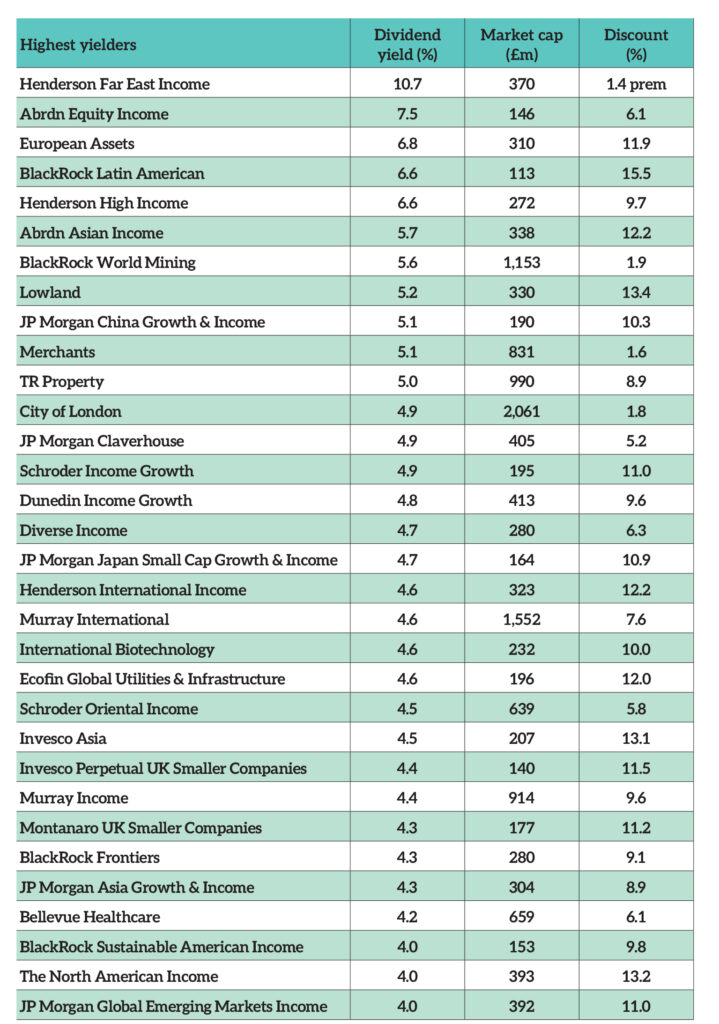

Investing in a trust that predominantly holds equities can prove volatile, so finding one with a high dividend yield can offset some of this risk and put investors’ minds at ease. That is why Lipper Funds have identified the 32 equity trusts with yields exceeding 4%.

This blend can therefore give investors a steady source of revenue without having to sacrifice on capital growth.

At the top of the list was Henderson Far East, with a sizable yield of 10.7%. Despite being one of the worst performing trusts in the IT Asia Pacific Equity Income sector over the past decade (up 53.4% versus the peer group’s 97.7%), it is the only one to trade on a premium. Shares in this £367m trust sell at 1.4% above its net asset value (NAV).

Its high yield may be eye-catching, but Hargreaves Lansdown investment analyst Henry Ince said that those holding the trust should be willing to take some risk.

“It could be used as part of a more adventurous income portfolio, as it invests in some higher-risk emerging markets,” he said.

Much of Henderson Far East’s underperformance came from its weighting in China, which manager Mike Kerley – who will retire in June – has since lowered this to 14.3%.

Ince added: “There are no guarantees how the trust will perform in future though and investments in companies based in Asian and emerging markets means performance will be volatile at times.”

Investors who want a less volatile and cheaper allocation to the region may want to consider two other trusts highlighted by Lipper Funds – Abrdn Asian Income and Schroder Oriental Income.

The Abrdn portfolio offers investors a yield of 5.7% at a discount of 12.2%, while the Schroder trust yields 4.5% and trades 5.8% below is NAV.

Cost-conscious investors may have their head turned by the cheapest trust on the list, BlackRock Latin American, with its considerable discount of 15.5%. It offers a yield of 6.6%, but researchers at Lipper Funds cautioned investors that it may not be sustainable.

It is one of nine trusts on the list that pays out a fixed amount of their NAV in the form of dividends – a benefit in upward markets, but a detractor when conditions aren’t so rosy.

The report said: “Investors need to be aware that in years when the NAVs on these trusts fall, the total dividend paid and the prospective yield in the following year are also likely to decline, as we have seen in several cases in the past year or two.”

See also: FE Fundinfo: Gold and commodities top the charts for April