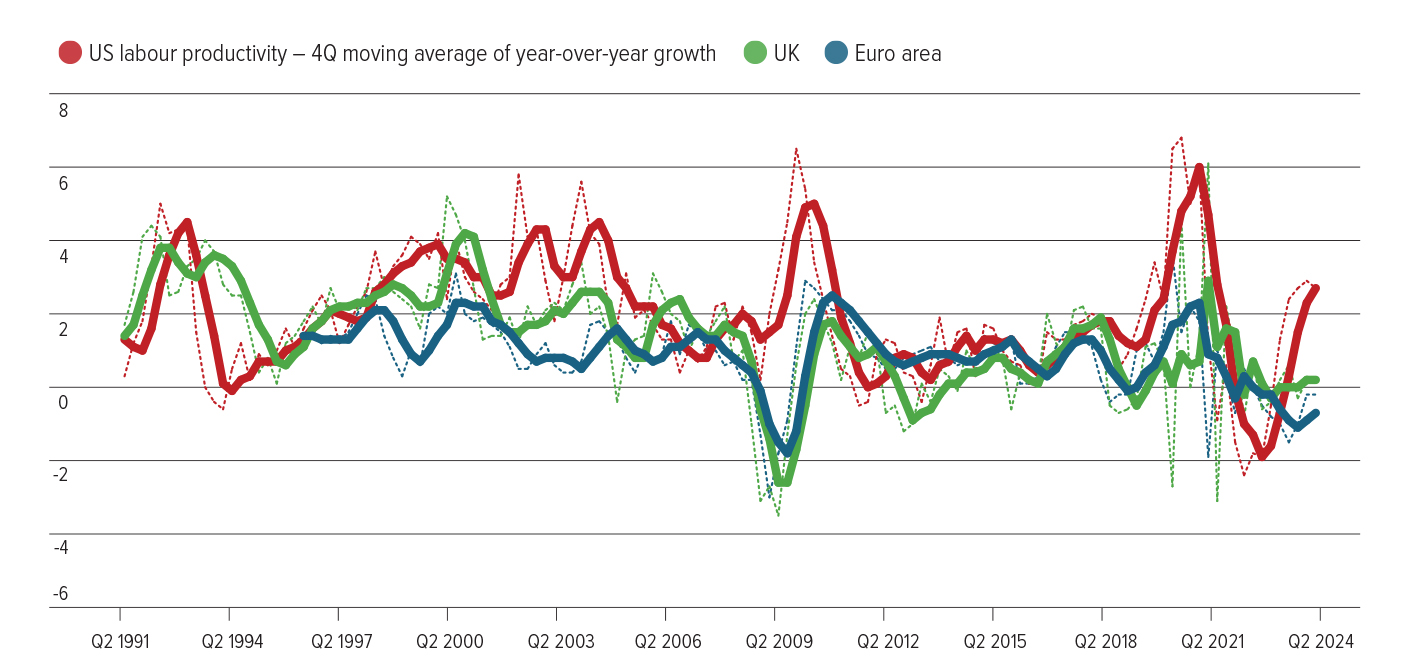

Labour market productivity trends in Europe and the US have diverged meaningfully in recent quarters. While US labour productivity has surged to levels typically associated with economic recoveries, in the UK and euro area it remains stagnant, with growth as uninspiring as a British barbecue. This gap can be attributed to a host of structural and cyclical factors, including human capital investment, regulation and the pace of technological adoption.

In equity markets, this productivity bifurcation seems to be reflected in valuations. US equity markets are buoyed by rather extreme earnings growth expectations. Furthermore, not only are expectations high but so are valuations, with US large-cap stocks near all-time highs on 22x forward earnings. Meanwhile, equity markets across the UK and Europe are projected to trade on low-teen earnings multiples over the next 12 months.

This disparity reflects not only differences in productivity but also market expectations for future growth alongside investor sentiment. The valuation gap is even more pronounced in small and medium-sized companies across the region. As an example, the FTSE 250 is trading near levels last seen during the global financial crisis.

Diverging trends in US versus UK and European labour market productivity (%)

While there is an undeniable link between labour market productivity and corporate profitability, it is important to recognise that these factors are cyclical. US companies are perceived to be better positioned to capitalise on emerging technologies and new markets, reinforcing the appeal of US equities relative to their UK counterparts. However, with the potential for lower interest rates and central banks adopting more accommodative monetary policies, we may see an increase in capex and investment.

Historically, periods of monetary easing have coincided with rising capex, a weakening US dollar and outperformance of value over growth. Such conditions could be particularly supportive of UK and European equity markets, helping to close the valuation gap and improving investor sentiment.

After years of capital outflows as investors favoured US equities over developed market ex US stocks, equities this side of the Atlantic remain underinvested. With valuations of US growth stocks near historical highs and expectations running lofty, this could be an ideal moment to consider diversifying equity exposure into something more contrarian. Shifting attention to underappreciated markets may offer both a margin of safety and the potential for stronger returns as the cycle takes hold.

This article originally appeared in the November issue of Portfolio Adviser magazine