here is the dividend’ and then the shares rallied. So we had a template for how these assets behave in a crisis.

“It doesn’t make the journey, any more comfortable though,” he adds with a smile.

Pinggera thinks the authorities won the first round of Covid, given the scale of the stimulus was able to stabilise economies, but questions remain about the future. “Is there a round-two battle, in which case, can they maintain the level of financial support? Are we going to see structural changes?”

If there is a significant second round of Covid, Pinggera believes the companies that had the ability to navigate round one are likely to survive further bouts of volatility, even with a lack of government and central bank stimulus.

“Maybe the first move was very much a beta one,” he ponders. “The second round, if there is one, could be an alpha move, so perhaps more stock-specific.”