The Lindsell Train Investment Trust is changing the way it values its stake in Nick Train’s eponymous fund boutique, its largest holding, in a bid to improve transparency.

The board of directors said it had decided to swap to a new methodology “after taking professional advice”.

It is designed to be as “transparent as possible so that shareholders can themselves calculate how any change to the inputs would affect the resultant valuation”, the board added.

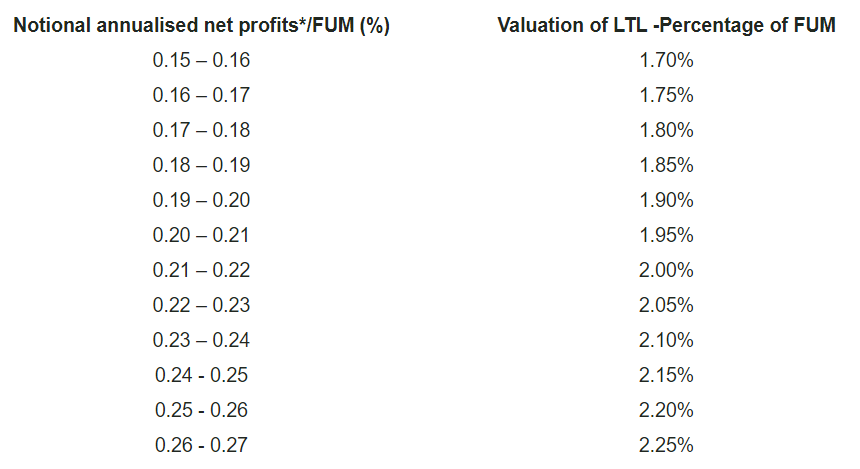

Lindsell Train Limited’s valuation will now be based on a sliding scale of percentage of funds under management (FUM), ranging from 1.7% to 2.25%, which increases as profits grow.

Additionally, LTL’s valuation will be updated monthly instead of quarterly, with effect from 31 March 2022.

The £232m trust currently has a 24.2% stake in LTL. It is the single largest holding in the portfolio by a longshot, representing around 45% of net assets, meaning its fortunes have a huge bearing on the investment company.

New calculation ‘simpler’ and takes stock of LTL’s surge in assets

The board said the “simpler” calculation provides a better reading of “the changing economics and prospects” for LTL, which has seen FUM balloon in recent years.

Historically, the value of the business was based on a “simple average” of 1.5% of FUM; and adjusted net earnings calculated with reference to LTL’s most recent end month’s FUM, divided by the annual average running yield on the longest dated UK government fixed rate bond, subject to a minimum yield of 4% plus an equity risk premium of 4.5%.

LTL’s annualised notional net profits were £42.6m at the end of March and its FUM was £20.5bn. Under the new methodology, this gives it a valuation of £15,024.84 per share.

This is 1.3% less than its valuation under the old methodology, which works out to £15,219.25 per share.

At the end of March 2021, LTIT’s quarter stake in the business was worth £114m, effectively valuing the fund boutique at £456m.

LTL valuation comparable to similarly sized listed managers

Numis described the change in approach as “sensible”. The new methodology gives LTL an implied price to earnings (P/E) valuation of 8-11x, which Numis notes is “comparable to small, listed management groups, albeit LTL shares have less liquidity”.

It noted that LTL’s strong performance has helped the trust deliver impressive long-term performance. It was responsible for the lion’s share of LTIT’s 29% boost to NAV in the year to 31 March 2021, delivering a total return performance of 40.8%, over double the gains of its quoted portfolio.

However, over the past year, LTL’s funds have had a more difficult time as its preferred quality growth style has come under pressure in the rising inflation and interest rate environment.

Its performance woes have caused some investors to head for the exit, with Lindsell Train UK Equity losing £1.1bn to redemptions in 2021 and Lindsell Train Global Equity £435m, according to Morningstar estimates.

This has greatly impacted LTIT, which has gone from trading on “excessive premiums” to sub 10% based on the current NAV at the end of March, Numis said.

Last year, LTIT decided to ditch its controversial gilts benchmark, which had bagged the global equities trust £14.5m in performance fees over the last decade, Portfolio Adviser revealed. Performance is now pegged against the MSCI World Index in sterling.

See also: Lindsell Train faces headwinds attracting investors to US equity fund