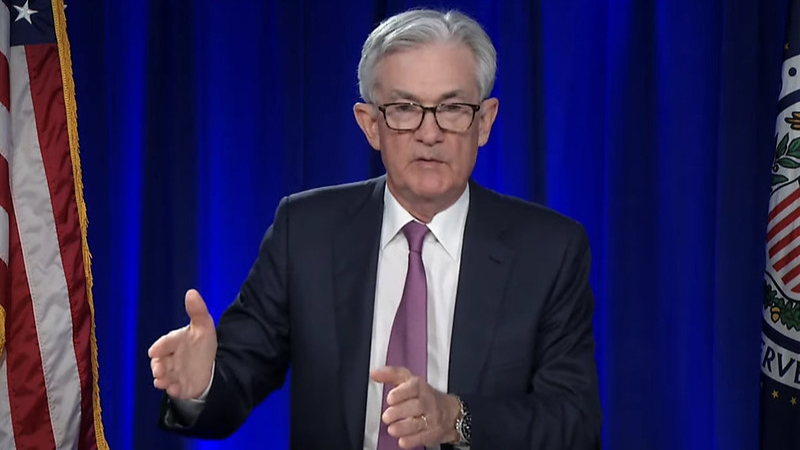

Fed chair Jerome Powell (pictured) has defended the Federal Reserve’s 2% inflation target and did not rule out further interest rate rises in a hawkish speech at Jackson Hole.

Addressing the central bank symposium today (25 August), he warned the Fed would “proceed carefully” as it decides whether to “tighten further or, instead, to hold the policy rate constant and await further data”.

Powell said: “At last year’s Jackson Hole symposium, I delivered a brief, direct message. My remarks this year will be a bit longer, but the message is the same: It is the Fed’s job to bring inflation down to our 2% goal, and we will do so.

“We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

See also: Jackson Hole a ‘pivotal’ moment for central banks with policy set to diverge

‘Yawns from a sleepy August Wall Street’

The annual speech at the tiny town in Wyoming is often scrutinised by analysts who look for clues on the Fed’s future thinking. Last year, markets fell as Powell adopted a hawkish stance on tackling inflation, bluntly saying that combatting it would “bring some pain to households and businesses”.

Reacting to this year’s speech, Lazard chief market strategist Ronald Temple said: “Powell’s speech today should give investors confidence that rate hikes are likely over, absent an unexpected resurgence of inflation. The commentary was largely in line with expectations, eliciting yawns from a sleepy August Wall Street.

“While noting that it will take time before the Fed can be certain inflation and expectations thereof are safely anchored at 2% and suggesting that there are situations that could trigger additional rate hikes, Powell was also careful not to signal imminent additional tightening measures.”

See also: Weekly outlook: UK and US to reveal house price data and Prudential reports

Fidelity International global head of macro and strategic asset allocation Salman Ahmed added: “Latest remarks from Fed chair, Jay Powell, continue to highlight the higher for longer mantra and potential for further hikes if needed. Focus remains on inflation as has been the case for much of 2023 despite recent signs of disinflation.

“The strength of the economy, especially labour market strength, continues to keep the Fed vigilant and away from any significant pivot. Furthermore, chair Powell defended the 2% target which helps explain the sustained hawkishness. This communication is in line with our views.

“However, from a business cycle perspective, we remain in the camp that the transmission mechanism is delayed and not broken, implying that cumulative rate hikes done so far will start to negatively affect the economy as temporary factors such as excess savings and delayed maturity walls fall through in coming months. We are already seeing signs of such pressure building in Europe and the UK and we think the US will follow suit by early 2024.”