Kris Atkinson and Shamil Gohil, portfolio managers, Fidelity Short Dated Corporate Bond Fund

With the new Labour Chancellor Rachel Reeves’s first post-election budget fast approaching, there has been some speculation that recent increases in Gilt yields over the past month could be indicative of investors anticipating a ‘Truss 2.0’ budget fiasco, with another potential subsequent jump in UK borrowing costs as a result. We disagree with this interpretation and expect the current Labour government’s inaugural budget to be a largely benign event for UK Gilt markets.

Overall, the UK economy continues to chug along, but there are some slowing signs in the wage data which, coupled with more rate cuts around the corner, makes us bullish on UK interest rate risk from here. From a credit perspective, valuations continue to look stretched and so we are cautious overall, but see the best risk-adjusted value at the front end of the credit curve.

What explains the recent rise in Gilt yields?

The simplest and most enduring explanation of the recent climb in Gilt Yields is the historical correlation between US Treasury yields and Gilt yields. Recent, strong, economic data out of the US combined with a potentially inflationary geopolitical backdrop have caused sharp increases in US yields over the last month. We believe this to be the main driver of recent absolute moves in Gilt yields.

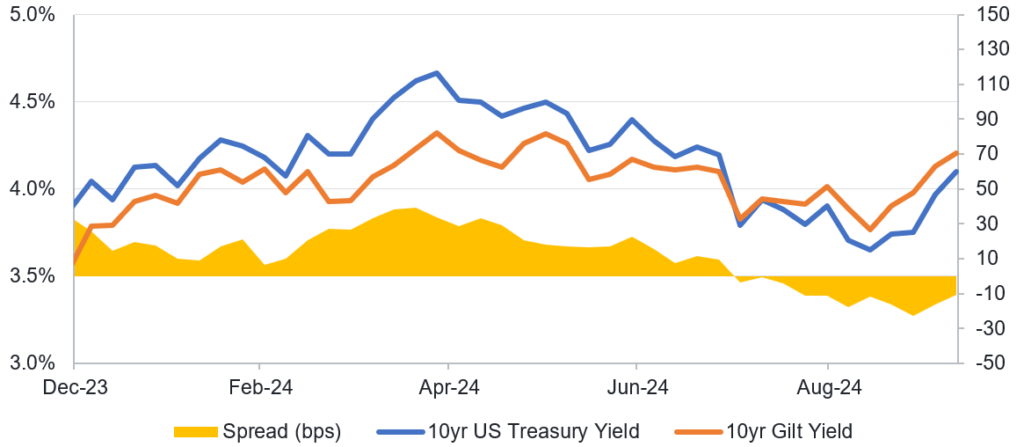

On a relative basis, it is worth noting the widening spread of Gilt yields over US Treasury yields since the beginning of August (see Figure 1) indicating Gilt markets remain scarred from the 2022 Truss budget, with reignited investor uncertainty over the UK fiscal picture. This trend has been reversing recently however, in line with our view that the budget will be a largely benign event for markets, with Labour opting to demonstrate fiscal prudence.

Figure 1: UK versus US government bond yields

Source: Fidelity International, Bloomberg, 16th October 2024.

Tentative signs of a slowdown in wage growth

Looking more broadly at the UK economy, while GDP growth remains positive, it remains vulnerable from external shocks, and we see early signals of weakness in wage data. GDP growth has remained positive at 0.9% YoY, however a sustained growth picture remains vulnerable to external shocks which could follow the US election or a further escalation of geopolitical tensions. This underlines the importance of credit selection and defensive positioning, a key focus in the funds.

Despite being hard to judge effectively given question markets over data collection, the labour market picture remains strong, with increasing probabilities of becoming employed if unemployed in the UK, and falling probabilities of remaining unemployed. The probability of becoming unemployed also remains in the lower end of the historical range.

Whilst the labour market remains firm, wage growth is starting to fall after remaining particularly sticky in the UK relative to the US and Euro Area, partially due to supply side shocks to the labour market with elevated levels of economic inactivity due to long-term sickness and the Brexit-related drag. This falling wage growth picture in combination with UK inflation in September falling to a three-year low of 1.7%, below expectations, should give the Bank of England (BoE) confidence to cut by 25bps again in November. Accordingly, we are leaning long in UK interest rate risk across the portfolios.

Searching for overlooked areas in expensive credit markets

Credit markets are trading close to all time tights in many geographies and sectors, particularly in the longer dated and highest quality areas of the market, which explains why we are defensively positioned overall in credit. We do, however, still see value in sterling markets particularly at the front end of the curve, where we have been targeting individual credit opportunities to maximise risk-adjusted returns.

We currently see opportunities to take profit in the financials sector where valuations have compressed, moving instead into areas of the utilities sector across the UK and Europe where valuations remain attractive. Certain secured bonds also present opportunities with higher spreads on offer, and where valuations have not compressed to the same extent as other sectors with similar levels of credit risk.

IMPORTANT INFORMATION

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates rise and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document (Key Information Document for Investment Trusts), current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. FIPM: 8535