Jupiter has landed in the dog house thanks to its recent acquisition of rival Merian Global Investors which saw its level of underperforming assets more than double to £4.1bn in Bestinvest’s latest edition of Spot the Dog.

The twice-yearly report from Bestinvest revealed £49.6bn worth of savings were tied up in 119 dog funds, those that have underperformed the market more than 5% after fees over three years.

The number of lumbering laggards was down from the record 150 funds named and shamed six months ago but still 31% higher than the 91 funds in the kennel a year ago.

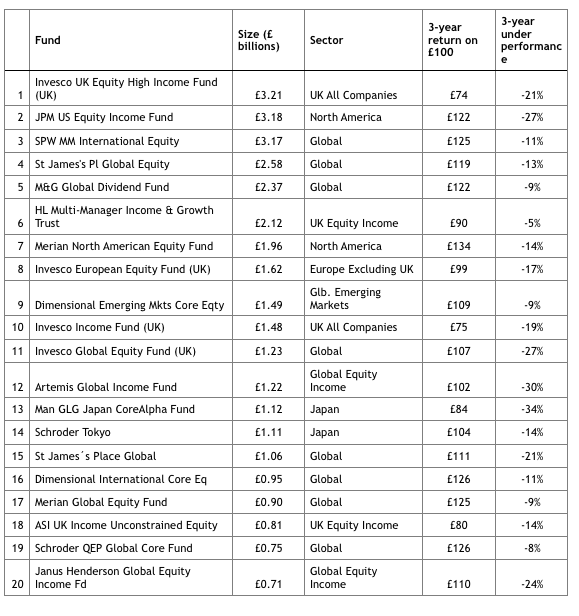

Among them were 15 “Great Dane” sized funds that held £1bn in assets or more.

Biggest beasts in Spot the Dog by fund size

Jupiter becomes ‘a rescue home for two sizeable beasts’

While some fund groups saw a decline in the number of underperforming funds, including last report’s top dogs Invesco and St James’s Place, Jupiter saw a dramatic reversal of fortunes, jumping from ninth to second place in Bestinvest’s rankings.

Though its number of dog funds only increased from 7 to 8 in the six months since the last report, the number of assets trapped in “investment duds” doubled from £2.1bn to £4.1bn.

This was down to its acquisition of Merian which made it “a rescue home for two sizeable beasts” – the Merian North American Equity fund and the Merian Global Equity fund.

The £2bn Merian North American Equity was the biggest beast in Jupiter’s enlarged pack, coming in at seventh on Bestinvest’s list of laggards after underperforming its benchmark by 14% over three years. The £0.9bn Merian Global Equity fund fell 9% over the same timeframe.

But the worst performers of Jupiter’s pack were two mutts from its existing range, the £141.1m North American Income and the pint sized £16.4m Global Equity Income funds which slumped 33% and 20% relative to their benchmarks over three years.

Other funds in the dog house include its £510.4m UK Growth fund, which a year ago was handed over to Newton manager Christopher Smith following a performance slump, and the £36.6m Growth & Income fund, run by Alastair Gunn.

SJP and Schroders not far behind

But it was a tight race for second place with SJP and Schroders each sporting around £4bn worth of their own dog funds.

SJP which was the runner up in Bestinvest’s “Hall of Shame” six months ago came in third this time around with four poorly performing pooches, including the £2.6bn Global Equity fund which underperformed the market by 13%. But this was an improvement on the last report where nine of its funds, containing £6.9bn worth of assets, were named and shamed.

Once again SJP criticised Bestinvest’s analysis of not making accurate like-for-like comparisons. SJP’s fund performance is shown net of all charges, including ongoing advice and administration, so it is unfair to compare it against others in the list which are not calculated in the same way, a spokesperson said.

Schroders rose from fifth to fourth place in Bestinvest’s rankings with 11 dog funds, including two Great Danes – the £1.1bn Schroder Tokyo and £0.8bn Schroder QEP Global Core funds.

However, it missed out on being the runner up in the dog house on a “technicality,” the report noted. Its paw print was also found on the £3.2bn Schroders Personal Wealth MM International Equity fund, the third biggest beast in the 119 duds identified by Bestinvest, which if included would have seen it soar past Jupiter to snag second place.

A spokesperson from Schroders said: “As an active manager we recognise that there will be periods of underperformance given where we are in the market cycle and the significant impact of the global pandemic. We regularly review our funds to ensure we understand the reasons for underperformance and whether any action is required to improve outcomes for our investors. We remain confident that our strategies can outperform over the long term.”

Invesco top dog sixth time in a row

Henley-based fund group Invesco took the ‘top dog’ spot for the sixth time running with 11 funds worth £9.2bn in the kennel. This was down from the previous report where it had 13 dog funds with £11.4bn of assets between them.

The £3.2bn Invesco UK Equity High Income fund, previously run by Mark Barnett, was once again the largest Great Dane in Bestinvest’s list, losing 21% over the period, and the ex-manager’s £1.5bn Invesco Income fund also featured in the top 10. Both funds have been overhauled following Barnett’s departure with James Goldstone and Ciaran Mallon taking the reins.

Invesco has been going through a shake-up over the past year under the direction of CIO Stephanie Butcher. “This is clearly a work in progress,” Bestinvest noted in the report.

An Invesco spokesperson stressed the Spot the Dog report was a “snapshot covering a specific time period and methodology” and that the company had evolved since then.

“Invesco as a global business has continued its strong growth over the last 12 months and finished 2020 with record assets under management of over $1.3tn,” they said.

“Our UK business has undergone significant and positive change across our product range over the past year to better align to client needs, whilst remaining true to our high conviction, engaged and disciplined approach to investing.

“We have the investment expertise and experience across all major markets to continue to ensure our business remains innovative and competitive and we remain committed to supporting our clients with their investment goals and provide them with the best investment experience along their investment journey.”