“I mean, would they be doing it to us if we were a person?” huffed the chairman of the insignificantly-sized investment company Kermitted Asset Management when we caught up the other week. “It just isn’t right, is it?” “I’m sure it really isn’t,” I replied consolingly. “Although I would say it feels as if I’ve come in halfway through the conversation. Who are ‘they’, ‘us’ and ‘we’ in this context – and, while we are about it, what is ‘it’?”

“Oh, do try and keep up,” snapped the chairman. “I should have thought it was perfectly obvious I’m talking about the way the press have been treating Kermitted Asset Management over the last however many years. Quite frankly, their behaviour has been horrid and mean and vexing and beastly and … and …” “Childish?” I offered helpfully because, well, whatever was happening here, it seemed like a fun game.

“Thank you,” said the chairman, nodding enthusiastically. “That is exactly the word. The behaviour of the so-called media has indeed been childish – and, I don’t mind telling you, I’m mad as heck and I’m not going to take it anymore.” “Gosh,” I said – and then, wary of being snapped at again, added: “I’m sorry if I missed something recently but what piece of coverage would you say was the final straw?”

“Coverage?” the chairman spluttered, turning a worrying shade of merlot. “Coverage? Are you deliberately trying to provoke me? And if so, given my whole mad-as-heck speech, do you really think that is wise? The whole reason for my current discombobulation is that Kermitted never receives any coverage – not a single, solitary dickybird – and …” “Ahem,” I coughed politely. “Oh, I do apologise,” nodded the chairman.

You could – if you really had nothing better to do – read more from Kermitted Asset Management here

“Your assorted scribblings about us have been very sweet – but I’m talking about proper press coverage by real journalists here. Kermitted has been going since – what? – the start of 2020 and, in all that time, barely a sniff of a mention in the mainstream media. Did you know we actually got fired by our press-cuttings service a couple of years back? They said they were starting to feel bad about taking our money in return for absolutely nothing.

“Look, I understand that, to some extent, this is part of the game with the press …” “Only writing about stuff they feel should be written about?” I checked. “Indeed,” the chairman nodded. “Still, it is a little – how did you put it? – childish to keep hammering us for our lack of newsworthiness. I’m not even sure it’s ethical – in fact, a chap might even suggest it was the dictionary definition of ‘corporate bullying’.”

“A chap indeed might,” I replied. “Always assuming a chap didn’t realise the dictionary definition of ‘corporate bullying’ involves the rather more problematic issue of individuals being picked on by companies. And speaking of ethics, there was a time – numerous times, in fact – when you would have been thrilled skinny that an insignificantly-sized investment company you were running was receiving zero press scrutiny.”

“No argument there,” the chairman conceded. “It’s just so galling, though, that now we are actually doing something that is at least in a neighbouring postcode to virtuous, nobody is paying the slightest attention – not even, if you remember, when we adopted that new rebrand that was so modern, dynamic and, most importantly, engaging for all of our client and customer channels.”

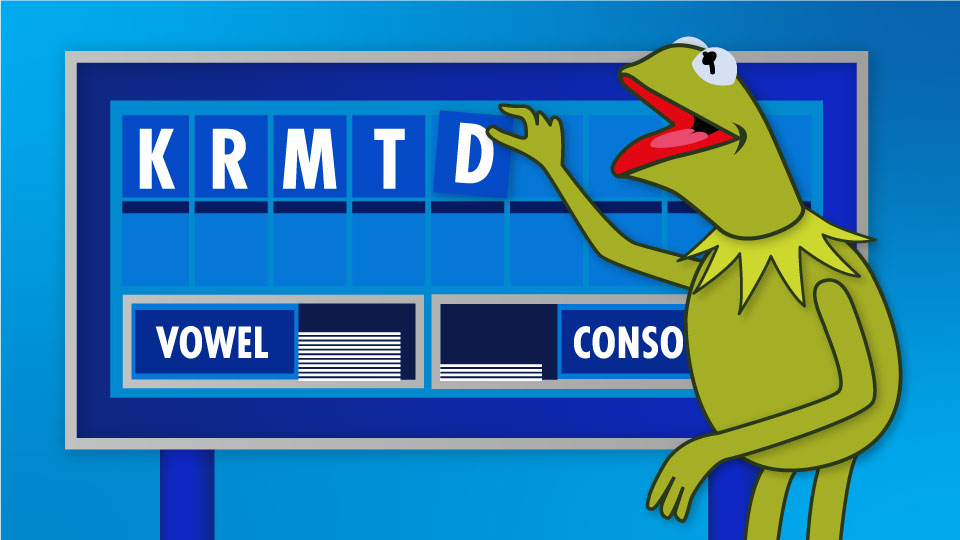

“As if I could ever forget your debilitating case of invisible vowel syndrome,” I nodded. “How long did that last again – 23 days? Under the circumstances, it was very astute of you to take that ‘Buy one rebrand, get a second free’ offer from your marketing consultant. I think your problem there, though, was switching to ‘KRMTD’ or however you pronounced it so soon after one of your competitors did something very similar.

“So, while you ticked some of the right rebrand boxes – you know, stirringly optimistic press release, stunningly generic corporate video and the like – you failed to factor in that my alleged profession does not boast the longest of attention spans and so missed out on any resulting media coverage. Which brings me to the only advice I’d offer you here – be careful what you wish for.”

This nonsense first appeared in the April 2024 issue of Portfolio Adviser