“Who was the marketing guru who came up with the phrase, ‘The only thing necessary for the triumph of financial services is for good men to do nothing’?” asked the chairman of the insignificantly-sized investment company Kermitted Asset Management as we caught up last week for our regular video-drink at the Zoom Bar. “Burke,” I replied.

“No need to be rude,” the chairman huffed predictably – because who doesn’t enjoy a bit of misunderstanding for comic effect? “No – Edmund Burke,” I elaborated. “The Irish statesman and philosopher – and since he was actually sounding a warning against ‘the triumph of evil’, I’m guessing the marketing guru who pillaged the line to make that point about one of the defining laws of financial services was you.”

“It does sound like something I would say,” the chairman nodded. “And it is a very perceptive point.” “No kidding,” I said ruefully. “Only last week I finally got around to cancelling a medical insurance policy that started off on a pretty reasonable monthly rate and has mushroomed to a significantly less reasonable one over the last eight or so years – to the extent that, from next month, it would actually have tripled in that time.

“You may not be entirely surprised to hear I received a phone call this morning from the broker who arranged it – the first one in a blue moon – to ‘discuss continuing the policy’. I suggested that, given they had effectively sat back and taken their commission while my payments soared merrily skywards, the only thing I would be interested in discussing was the concept of fiduciary duty. It was not a long conversation.”

“That must have been very satisfying,” nodded the chairman. “Not as satisfying as writing about it – which I must remember to do some time,” I replied. “They do say the cobbler’s children are always the worst-shod – but, when they fail to follow their own words of advice, at least financial journalists occasionally get to stick the boot in. That can prove therapeutic.” “Remunerative too, I should imagine,” observed the chairman.

“Still you do make my point about the power of inertia in financial services.” “Indeed,” I said. “I’m just not sure why you’re bringing it up now.” “Because,” the chairman sighed, “I fear I’ve just encountered my first real pothole in the road along which ESG is chauffeuring me towards my next fortune. And before you say that’s not a very green metaphor, the car I’m riding in is obviously electric.” “Never crossed my mind,” I smiled.

“I was, however, under the impression everything on that journey was running smoothly – weight of money heading into ESG funds, self-certification of ESG-friendliness, setting up your own ratings arm, boost to performance thanks to investors not being too picky about which ESG stocks they buy … you know, all the stuff we’ve been talking about this year.” “Well, clearly it’s this inertia business,” grumped the chairman.

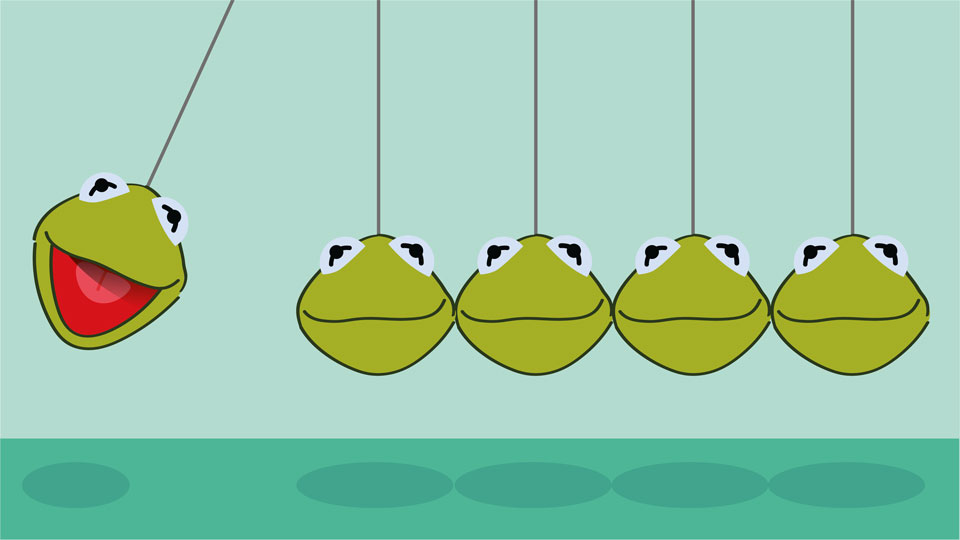

“Normally in financial services – whether it be zero-yielding accounts, the sort of low-grade mutual funds banks and building societies tend to offer or, indeed, spectacularly poor-value medical cover, you can always rely on a significant proportion of punters sticking around regardless of the sort of, er, no-frills service in which Kermit Asset Management specialises. So why do ESG-oriented investors have to be so damnably lively?”

“The spoilsports,” I said. “It’s almost as if they care about what they invest in. Still, into every life a little rain must fall, eh?” “That reminds me,” said the chairman. “I wanted a word with you about how a company with our ESG credentials has failed to make a single appearance within that Responsibility Ratings Index thingy you came up with in ESG Clarity.” “ESG credentials – that’s very good,” I chuckled before catching his tone.

“Ah … you’re being serious,” I continued. “I guess the short answer would be – please read our methodology.” “And if I wanted the longer answer …” the chairman said with just a hint of menace. “I’m sorry,” I lied. “The screen’s frozen and I can’t hear you. We’ll have to pick this up next time.” I’m really going to miss being able to do that when we eventually get back to meeting in person.