Longer term, the rising burden of government liabilities and shifting demographics will lead to an era of financial repression. As the world enters the ‘fiscal age’, governments are likely to fund the burgeoning welfare state by printing money. This strategy has historically led to the fall of empires and it is unlikely to be any different this time, as inflation uncertainty and wealth inequality continue to rise. Despite the enormous amount of money printed over the past two decades, gold prices have not kept pace, and one can reasonably believe upside potentials remain attractive.

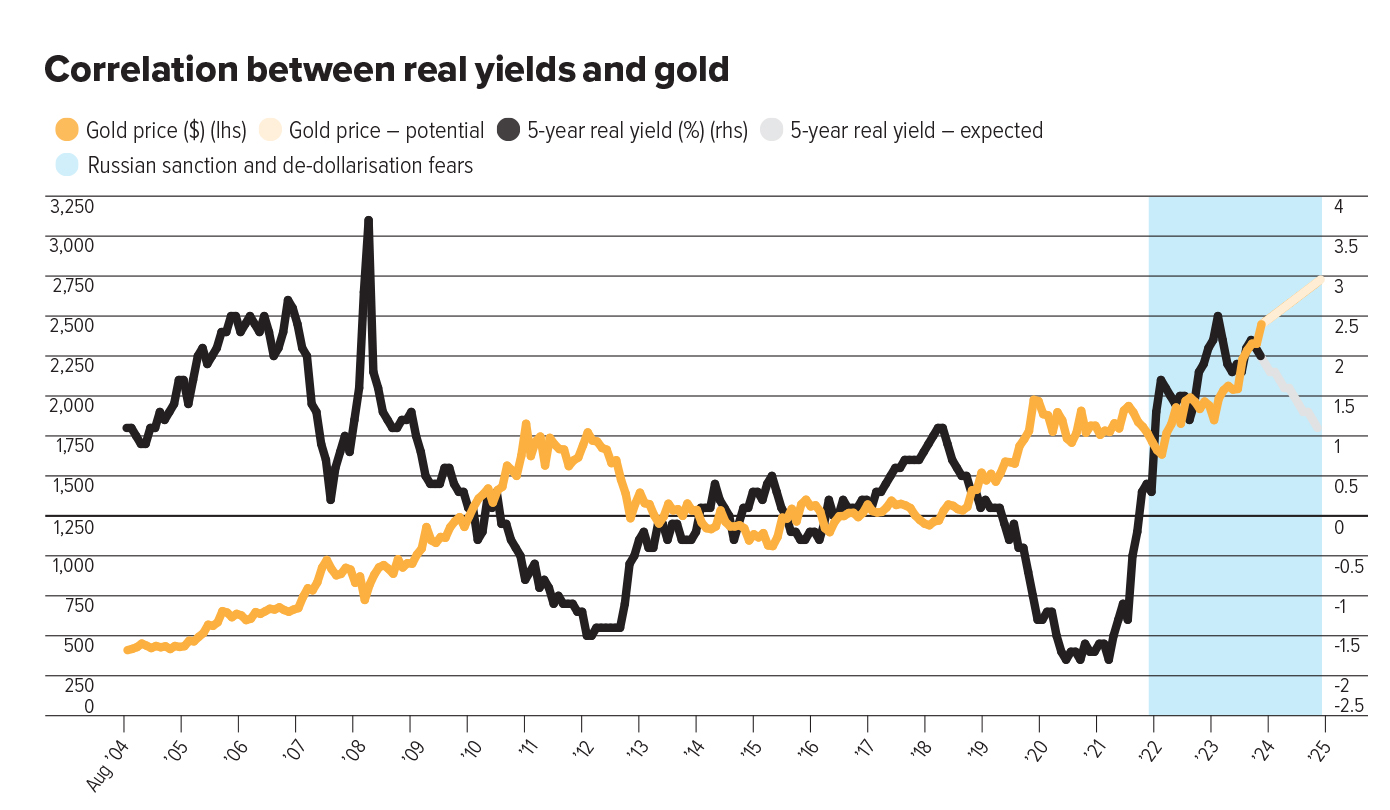

Of greater importance in the near term are underlying supply-demand dynamics. Supply remains constrained, underpinned by rising costs and production difficulties. However, demand-side dynamics are likely to change. Gold ETFs have experienced outflows in 24 of the past 36 months. This trend aligns with the recent surge in real yields. Surprisingly, as shown in the chart below, gold prices have remained strong despite their usual negative correlation with real yields. However, sanctions against Russia likely triggered fears of de-dollarisation, driving a surge in central bank demand for gold across many emerging economies, especially China.

As western central banks now begin to ease, a shift in western demand for gold is expected as real rates – the difference between nominal rates and inflation – decline. This, coupled with strong demand from emerging economies underpinned by an increasingly negative perception of the dollar as a reserve asset, will provide significant support for gold prices.

See also: Knacke’s money maps: Health is wealth

Beyond the base case, gold offers attractive ‘optionality’ as a hedge against unpredictable events including geopolitics, trade wars or changing market liquidity. When uncertainty rises, gold’s appeal as a safe haven only grows stronger, which is invaluable given the risks of financial repression are misunderstood, and those posed by macroeconomic and geopolitical turmoil underappreciated.

With gold under-owned by western investors and strong underlying price trends, the outlook for the metal is bright. Indeed, its status as a store of value is unlikely to change, whether you live in America, Africa or Asia. For investors looking for a stable, long-term asset with capital preservation characteristics against both inflation and geopolitical instability, gold remains an essential asset. The shiny metal is just getting started.

This article originally appeared in the September issue of Portfolio Adviser magazine