After a difficult time last week, stockmarkets fell sharply on Monday as a collapse in oil price added to the virus woes. First thing on Monday morning, the FTSE 100 was showing a 24% fall from its peak in January – taking the index below 6000 for the first time since 2016.

To this picture can be added the stampede into government bonds as a perceived ‘safe haven’, which has pushed yields to record lows again. In the UK, for example, the two-year gilt yield is struggling to remain positive. The long and short-term implications are still unknown as the full scale of the virus spread has yet to be determined, but it is worth a quick look at the various elements – starting with the Coronavirus.

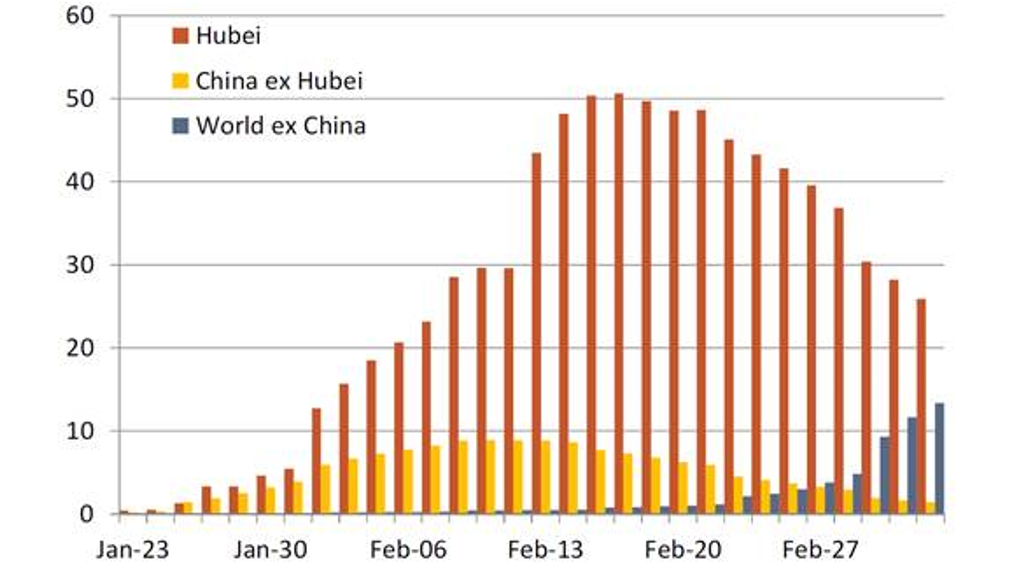

Below is a useful chart from Berenberg, which sets out the pattern these viruses usually follow. Undoubtedly, this will vary with each country’s response and it seems it will get worse in the West before getting better – but it is important to remember that it will end.

Coronavirus infections: active cases (in thousands)

Notes: Daily data. Active cases are confirmed cases adjusted for covered cases and deaths, in thousands. Source: Johns Hopkins University, Berenberg

The big question, from a financial point of view, is how much of a hit to economic growth is sustained. The first half of 2020 will, of course, see significantly lower growth but we are beginning to see countermeasures from governments and central banks so the impact on the second half of this year is less clear.

Collapse in oil prices

The collapse in oil price is a direct response to the breakdown in the talks between Saudi-led OPEC and Russia. The latter refused to go along with an OPEC plan to cut production so the Saudis have turned rough and increased production. The US shale oil industry will not be at all happy. Political fallout aside, though, a fall in oil price does help the rest of the World.

The sinking government bond yields seems to us to owe as much to the thin or illiquid nature of markets now – thanks to central bank and regulatory actions – as it does to a rational economic assessment.

Meanwhile, we would question whether anyone with a time horizon of more than a few weeks would sensibly buy a 30-year gilt with a yield (fixed) of 0.4% rather than, say, Unilever with a yield (most likely growing) of 4%.

There has been talk around how overpriced some stockmarkets were and it is this, along with the proliferation of ETFs, that is making the sell-off more pronounced. A FTSE 1000 around the 6000 mark offers good value in a number of areas and long-term investors should definitely be buying. In the short term, of course, there is no knowing where a panic might take us.

James Mahon is CEO and joint CIO of Church House Investment Management