Author: Ben Deane, Investment Director, Sterling Investment Grade, Fidelity International

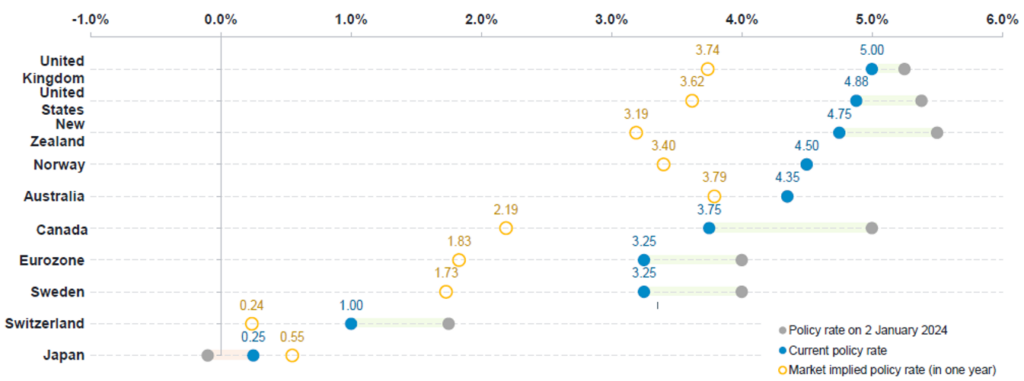

The Monetary Policy Committee (MPC) met on 7th November to decide on Bank Rate and deliver their monetary policy report. As was widely expected, the Bank of England (BoE) cut interest rates from 5.0% to 4.75% and the market expects Bank Rate to be around 3.75% 12-months from now (see figure 1).

With interest rates falling, and there are almost certainly more to go, we think the time is right to be leaning long in interest rate risk and are positioning the portfolios accordingly. It is time to lock in these attractive yields – by historical standards – while we still can. Credit valuations look rich, which is why we are defensive here, but we continue to find value under surface, particularly via securitised bonds.

Central banks are in easing mode, with plenty of rate cuts to come

Globally, central banks in the DM space are in the midst of a cutting cycle, with the market expecting further cuts to come over the next 12-months (see figure 1). The exception to this is the Bank of Japan (BoJ) which is hiking its policy rate following a period of negative rates. Inflation rates have moved to, or close to, central bank targets which has given the green light for policy makers to embark on this easing cycle. As we have commented on in the past, corporate bond markets tend to offer positive excess returns over cash during cutting cycles and this environment should be supportive for high quality bond markets.

Figure 1: Historical, current, and expected interest rates

Source: Fidelity International, Bloomberg, 24 October 2024.

Credit valuations do look rich

The key argument against moving into credit markets all ‘gung-ho’ are valuations. Credit spreads, or the extra yield investors receive for lending to corporates over ‘risk-free’ government bonds, are low by historical standards. To illustrate, our quantitative screens show that since 2006 (before the global financial crisis), sterling investment grade credit spreads have traded tighter just 11% of the time. Or, to put it another way, the extra yield investors receive in sterling investment grade credit relative to gilts has been more attractive 89% of the time since 2006. Meanwhile, by the same measure, US and Asia investment grade credit is trading at all-time tights. This, we should add, is why we are relatively defensively positioned in credit right now.

If credit looks rich, why not move into government bonds?

So, why not just go into government bonds if credit valuations don’t stack-up? Three reasons.

- The credit spread still exists! There is still a credit spread, so investors get more yield for lending to corporates over government bonds and this extra carry tends to mean corporate bonds outperform government bonds over the long term. That credit spread today, despite being low versus history, is still over 1% in sterling investment grade, and through active management Fidelity is able to generate a little more over this as well. So, for investors concerned with income, corporate bonds still have something over government bonds. This spread also offers a cushion against underlying rates volatility or interest rate risk. To illustrate, wipeout yields, which measure the level of yield change required to ‘wipeout’ a years’ worth of carry are more attractive in credit markets versus government bonds, and particularly so in the front end of the credit market.

- There is value under the bonnet, particularly via securitised bonds: While index-level spreads look tight, there are more attractive opportunities beneath the surface. For example, while sterling investment grade credit has traded tighter just 11% of the time since 2006, sterling securitised bonds have traded tighter 50% of the time. This is an area of the market we remain overweight across the funds, and should the economic environment deteriorate, this area should outperform straight corporate bonds as it has done during historical periods of stress.

- Investment grade spreads still offer compensation – even under a severe default environment: Our quantitative research team have conducted analysis to stress credit markets against different default regimes (stable, rising, or a 95th percentile worst case) to see if the credit spread compensates investors for the typical losses experienced during those default regimes. The good news is that credit spreads, even at today’s levels, still offer a premium after accounting for losses in a worst case 95th percentile default environment. However, this is only in investment grade credit. Sadly, the credit spread in high yield from double-B’s down through triple-C’s is not sufficient, based on history at least, to compensate investors for the typical losses experienced in a severe default environment.

All-in yields remain attractive and the recent rise in yields offers an attractive entry point

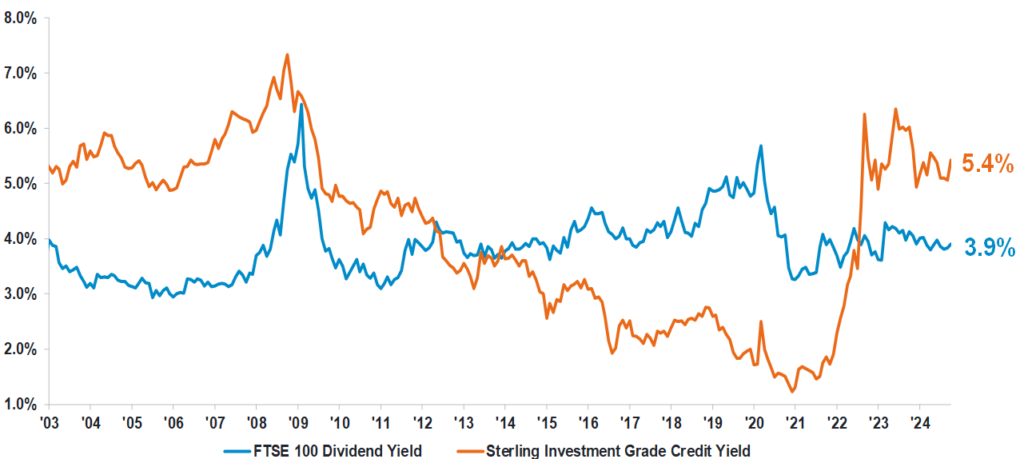

Yields have risen over the past few months with the US election, stronger-than-expected economic data and, specific to the UK, the recent budget all contributing to this move higher. We think this offers an attractive entry point for income-seeking investors. All-in yields in sterling investment grade credit are now 5.4%, offering a healthy pick-up over FTSE 100 dividend yields at 3.9% (see below).

Furthermore, while UK rates are expected to be c. 3.75% one year from now, this is absent a hard-landing. Should a hard-landing transpire, which is a risk severely underpriced by the market, rates are likely to move lower than this, quickly. With interest rates falling, and there risks to the downside should the economy slow, we think now is the time to lock in these yield levels while they are still around. In a few years’ time, we may look back at these levels in awe….

Figure 2: Yields compare favourably in credit versus equity dividends

Source: Fidelity International, Bloomberg, 31 October 2024. Sterling Investment Grade Credit = ICE BofA Euro Sterling Index. The Yield to Maturity (also known as the Redemption Yield) is the anticipated return on a bond / fund expressed as an annual rate based on price / market value as at date shown, coupon rate and time to maturity. The redemption yield is gross of any charges and tax.

IMPORTANT INFORMATION

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates rise and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document (Key Information Document for Investment Trusts), current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. FIPM: 8578