At the start of the year, Smith & Williamson (S&W) added gold to its model portfolios on the basis that inflation was likely to move higher over the medium term. While admitting the timing of the trade could have been better, James Burns (pictured), co-head of the firm’s model portfolio service (MPS), says it was done with a long-term view.

“It’s obviously not been a fantastic investment so far,” says Burns. “But, like a lot of the themes in the portfolio, it’s in there for the longer term; it was never going to be a six-month trade.”

See also: Smith & Williamson adds Blackrock gold fund to tackle inflation

In fact, Burns explains, it was part of the long-term view to protect the portfolio should inflation come through more than it has in the past few years. Allocating to the Blackrock Gold & General Fund, currently 1.7% of the portfolio, was a way of adding another layer of protection.

“Importantly, we recognise that it could be relatively volatile,” he adds. “The position size was done accordingly so that it wasn’t going to kill us if it didn’t work out.”

Does Burns still see the same path for inflation? “I don’t think we’ll see inflation exploding,” he says, “it’s just whether it’s more than we’ve seen in the past couple of years. Therefore, the portfolio having extra exposure to that makes sense.”

Don’t overtrade

Early last year, pre-Covid-19, the team was positive on markets, particularly on the UK following the general election result in December 2019 and the view that Brexit would soon be agreed.

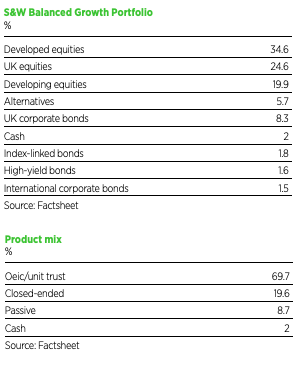

As such, the team entered 2020 overweight equities and underweight bonds. Global manufacturing indices were improving, global corporate earnings were continuing to grow, and central bank policies remained accommodative.

After the pandemic hit, the subsequent government and central bank response to do ‘whatever it took’ to support economies and markets made equities a good place to be throughout most of 2020, according to Burns, but activity in the portfolio this year has been muted so far.

Since the gold trade in December, Burns’ team does not think the world has changed enough to merit any changes in asset allocation. “This is the first quarter I can remember where we haven’t done anything in the portfolio,” he says.

Part of S&W’s ethos for the MPS is not to overtrade but it does not purposely limit trading activity either. At present, the team is happy with its positions and managers, and that is because the portfolios contain a balance of styles, particularly for equities.

“We may have a slight bias to value or growth, but we are not going to be completely exposed one way.”

Burns illustrates this point with the portfolio’s exposure to European equities. One fund, Blackrock European Dynamic, did extremely well last year, while another, Janus Henderson European Focus, did just “fine”. This year it is the reverse, and the team has taken money out of the former fund and allocated it elsewhere.

“We haven’t had the need to suddenly say, ‘Value is having its day in the sun, and we are in the wrong position’. Having that mix of managers, where one is picking up the slack at any one time has helped.” In autumn last year, due to the uncertainty of the US election outcome and a possible second wave of Covid-19, the team felt it prudent to reduce equity exposure in certain areas.

Burns took profits on Japan exposure throughout last year as well as Blackrock European Dynamic, a growth-focused fund that did extremely well. The team also did well out of some of the Asian names in the portfolio and Fidelity China Special Situations.

“These weren’t seismic changes, but it was prudent portfolio management to trim them a bit after making over 40% in a couple of holdings.”

Back from the wilderness

The team moved overweight the UK for the first time in a while in the early part of this year during what they believed was a period of excess pessimism. Brexit was underway, the vaccine rollout had begun and the UK looked too cheap relative to virtually all other markets.

Exposure to the UK was a beneficiary of moving underweight US. “We felt the US had less of a chance to outperform in the next couple of years and that maybe it was time for other markets to take over,” says Burns.

“The UK had four years in the wilderness where no one wanted it, and just as you thought it might come back into the limelight it got clobbered again by Covid-19. So once there was more positive news on the vaccine, the UK market looked cheap relative to most other equity markets. It is also completely under-owned by global asset allocators.

Burns does wonder, however, if UK valuations could rise if a wave of money enters the sector. “The UK market is quite small on a global scale, so it wouldn’t take much sentiment from global allocators to push it up because there is not that much paper around.”

He mentions Man GLG Undervalued Assets and RWC Enhanced Income as two UK funds that have done well in the past quarter. Alongside Artemis UK Select, these were added to last year rather than Troy Income and Growth. This is because the team thought these funds would benefit more from the UK recovery than the Troy fund. “But for the sake of portfolio balance, we weren’t going to sell out of Troy,” he says.

See also: Is the UK really emerging from the investment wilderness?

EM trade

S&W also added to emerging market (EM) managers that had fared less well during the past year because the region is looking attractive relative to the US on a weakening dollar basis. In some of the higher risk models, the team also recycled money from the Fidelity China Special Situations trust into EMs.

Funds that benefited include Blackrock Emerging Markets Equity Strategies, which has a significant contrarian bias and avoided many of the large-cap tech names that drove the markets. The Utilico Emerging Markets trust also fared well. It is heavily skewed towards infrastructure such as ports and airports, which unsurprisingly struggled in the past year.

Burns says that an element of mean reversion is employed when approaching EM exposure.

He explains: “Going back to the European example, if you’ve got two good managers and one has had a cracking time, it probably makes sense to allocate to the one that has underperformed because it will have its time in the sun again at some point. It’s a similar way of thinking about the EM trade.”

See also: Could a rising dollar throw emerging markets and commodities off course?

Since the MPS launched in September 2012, the portfolios have been overweight index-linked bonds, which Burns says has been a solid call and one that is set to remain in the portfolio for several years.

But at the lower-risk end of the range, during the course of last year it took some profits from index-linked bonds and gilts, which had held up well. The capital was recycled into UK and US corporate bonds.

It took the gilt duration shorter than benchmark, which Burns says has been the right call. The team is also short-duration within the corporate bond market, with its big position there being the Artemis Corporate Bond Fund, as well as the Axa US Short Duration High Yield and Liontrust Monthly Income funds.

Portfolios also moved overweight alternatives, primarily through hedge funds. Burns flags up the Brevan Howard-run BH Macro Investment Trust, which has delivered “phenomenal” returns, particularly in the early months of last year. However, he notes the fees attached to the trust are set to double in a proposed move back to the manager’s expensive 2-and-20 model.

Fees were halved a few years ago after a period of poor performance, but with a new focus on capital constraint, Brevan wants to revert back to the old fee model and has threatened to walk if its demands are not agreed by shareholders. It’s a conundrum for Burns and the team.

“It’s absolutely done what we wanted it to do when times were tough, but the new fee structure is something we have to consider,” he says. “Our investors look at the bottom line in terms of costs of the portfolio and something like this will bring that up. We also don’t like the way it has been handled by the company.”

This article is taken from the May 2021 issue of Portfolio Adviser. Read more here.