Before Covid-19 shook global equity markets, we made the case for how unpopular value stocks could rediscover their unconventional success, leading to the return of a financial environment where traditional equity valuation metrics would once again be relevant. With rising inflation and interest rates, today’s financial world now looks very different – yet a quick recap of recent history illustrates how things have changed and why it is now undeniable that valuation matters.

* 2010/20 – QE and the tech behemoths: Post financial crisis was the era of quantitative easing (QE) and the emergence of the gigantic technology monopolies. The availability of easy money and unrealistic growth assumptions fuelled a boom in unsustainable valuations and irrational expectations that financial markets are still sobering up from.

* 2020/21 – the ‘pandemic puzzle’: Covid-19 shattered the financial puzzle in just a matter of months and important pieces have still not fallen back into place. Skilled workers were laid off, leading to major labour shortages in many industries. Supply-chain bottlenecks appeared and are yet to be resolved. There were shortfalls of almost everything – except easy money, as central banks began another round of extreme global financial stimulus – and the foundations for inflation to enter the economic landscape were cemented.

* 2022: The ‘new Cold War’ and QT: Without Russia’s disastrous decision to invade Ukraine, the inflation picture would probably have been quite different. Russia and its surrounding neighbours are, however, substantial producers of wheat, gold, nickel, palladium, potash and, of course, oil and gas and this commodity spike is now being passed on to consumers in value chains across the globe.

Shifting dynamics

Inflationary pressures are, to a large extent, supply rather than demand-driven but, even so, they have forced global central banks to hike rates aggressively and to broadly withdraw support to bonds by ending the QE experiment around the world. This change in the investment environment has propelled value equities ahead of growth equities at mid-year and value is on track for a second consecutive year of outperformance. The resurgence has arguably been driven by shifting dynamics in five key forces:

Removal of ultra-low interest rates

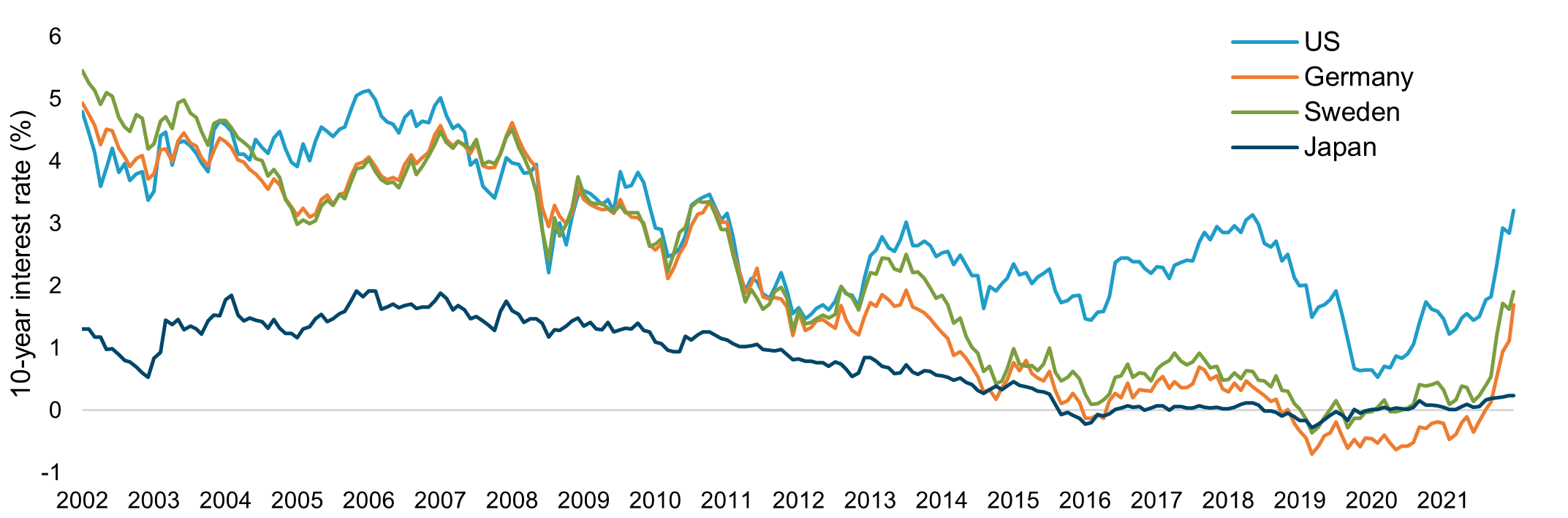

Ultra-low rates saw much of the investment community focus on companies with certain growth characteristics, whose valuations expanded to record levels at the end of 2021. Since then, as the following chart shows, global bond prices have corrected while inflation has soared and appears to be stickier than anticipated by central banks.

Expectations of rising interest rates are forcing investors to focus on higher mid-term earnings yields that can compete with a risk-free bond rate of 3% or more. We are in the middle of a rotation into stocks with lower valuation multiples at the expense of more elevated areas of the equity market.

Interest rate normalisation ongoing (as of mid-June)

Source: Skagen Funds

The fall of ‘Super Big-Tech’ companies and their disciples

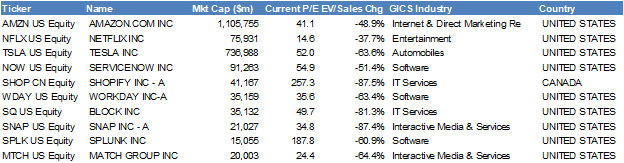

As the following table illustrates, a subset of equities for which investors were previously prepared to buy ‘growth at any price’ have seen their valuations fall from record highs late last year. It is now becoming clear that many of these companies are cyclical at core and, as earnings growth has disappointed investors (or in some cases completely disappeared), share prices have nosedived.

Enterprise-to-sales ratio change in select tech-related stocks from top level to current level

Source: Skagen Funds

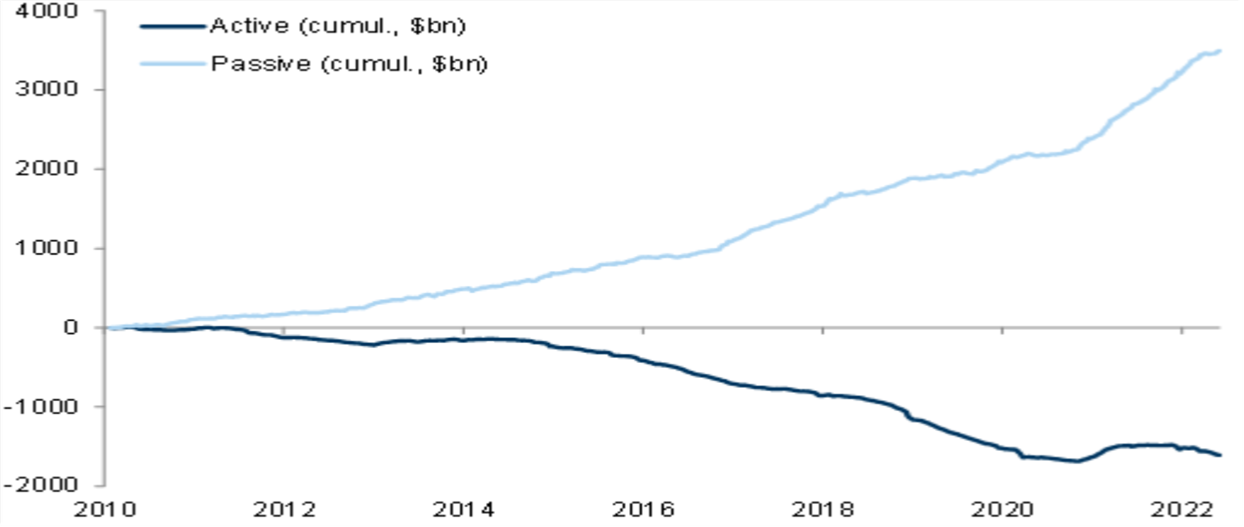

An accelerated interest in actively managed funds

As the next chart shows, value’s underperformance over the past decade has coincided with a $5tn (£4.1tn) rotation from active to passive management, according to Morningstar figures. As the investment environment normalises and the playing field becomes more even, we are starting to see signs of investors returning to actively managed mandates – and specifically those that are value-based. Many are discovering that global index mandates are often poorly diversified and a recent report by Bloomberg found almost 70% of active US mutual funds are outperforming the S&P index this year.

The return of the active investor?

Source: Goldman Sachs, Bloomberg

Dispersion among ‘penguin’ investors

The herding mentality of the past decade should not be underestimated. Limiting one’s investment focus to a small subset of global equity markets will no longer be sufficient, however, and the rise of active management has resurrected interest in forgotten value-based investment managers. As huddling penguins become scattered and confused, substantial opportunities emerge for skilled stockpickers.

A de-rating of intangible asset values

While intangible assets clearly have economic value for software companies or those selling branded consumer goods, they have been used to justify elevated multiples across several industries. In many cases, the actual return on investment from these investments is largely unknown and the market is currently de-rating them in a similar way to unprofitable companies.

These changing dynamics provide lucrative opportunities for active, price-driven investors. With equity markets shorn of QE and facing normalised interest rates, valuation matters again. In the long run, the one thing that will never change is that investors must swim against the tide to beat the market and deliver superior risk-adjusted returns over time.

Jonas Edholm is portfolio manager of SKAGEN Focus