By Fergus Argyle, portfolio manager of the New Capital Emerging Markets Future Leaders Fund

Dramatic elections and rapid rate hikes have created a cloud over the Latin American nation that could be obscuring some compelling opportunities.

The hotly contested October election between Jair Bolsonaro and Luiz Inácio Lula da Silva revealed a divided nation, while the country’s central bank hiked interest rates from a little more than 2% at the start of 2021 to 13.75% by August 2022, where they remain today.

Unnerving though this is, the fundamentals of companies operating in Brazil remain compelling.

Essentially, three pillars – a less stringent government strategy than feared, monetary policy, and equity valuations –provides the foundation for continued optimism.

Withholding judgement

As president-elect, Lula da Silva spooked markets after pushing for greater social spending without providing an outline of any supporting long-term fiscal rules.

But the new government took a less heavy-handed approach than expected, bolstering our stance on Brazil.

It might not sound effusive, but the least bad outcomes have transpired on several fronts.

Experts were predicting Lula would apply the hand brake to Bolsanaro’s path towards privatising state-owned enterprises, notably energy giant Petrobas. Though further privatisations certainly look less likely under Lula, his administration has not engaged in the kind of interventions his detractors might have expected, such as curtailing dividends, meddling in the firm’s capital allocation plans around downstream assets and its renewable energy strategy.

See also: Is China a ‘dead weight’ in emerging market equity funds?

On broader policy, Fernando Haddad, Brazil’s finance minister, appears to be orchestrating targeted leaks of fiscal plans, digesting and incorporating feedback to help inform final policy proposals.

We now await the revenue side of the Finance Ministry’s fiscal policy. While our base case is that alterations to taxation could occur, fears about drastic action that could cause value destruction at the stock market level appear unwarranted. Indeed, simplification of the tax bureaucracy would be welcomed.

War on inflation

This, as of yet, relatively restrained approach by ministers has been offset by an unyielding central bank, which perhaps ironically forms the second factor behind our positive perspective.

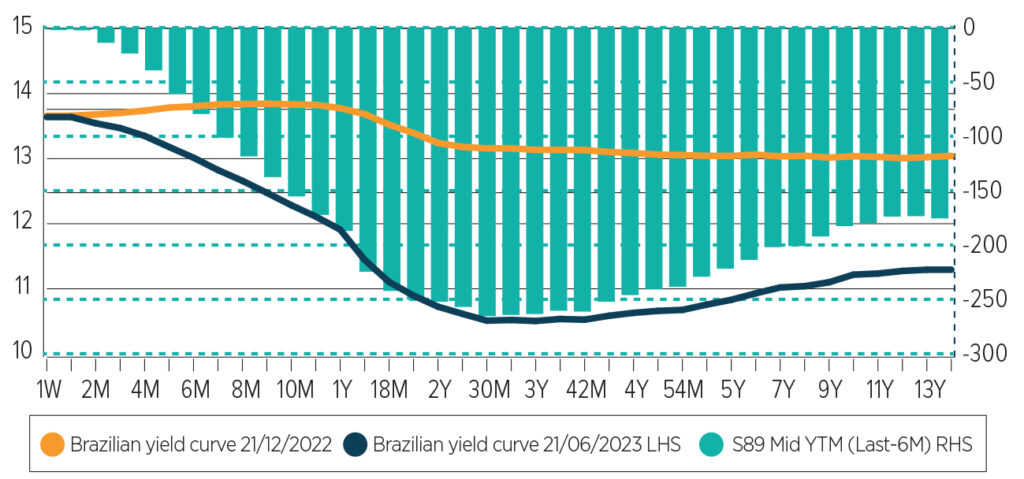

Brazil’s rapid interest rate hikes saw rates rocket from 2% into double digits by mid-2022. The aim, as with interest rate policies across the world, was to tackle inflation, which stood at around 12% a year ago. Local investors pulled money out of equities and bought local bond funds. With inflation now at 3.16% (as of the end of June) Brazil’s real rates are the highest among emerging – and global – market peers.

While investors are beginning to eye the prospect of an interest rate cut, the Brazilian central bank’s monetary policy committee, Copom, is talking tough, despite the vociferous criticism of the government.

With inflation falling, we expect a more dovish tone eventually from CB Governor Campos Neto. The ideal outcome would be for inflation to continue cooling as rates start to fall, creating a virtuous circle around equity ownership.

See also: Vietnam: A rising star in emerging markets

Despite the equity market pain, Neto’s policy intransigence has been positive. Firstly, it shows the improvement in governance at a key institution in Brazil. This is a significant improvement from previous administrations (and to an extent contrasts positively with developed market central bankers today – particularly in Europe). Secondly, it creates a significant degree of valuation ‘latency’. Given real rates and “less bad” moves from Lula’s administration, we know cuts are coming and the equity market is coiled spring in front of that event.

Brazilian yield curve pricing 250bps of easing in the next three years (source: New Capital)

Even if interest rates remain elevated, company valuations price in very little good news and, therefore, provide a cushion for Brazilian equity owners.

The Brazilian stock market’s one-year forward price-to-earnings ratio stood at roughly 7.5x in early June, equivalent to its lowest 20th percentile of earnings compared to its own five-year history.

This means that any negative news flow is unlikely to suppress prices much further, and any upside is likely to be enthusiastically welcomed.

The changing expectations of rate cuts has had the effect of sparking moves in particularly depressed or rate sensitive companies.

These three factors have led to our changing perspective on Brazil. We recently added companies that we felt were displaying distressed valuations in spite of their robust business models.

These included the Brazilian stock exchange B3 and brewer Ambev, the latter, has launched premium products, used digital tools to improve their distribution efficiency, and provided a finance platform for their retail customers.

At face value, there is a lot of pain baked into Brazilian stock market valuations, but the trio of government strategy, monetary policy and equity valuations give us cause for optimism. And with early signs that investors are ditching money market funds in favour of equities, the country in our opinion could see momentum pick-up behind its listed firms.

–

PA event: The Watchlist, September 7th | RSVP HERE

Hosted at the Soho Hotel.

This event will explore the latest trends and strategies on Portfolio Advisers’ radar. It will provide an opportunity to gain unique perspectives on up and coming funds.

Sponsors include Goldman Sachs Asset Management, J Sarfra Sarasin, Munich & Co, Oldfield Partners, Premier Miton, Trium Capital and SVM Asset Management.