Bond funds saw their heaviest year-to-date inflows in September, according to the latest UK market analysis from LSEG Lipper.

Inflows of £11.59bn to bonds struck a sharp contrast with equities, which collectively shed a net £1.62bn.

Sterling bond strategies were popular, as corporates, government, and inflation-linked took in £1.53bn between them.

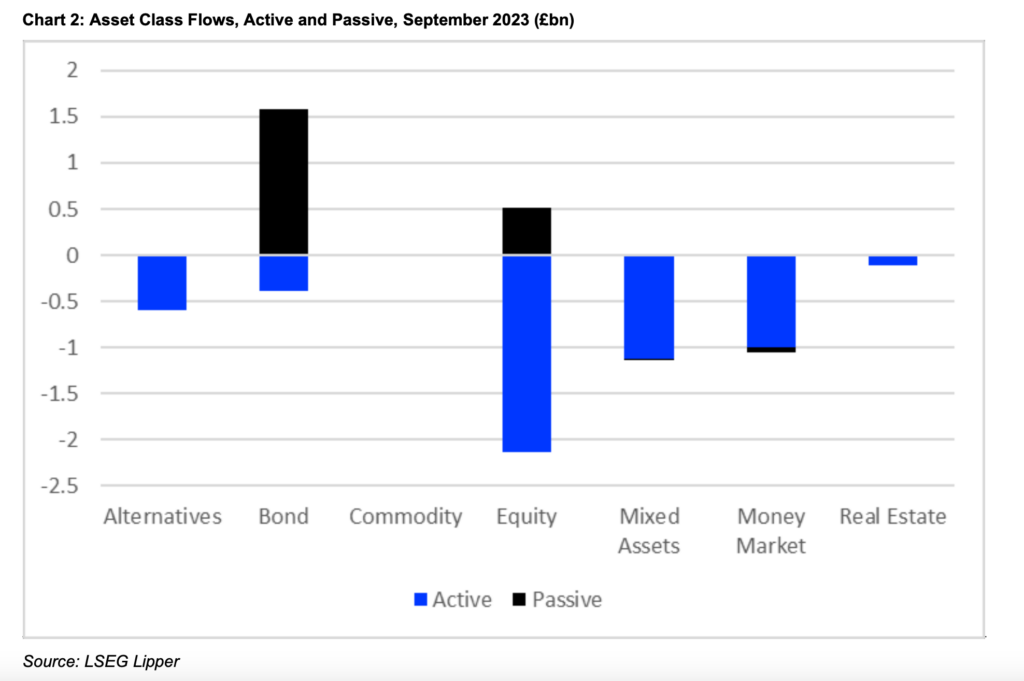

In terms of active versus passive flows, the figures also sat on opposing sides of the ledger. Passive funds in total saw inflows of £2.06bn, while active funds suffered outflows of £5.36bn.

See also: PA ANALYSIS: The trials and tribulations of investing in European equities

Passive bond funds pulled in £1.58bn and equities drew a net £516m over the month.

Over the year-to-date, £58.43bn has been redeemed from the UK fund market, LSEG Lipper found. Of this, most is accounted for by the £54.22bn of money market redemptions, but the remaining £4.21bn is still significant. Only bonds and mixed-assets funds have positive flows for the year.

Turning to sustainable fund flows and the figure was in positive territory at £1.61bn. BlackRock was the top-selling fund manager, with net flows of £5bn.

Dewi John, head of research, UK & Ireland, for LSEG Lipper, commented: “This was supposed to be the year for bonds. Shame that no-one told the bond market. September saw yields creep further up to pre-financial crisis highs on both sides of the Atlantic.

“This begs the question: when is a good entry point? Spoiler alert: it wasn’t January 1. For the first three quarters of the year, UK market bond funds are more or less flat (at -0.09%), as rising rates have continued to undermine fixed income portfolios.

See also: Rising bond yields: A one-off adjustment, or a warning light for investors?

“Treasury yields rose by about half a percent in September alone. Money market funds have delivered 2.95%, more or less in line with equity funds,” John said.

“Is it the Fed signalling higher for longer that’s having this effect, as the market slowly digests this unpalatable possibility, or is it the supply/demand dynamics of quantitative tightening? Both are plausible and will likely continue to be a drag on fixed income returns.”