Football may not be ‘coming home’ just yet – after Italy overcame England in a dreaded penalty shoot-out to be crowned 2020 UEFA European Football Champions – but UK investors certainly are. According to analysis by Last Word Research, fund selectors, wealth managers and other UK-based professional investors are now strongly targeting domestic equities.

The latest round of Asset Class Research has revealed UK equities as the most popular destination for investors’ money over the second quarter of 2021, with nearly all respondents reporting some domestic exposure. Indeed, just 7% of UK fund selectors now say they do not use this asset class at all.

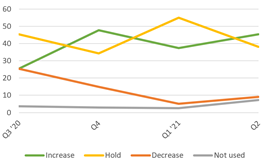

This continues a trend dating back to the middle of last year, with buyers of UK equities consistently outnumbering sellers over the last half of 2020 and the first quarter of 2021. As Chart 1 illustrates below, nearly half of top fund selectors across the UK are looking to increase their allocation to domestic equities over the coming 12 months.

Chart 1: 12-month buying intentions of UK fund selectors – UK equities

Source: Last Word Research

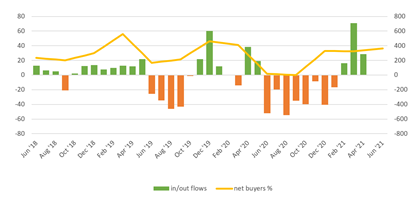

To test the Fund Flows conclusions, Last Word Research overlaid the net sentiments of its UK respondents with fund flows data provided by Morningstar. As Chart 2 illustrates below, for example, the intention to decrease allocations to UK equities that was signalled by respondents between March and June 2019 duly materialised as some £1.4bn left the sector between June and September that year.

Chart 2: 12-month buying intentions v fund flows – UK equities

Source: Last Word Research & Morningstar

Similarly, in the third quarter of 2020, when money was pouring out of UK equities, UK-based respondents to the Fund Flows survey indicated their intention to increase their allocation to the asset class. According to Morningstar, investors subsequently moved more than £1.1bn into UK equities between February and June 2021.

Stars align

While the stars may not have aligned for England’s penalty-takers last night, then, UK fund selectors clearly believe the outlook is brightening for domestic equities and are backing that view with fund flows.

Last Word Research will be paying close attention to this asset class over the coming months – and, with the 2022 World Cup just around the corner, despondent England fans will be hoping it will not be very much longer before football can follow the example being set by UK equities.

Lottie McGurk is head of research at Last Word Media. The data in this article is taken from a much larger report. If you are interested in subscribing to our quarterly reports, please contact Frank.Reed@lastwordmedia.com