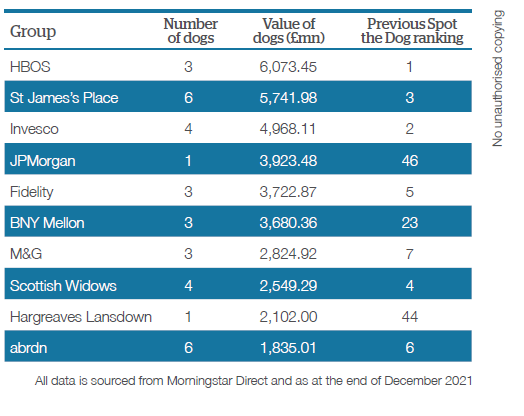

Multi-billion-pound equity income favourites from JP Morgan Asset Management and BNY Mellon Investment Management have dragged their respective firms into the doghouse in Bestinvest’s latest edition of Spot the Dog.

Around £45bn of investors’ savings were tied up in 86 “dog” funds, those that have underperformed the market more than 5% after fees over three years, according to the latest report.

While this was a slight increase on the 77 mutts named and shamed in the previous report, the portion of assets held in poorly performing pooches ballooned 54% from £29.6bn.

This was due to a larger number of outsized canines hitting the list of worst performers. Bestinvest counted 12 “Great Dane” sized funds that held £1bn in assets or more, up from seven big beasts in the previous edition.

Jason Hollands, managing director of Bestinvest, said in recent years low interest rates and ultra-loose central bank monetary policies, has propelled share prices higher and “helped disguise some bad decisions from fund managers who have earned handsome fees in the process”.

“However, as the environment gets more difficult it will leave weaker managers exposed,” he added.

BNY Mellon Global Income and JPM US Equity Income in the doghouse

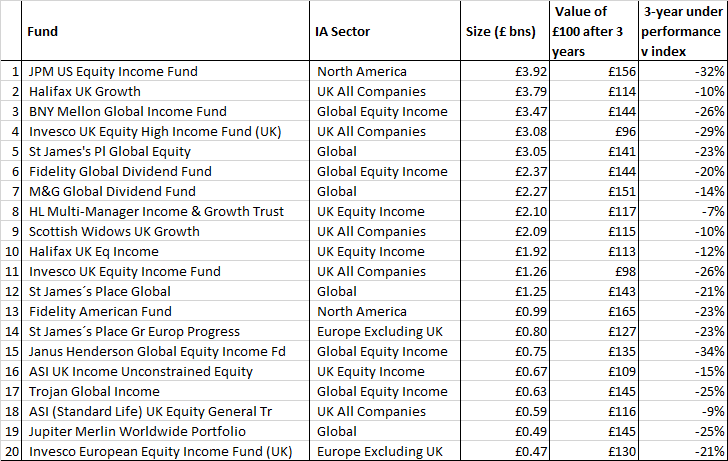

BNY Mellon’s £3.5bn Global Equity Income fund was a new entrant to the kennel and the third biggest laggard by fund size.

Formerly run by heavy-hitter Nick Clay, Bestinvest noted its “performance has come unstuck” during the Covid crisis. It now trails its benchmark, the MSCI World, by 26% over three years.

Following its bout of underperformance, BNY Mellon has jumped up Bestinvest’s rankings of firms with the largest chunk of assets trapped in dog funds from 23rd to sixth place.

JP Morgan Asset Management also shot up the list of worst offenders thanks to one Great Dane – the JPM US Equity Income fund.

Standing at £3.9bn, Clare Hart’s fund was not only the biggest beast in terms of size but was the only vehicle with more than £1bn in assets to appear in the top 20 worst performers. Over three years it has lagged the MSCI USA Index by 32%.

Pegged against a tech-heavy benchmark, Bestinvest admitted the fund has a “natural disadvantage”. However, it noted other US equity income funds have “struggled through,” the tech-driven rally in recent years.

Rounding out the top five misbehaving pooches were repeat offenders Halifax UK Growth, Invesco UK Equity High Income and St James’s Place Global Equity.

Global funds dominate biggest beasts

Four out of 10 of the biggest mutts were from the global equity and global equity income sectors, with Fidelity Global Dividend and M&G Global Dividend also making an appearance.

In total, £18.5bn of underperforming assets were trapped in global equity or global equity income funds, or 39 out of 86 dog funds.

The Biggest beasts in Spot the Dog by fund size

Hollands said this was partly because the US has come to dominate the indices by which many funds are measured. The MSCI World holds two thirds of its market capitalisation in the US.

“This has presented a dilemma for active managers: either hold significant amounts in the US and technology stocks with the resulting lack of diversification and income, or risk weakness versus the benchmark,” said Hollands.

The BNY Mellon Global Income investment team cited the fund’s strict yield discipline as the reason for its recent performance slump. For a stock to be considered for investment it needs to yield at least 25% more than the FTSE World TR Index.

However, they stressed performance has already picked up in the higher inflationary environment. The fund has returned 2.6% over three months compared with the 0.4% IA Global Equity Income average, putting it in the top quartile.

“The emergence of more sustained inflation means higher interest rates and an end to free money, and while markets are likely to continue to be volatile, we believe we will see a return to the long-term trends of dividends driving equity market returns,” the team said in a statement.

“Following a strong rebound post-Covid – and with earnings recovering faster than dividends – the prospect for dividend growth is strong, and the valuation of income stocks is attractive. This, coupled with the strong demand for income driven by global retirement needs and the attractive spread compared to the yields from fixed-income assets, means that in our view the fund continues to be highly relevant for investors.”

SJP, Abrdn and Jupiter tie for most ‘dog’ funds

Looking at a company level, many of the usual suspects wound up in Bestinvest’s hall of shame.

St James’s Place, Abrdn and Jupiter shared the dishonour of having the highest number of dog funds at six apiece. However, total assets languishing in poorly performing pooches at Abrdn and Jupiter was £1.8bn and £988.6m, a sliver of SJP’s £5.7bn.

SJP’s £3.1bn Global Equity fund remained its top dog, underperforming the market by 23%, followed by its £1.3bn Global fund and £800m Growth European Progress fund. Its chihuahua-sized Global Smaller Companies mandate, which has £200m in assets, was one of the worst performers overall, lagging its benchmark by 38%.

SJP has previously criticised Bestinvest’s analysis of not making accurate like-for-like comparisons.

Invesco continued to lurk near the top of the worst offenders, sporting four dog funds with £5bn worth of assets. However, this is a dramatic decline from the start of 2021 when it had 11 funds worth £9.2bn in the kennel.

Many of its former laggards have turned performance around thanks to an internal shake-up of its investment team, though Bestinvest noted its UK Equity High Income and UK Equity Income funds, previously run by Neil Woodford and Mark Barnett, “can’t shake off their doggy credentials”.

Halifax Bank of Scotland (HBOS) retained its position as top dog for the second report running, with three mutts worth £6.1bn. The funds, managed by Schroders, remain some of Spot the Dog’s most persistent offenders.