Time is running out to meet the global goal of reaching carbon neutrality and limiting global warming to 1.5⁰C. As governments, businesses and consumers grapple with different ways to accelerate the environmental and energy transition, it’s becoming increasingly clear that everyone has a role to play – including fixed income investors.

Green bonds have emerged as a credible and measurable fixed income solution for helping to finance a radical transformation of the energy mix. The openness to engagement, free dialogue and sharing of best practice makes the green bond market one that governments and policy makers worldwide are keen to promote.

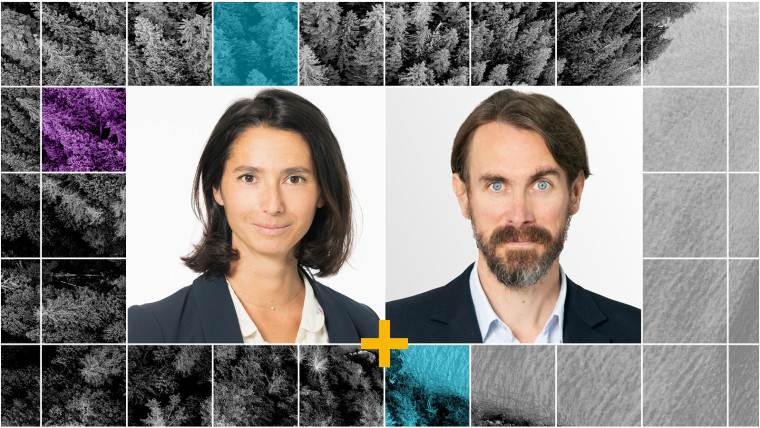

In 2022, the brutal macroeconomic headwinds that challenged global bond issuance across the board also saw green bond volumes fall year-on-year for the first time in a decade1. Bertrand Rocher and Agathe Foussard of Mirova explain why 2023 looks brighter for the sustainable fixed income landscape.

Read more about the topics covered in this Q&A, such as:

- What the team sees as the attraction of green bonds for investors

- What investors should know about the market for green bonds

- Whether a higher rate environment makes green bonds more attractive than conventional bonds

- Why there tends to be longer duration at the aggregate level

- The particular challenges sovereign issuers might pose in terms of transparency

- Measuring and reporting the impact of green bonds, given fears around greenwashing

- What keeps the team motivated and excited about investing in green bonds.

“We expect the markets to expand this year and we hope to have more visibility for fixed income markets and bond issuers generally.”, Agathe Foussard CFA*

Mirova is an affiliate of Natixis Investment Managers.

*CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

1 Source: Climate Bonds Initiative, 2023 https://www.climatebonds.net/2023/04/green-and-other-labelled-bonds-fought-inflation-reach-usd8585bn-2022