“Do you still have access to your Chairmovision network?” I asked the chairman of the insignificantly-sized investment company Kermitted Asset Management when I visited him in his office the other week. “My network of hidden surveillance cameras covering assorted offices around Canary Wharf, the City of London and Whitehall, you mean?” he helpfully replied. “We do indeed – we just don’t use it so much these days.”

“Your ESG-adjacent investment approach induced an attack of conscience?” I laughed. “Not exactly,” sighed the chairman. “ESG considerations did play a part – but more in terms of us feeling we needed a more renewable source of energy to power the network.” “Let me guess,” I said. “You get Adair, your terrier-sized bodyguard-slash-emotional support hamster to run round and round inside a modified wheel?”

“No – that would be ridiculous,” sniffed the chairman. “He pedals that little exercise tricycle in the corner over there. That is hooked up to our network but, game as the little chap is, if we operated the system even half as much as we used to, the only attack being induced would be of the cardiovascular variety.” “Of course,” I nodded. “Still, you couldn’t ask him to hop on just for a minute, could you?”

“Anything particular you were after?” asked the chairman, clicking his fingers in an unsuccessful attempt to attract Adair’s attention away from his current favourite pastime of growling at TikTok pet videos. “Some colleagues and I were discussing the FCA’s thought processes when they were drafting the Sustainability Disclosure Requirements,” I replied. “And then I realised I might gain some insights from Chairmovision.”

You could – if you really had nothing better to do – read more from Kermitted Asset Management here

“And by ‘gain some insights from’, you mean ‘eavesdrop on’,” grinned the chairman, who had managed to prise Adair’s iPhone out of his paws on the third go and was now using it to lure him onto his tricycle. Then, having positioned the device at Adair’s eye level on what looked like a stand specially built to enable the rodent to swipe, growl and pedal at the same time, he added: “Well, you might just be in luck.”

Returning to his desk, the chairman pressed a couple of buttons on his keyboard and the television on the wall opposite him sprung to life to show a man and woman – the latter asking: “But don’t we have study after study showing investing sustainably no longer means compromising on performance?” “Indeed we do,” nodded her colleague. “Trouble is, those studies were largely based on a decade-plus of growth-friendly markets.

“Of course, that naturally played to the strengths of the sustainable industries – but apparently a couple of less growthy years was all it took to shake out not just the non-believers but the swing-voters too. And it seems there were rather more non-believers and swing-voters than anyone anticipated.” “But what chance does sustainable investing have if people can’t stick with it through some tricky months?” sighed the lady.

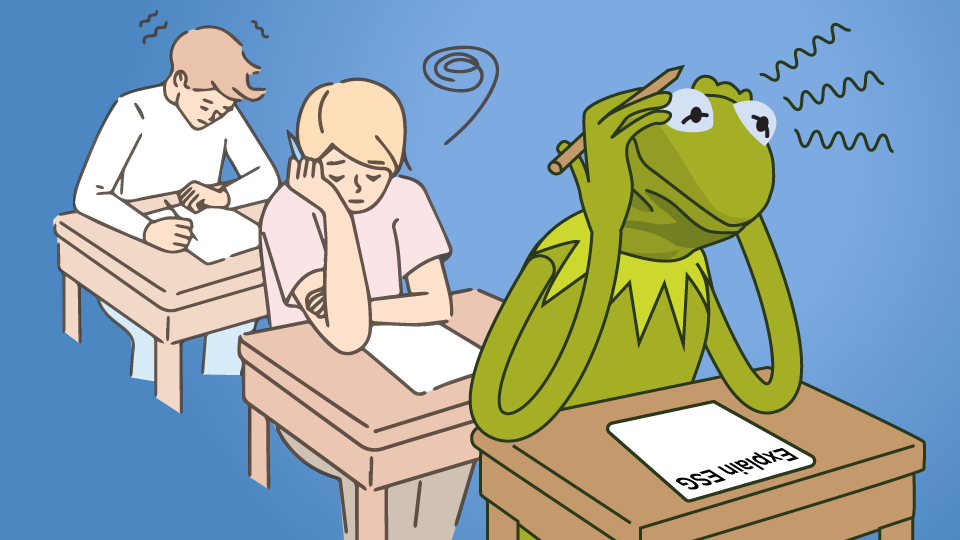

“Are you suggesting we haven’t gone quite hard enough on the idea the price of investments can go down as well as up?” laughed the man. “Maybe we should be asking would-be sustainable investors to pass a test?” “It’s not the worst idea in the world,” said the lady. “It certainly isn’t the best,” her colleague retorted. “Investors are hardly queuing up to buy sustainable funds as it is, but can you imagine if there was an exam involved?

“Question 1: A company operates a mine in an African state run by an oppressive regime. The rare precious metal coming out of the mine is vital for the production of electric vehicles. Everything else coming out of the mine is hugely bad for the environment. The mine is by far the major employer for all the surrounding villages and closure would put hundreds of families below the poverty line.

“Multiple-choice – do you: A) Um; B) Er; C) My head hurts; D) How much is Bitcoin again? Or E) …” Unfortunately, or perhaps not, we missed the fifth option as the screen went blank and the next sound we heard was something very much like a terrier-sized hamster falling exhaustedly off a small tricycle onto the plushly-carpeted floor of the office of a senior executive of an insignificantly-sized investment company.

This nonsense first appeared in the March 2024 issue of Portfolio Adviser