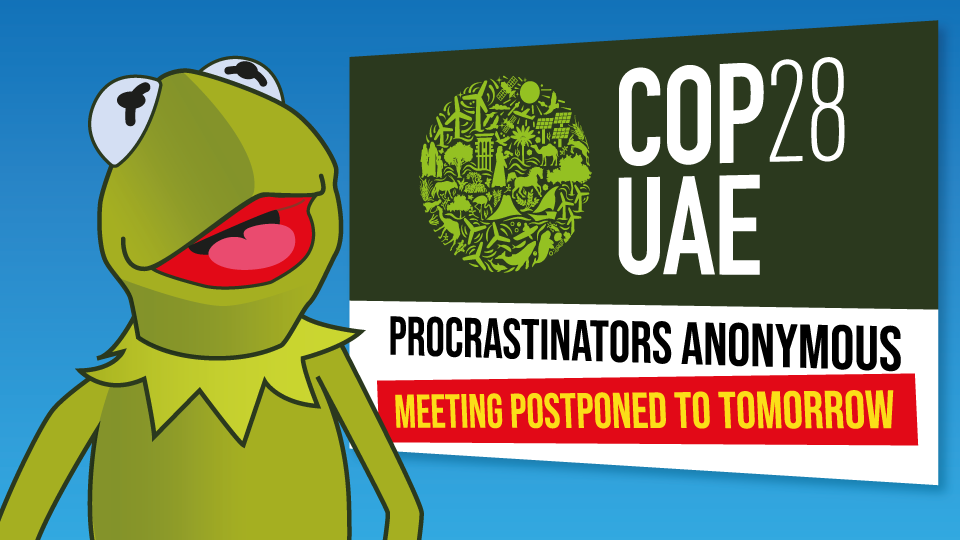

“So what would you say was the most important outcome from COP28?” I asked the chairman of the insignificantly-sized investment company Kermitted Asset Management when we caught up for our first chat of the new year. “What-come from where-now?” he replied blankly. “From the COP28 conference on climate change that took place in Dubai last month,” I added helpfully.

“It occurred roughly 12 months after COP27, which took place in Egypt’s Sharm El Sheikh – as you may recall because you did spend a lot of time enthusing about the hotel, the food, the beach … though rather less about all the meetings – and especially the travelling back and forth between them, now I come to think about it. And, coincidentally, it also occurred a similar sort of time ahead of COP29, which will take place in … um … in …”

“Azerbaijan,” pronounced the chairman, unexpectedly. “That’s the bit you know?” I laughed. “Why would you think otherwise?” shrugged the chairman. “You’re mocking my memory but wasn’t it only last month I was apprising you of the attitude of His Majesty’s financial services industry on exactly this subject? In essence: COPs past, bad; COPs present, meh; COPs future, fingers crossed we aren’t priced out of hotel rooms this year.”

“Even for Azerbaijan?” I asked. “Don’t be such a snob,” the chairman tutted. “I still count Eurovision 2012 as one of the happiest business trips of my entire career.” “Business trip?” I repeated. “We are definitely returning to that at some point. Clinging to the matter at hand, however – are you really saying the general view on COP of everyone in the wonderful world of investment can be summed up as ‘out of sight, out of mind’?”

You could – if you really had nothing better to do – read more from Kermitted Asset Management here

“Well, not everyone in investment, obviously,” said the chairman. “We both know the industry really does have its true believers – even if they perhaps do not constitute the same size of congregation they did a year or two back. That said, it’s not only professional investors who tend to adhere to – how did you so neatly put it? – ‘out of sight, out of mind’.

“Throwing your opening question back at you, what do you think was the most important, er, ‘outcome’ from COP28?” “That is a tough one,” I lied, playing for time. “Let’s see – there was the voluntary carbon markets discussion, the global goal on adaptation, the global stocktake …” “Right – so ‘voluntary’, ‘discussion’, ‘goal’, ‘stocktake’,” sighed the chairman. “Are you even trying?”

“All right, all right,” I regrouped. “Would you be happy with ‘creation’ – as in the actual creation of the loss and damage fund first envisaged at COP27?” “I think we can both agree it was the headline-grabber from the whole show,” the chairman agreed. “More than seven hundred million greenbacks pledged to support developing countries in averting, minimising and addressing the effects of climate change – what’s not to like?”

“I’m guessing that was a rhetorical question,” I said. “How could you doubt it?” the chairman nodded. “And what kinds of contributions have we seen? $100m from the UAE, $100m from Germany, £60m from the UK, $17.5m from the US – pending Congressional approval – $10m from Japan, €225m from the EU. Not insignificant amounts, I’m sure you’ll agree?”

“Not until I hear what you have to say next,” I said warily. “Good boy,” smiled the chairman – never a reassuring sight. “Off the top of my head, at $75 a barrel, the UAE can pump $100m of oil in, what, a day? Google tells me the EU’s €225m could buy a Spanish investor a shiny logistics centre in Dublin. And Japan’s $10m should get you a luxurious condo in the snazziest part of Tokyo.

“Skipping past what the Middle East is currently paying golfers and footballers – as you know, sport was never my strong point – let’s try and put the States’ contribution into context via that hoary old chestnut of arms spending. Using the lower of the two numbers you can find on Google, my mental arithmetic tells me the US’s approval-pending $17.5m works out at some 12 minutes-worth of its annual military expenditure. The line I am reaching for here, I think, involves the road to hell being paved with good intentions.”

This nonsense first appeared in the January 2024 issue of Portfolio Adviser