A couple of months ago investment grade managers were heralding the asset class as the best value it has ever been but unprecedented government stimulus has caused spreads to drift back to tighter levels and while still cheap on most historical measures, investors are urged to be more discerning in their credit selection.

Blackrock corporate bond manager Ben Edwards (pictured) notes in the last couple of weeks of March when markets were in the grip of the coronavirus sell-off, certain US triple-B issues were yielding about 4.5% above government securities. This was a level that eclipsed anything seen in the last global recession scare of 2015-16 and the European sovereign debt crisis in 2011, he adds.

Edwards, who is lead fund manager of Blackrock Corporate Bond fund and co-manager of the Blackrock Sterling Strategic Bond fund, says: “I said at the time, ‘That’s the best value investment grade market I’ve seen in my career’. It wasn’t the cheapest, but it was the best value.”

He says this value was driven by an enormous liquidity gap in the market where participants hoarded cash and there were no buyers. For a very short period of time the price of credit had very little to do with the fundamental value of the companies, he says.

A web update on US investment grade from BMO Global Asset Management published in April explains that quite often investors will hold shorter dated credit (five-year maturity and under) as part of their liquid asset reserves and tap into this when they need to raise cash.

“We saw this happen on an unprecedented scale in early March as markets tumbled on coronavirus fears and, coupled with investors looking to mitigate risk in their portfolios or unwind index hedges, this all but took liquidity completely out of the market and led to the observed blow out in credit spreads as investors struggled to find bids and clearing prices on corporate paper.”

But Edwards says: “It was an example of where illiquidity has actually been positive for active managers in terms of being able to move their credit exposures higher to deploy cash, to sell government bonds and buy high quality investment grade assets at levels that don’t normally appear.”

Record investment grade issuance ‘a blessing and a curse’

US corporate bond issuance from investment-grade companies has ballooned this year, surpassing $1tn, according to data from Refinitiv. Q1 2020 reached the highest quarterly amount since records began 40 years ago as companies issued debt to shore-up their balance sheets and preserve liquidity.

Writing for the M&G Bond Vigilantes blog recently, M&G Absolute Return Bond fund manager Wolfgang Bauer described this as both a blessing and a curse. A blessing because issuers often offer new bonds at more attractive valuations – a new issue premium – than their outstanding bonds, but a curse because more attractive valuations put upward pressure on credit spreads in the secondary market, which hurts existing corporate bond holders.

“Away from bond valuations, it is genuinely worrying for credit investors that so many companies are currently binging on gluttonous amounts of debt,” he wrote. “Conventional wisdom has it that a bond issuer, when adding financial leverage through debt-financing, becomes more vulnerable, which in turn increases the riskiness of its debt instruments and puts downward pressure on its credit rating.”

Rescue packages end ‘everything is cheap’ mentality

To combat the effect of the Covid pandemic, central banks have unleashed record-breaking monetary policy measures to shore up markets, while governments in these jurisdictions have introduced fiscal measures to protect their respective economies.

Edwards says these “incredible measures” have closed the liquidity gap and allowed spreads to drift back aggressively from 400bps to about 275bps.

“Had you asked me two months ago, I would have said that 95% of the global investment grade market was incredibly cheap and now looking at it, I’d say 50-60% is.”

“That ‘everything is cheap, buy everything’ mentality, that’s over what we’ve now moved into is an environment where credit spreads are cheap on most historical measures, but we’re going to have to be a lot more careful about who we are lending money to.”

Psigma Investment Management head of investment strategy Rory McPherson agrees that at the peak of the coronavirus crisis, investment grade spreads were at the highest levels seen since the global financial crisis. But following all of the stimulus and improved confidence, they are now significantly tighter.

McPherson says the “easy” gains have been had, but spreads still represent decent value, noting they are above their five- year average level and still benefit from bond-buying programmes from the Federal Reserve.

Long-dated credit is attractive

Edwards believes over the next 12 months the driving force behind returns will not be the yield, even though income is scarce in an environment where corporates have been cutting dividends. The Blackrock Strategic Bond fund would in a normal environment have up to 70% invested in “good income-producing core bonds” but that has dropped to about 50%.

“We’ve dialled right back on those bonds that we expected to chunter along, generating moderate income and increased exposure to those assets whose price we expect to appreciate,” he says.

Edwards sees value in long-dated credit whose price has a high volatility because it has captured the cheapness in spread most effectively.

“To give you a very quick example, we saw really good quality UK bank debt that was 30% down, even though the equity was 20% down at the peak of the crisis. The long-dated nature of those assets means that actually you get equity-like upside by buying them and so we’re very focused on high quality.”

Similarly, McPherson says Psigma also sees opportunities in UK financials.

“Our view is that the best opportunities for investment grade are in the UK where a ‘Brexit’ premium still exists and in selective opportunities,” he adds. “For us, this means areas such as financials and banks where we still see strong opportunities.”

Quilter Cheviot head of fixed interest research Richard Carter says the firm remains positive on investment grade.

“It’s true that it has already recovered significantly so some caution is merited but we expect it to remain underpinned by central bank liquidity and the demand for income,” he says.

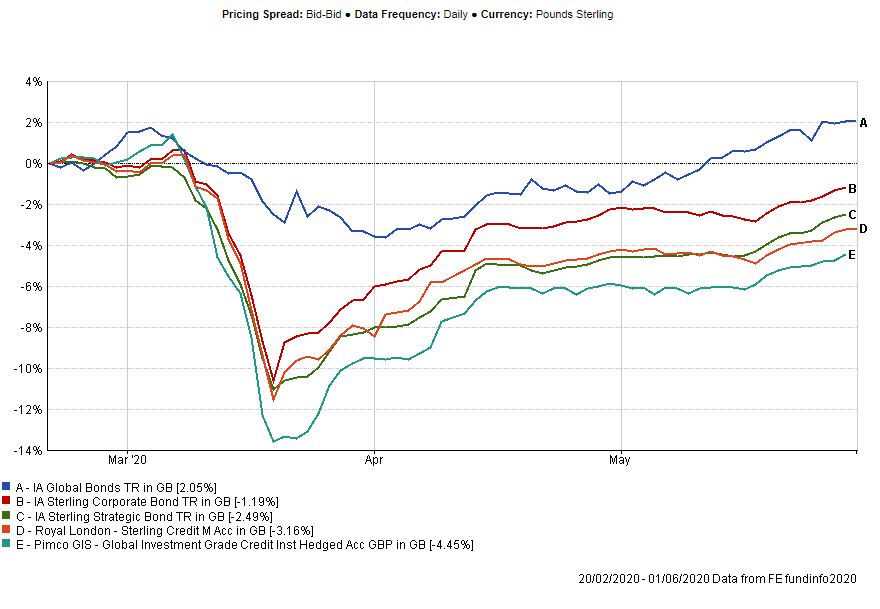

In terms of funds, Carter highlights the Royal London Sterling Credit in the UK and Pimco Global Investment Grade Credit for international exposure.

Since coronavirus hit markets on 20 February the Royal London fund has returned -3.16% while Pimco has delivered -4.45%. The Investment Association Global Bonds sector has returned 2.05%, while the Sterling Corporate Bond sector has delivered -1.19% and the Sterling Strategic Bond sector -2.49%.