The dramatic Covid-19 driven market sell-off and ensuing spate of dividend cuts serves as a stark reminder that equity sits at the bottom of a company’s capital structure, but does income from the asset class still have a role to play in portfolios?

According to AJ Bell figures, 43 FTSE 100 companies have withheld £23.8bn in shareholder payouts for the 2019-21 period as a result of the coronavirus crisis. Among the highest profile companies to cut so far were income-paying stalwarts Shell, which announced it was canning its payout for the first time since the Second World War, and BT which suspended its annual dividend for the first time in 36 years.

The rising number of UK corporates slashing their dividends also forced the Investment Association (IA) last month to suspend its equity income sector yield requirements to help fund managers avoid becoming forced sellers.

> See also: Richard Buxton lays into regulators for pushing dividend cuts

The IA’s UK Equity Income sector sits at the bottom of the performance table for all 39 IA sectors since the Covid sell-off hit markets. For the period 20 February to 12 May it delivered a -23.08% return while the IA Global Equity Income sector returned -14.8%.

Equity income holds its own

But Gam UK Equity Income manager Adrian Gosden (pictured) believes equity income is actually holding its own from a yield perspective despite the raft of recent dividend cuts, especially when compared with alternative sources of yield.

The 10-year gilt is yielding 0.27%, he notes, while a good chunk of open-ended UK property funds remain frozen after their independent valuers declared it too difficult to put a price on underlying holdings in the Covid-hit market.

“Anyone who’s using those instruments is getting much less for the pound they invest,” says Gosden. “People who use property for rental income, the yield in that area is just going lower due to the fact that people aren’t paying, so the quality of the income from office buildings and retail outlets is really coming into question.”

> See also: Will Covid prompt even more UK companies to get the ‘buyback bug’?

For Gosden, BT and Shell cancelling their dividends was a big shock but he believes there are plenty of UK companies still paying out that are not as sensitive to an economic downturn, including Tesco, Vodafone, British American Tobacco, Glaxosmithkline and National Grid.

But he warns against chasing yield, saying most equity income managers should have capitalised on good value stocks in March when the market was really beaten up, adding it’s about holding companies in resilient sectors regardless of whether they have cut their dividend or not.

“What you’ve got to do is make sure that you’ve got genuinely good companies that will return to the dividend list in the next 12 months as things start to improve,” he says.

Poor quality companies are structurally challenged regardless of how they have reacted to the sell-off, he adds.

“Some of the general retailers, their business model is just being eaten away, maybe even faster due to this [Covid-19] but they are not good companies. You’ve seen that in department stores, they’re not going to be coming back at all, let alone their dividends.”

Go global for diversification

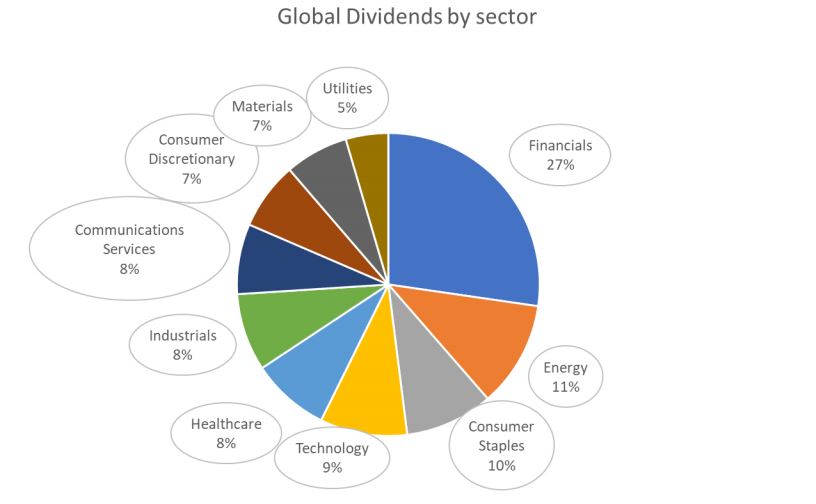

But Guinness Asset Management notes that the 15 largest UK dividend payers represented 64% of UK dividends in 2019. It believes in a global approach to dividend selection because the UK and European markets are too concentrated in a small number of sectors.

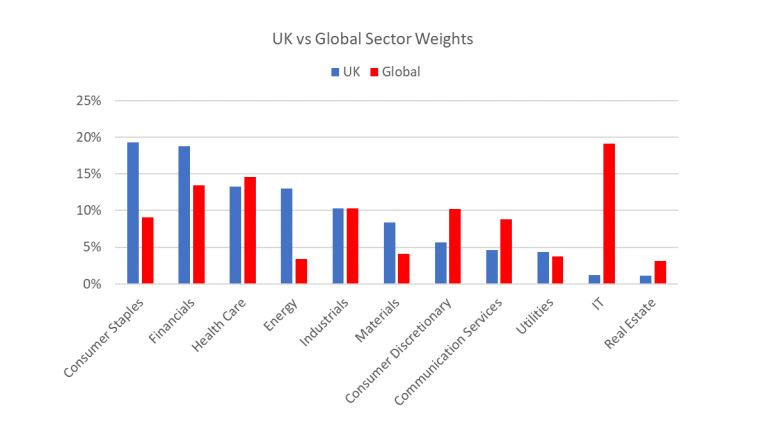

Guinness Global Equity Income fund portfolio manager Matthew Page notes the UK index is dominated by consumer staples, financials, healthcare and energy relative to the global benchmark. At the other end of the spectrum, the UK market only has a 1% or 2% exposure to the IT sector which makes up 20% of the global benchmark.

Page notes two cyclical areas of the market which find themselves in a difficult situation: UK and European banks, which have been forced to cut dividends by regulators, and energy companies such as Shell.

“Why expose yourself to very significant sector concentration with some very significant large companies which are finding they need to cut their dividends when you could take a far more diversified approach?”

Page says so far during the Covid crisis not one company in the Guinness Global Equity Income portfolio of 35 companies has been forced to cut its dividend. What’s the secret?

“We have not had any airlines, we don’t have travel companies and we haven’t had any hotels,” says Page. “Also, about half of our portfolio is in consumer staples and healthcare companies and that’s part of the market that has been the least affected. If anything, they’ve seen a bit of a boost in demand.”

According to the fund’s latest factsheet, it has a 28.6% weighting in consumer staples, 19.7% in industrials, 16.9% in healthcare, 14.1% in IT, 13.7% in financials (excluding banks) and 4.9% in consumer discretionary.

The US makes up half the portfolio at 49.9% and the UK is the second-highest geographical weight at 17.1%. Page says despite the concentration issues, the UK has some good opportunities.

> See also: SJP slashes dividend as coronavirus crisis drags assets down 13%

Page also believes the coronavirus-induced sell off has resulted in a change in mind-set from simply picking companies that pay the highest dividends to choosing those that can grow their dividend where the absolute level of income is less important.

He explains: “Traditional dividend fund philosophy has been about defining the universe by companies that pay the highest dividend yields and the problem with that is it naturally takes you toward either companies that aren’t growing, companies that may be in some form of financial distress, or companies that are in decline.

“That’s fine when the economy is growing but when you get a slow down like we’re having right now those are not the companies you want to be owning because they are already quite distressed, or they’re not growing. Whereas, if you’re looking for dividend growth you’ve got to find companies that are growing.”

Other sources of yield

Independent investment consultant Thomas Wells says equity income funds can become skewed towards old economy sectors – financials, telecommunications, mining, utilities and oil and gas – but they still represent one of the highest-yielding asset classes.

“However, investors should be willing to sell units in funds to generate income rather than purely relying on dividend flows,” he says. “This would open up the investment universe to a wider selection of funds, investment styles and new economy sectors.”

Momentum Global Investment Management director of investment management James Klempster notes equity income still plays a role in portfolios, recent dividend cuts have hurt total returns over the short term so it makes sense to use a basket of different income-generating asset classes.

Outside of equities, Klempster says the team is taking advantage of credit spreads widening to levels not seen since the global financial crisis and that are offering compelling risk-adjusted returns.

Wells, who used to be part of the Aviva Investors multi-asset team, also notes that banks might be cutting dividends but they are continuing to pay coupons on their AT1 bonds. “Alternatively, real assets such as infrastructure and residential Reits are providing their investors with stable contractual income flows,” he adds.

> See also: Multi-asset income funds tap into credit as £20bn worth of dividends slashed

GDIM investment manager Tom Sparke says the equity income sector has undeniably sustained a serious shock but those with international exposure, infrastructure, covered call strategies or other alternative income positions will all be able to sustain a good level of yield.

“We have moderately reduced the UK exposure in our income portfolios in favour of more global and income-sustainable funds and increased the yield moderately to cope with further reductions.”

But Guinness AM’s Page thinks there will continue to be demand for equity income for years to come.

“Just look at the demographics, just look at the yields there are on other asset classes; people need income from their equity investments and therefore dividend investing is not going to go away as an investment style.”