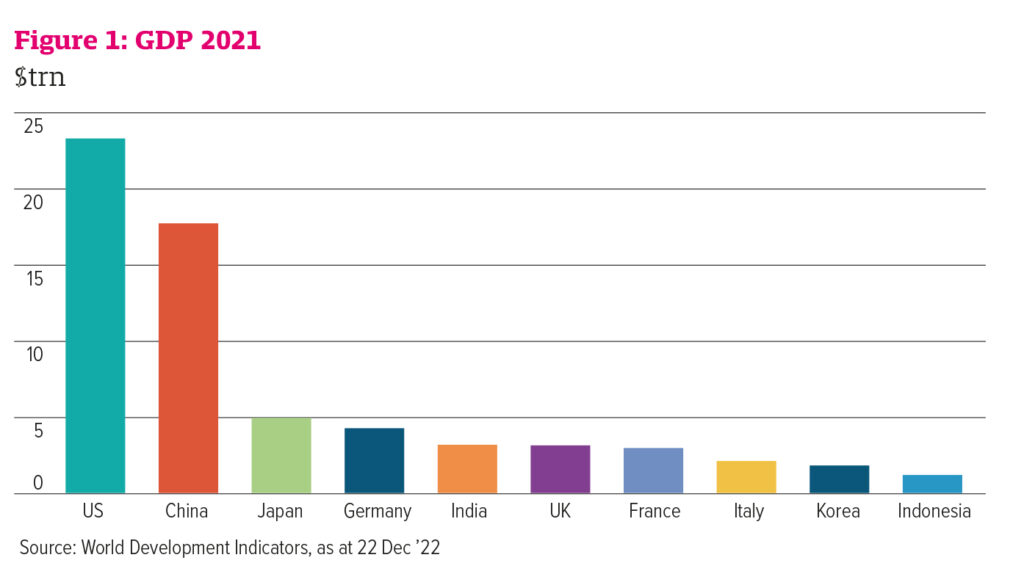

The sheer scale of China is difficult to wrap your head around. Its population is nearly 27 times bigger than the UK’s and it covers 39 times more of the Earth’s surface. It is the second-largest economy on the planet, while the UK ranks sixth (see figure 1). It is a vital cog in the world machine. But on 28 March 2020, its borders were closed. There was little expectation at the time that it would take nearly three years for them to open again.

On the very last day of 2019, China notified the World Health Organisation (WHO) about a cluster of ‘viral pneumonia’ cases in the city of Wuhan, which lies on the Yangtze River, roughly midway between Beijing and Hong Kong. The first international case was reported in Thailand on 13 January 2020. Just 10 days later, Wuhan and the entire Hubei province were put in lockdown. The region is home to more than 58.5 million people.

The virus reached the UK on 31 January, with the first local death confirmed on 4 March. A week later, the WHO declared Covid-19 to be a pandemic. The UK went into a national lockdown on 23 March.

While the response in the UK was to tighten and then relax the restrictions, China opted for a much more aggressive policy of ‘zero-Covid’. Swift, strict and specific containment became the name of the game, with the lockdown of Shanghai lasting for 65 days and impacting nearly 25 million people.

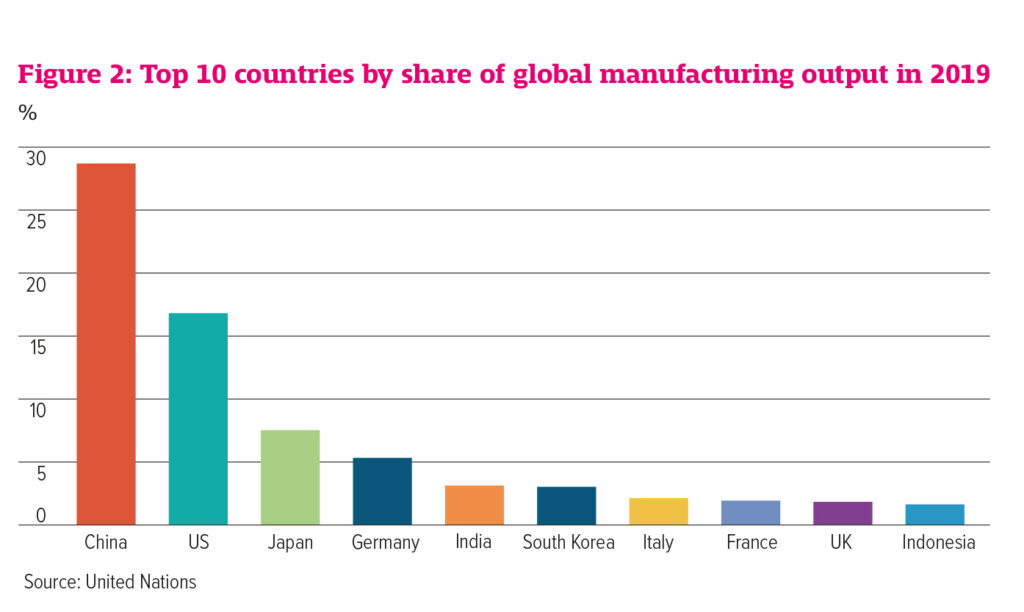

Often referred to as the ‘world’s factory’, China accounted for nearly 29% of global manufacturing output in 2019 (see figure 2).

While the rest of the world was in lockdown, the impact of China’s isolation was modest. But as the world re-opened and consumer demand kicked into high gear, it proved to be one of the biggest barriers to the return of some semblance of global normalcy.

So, it’s little surprise the announcement in December that forced quarantine and other aggressive measures were being pared back, and later scrapped, was welcomed almost as much internationally as it was domestically.

China’s international borders re-opened on 8 January 2023, with the news triggering a hefty rebound in investor sentiment.

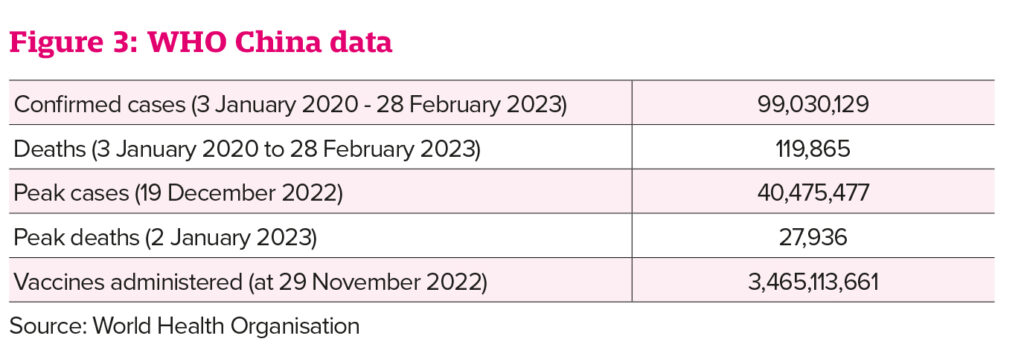

Having spent three years trying to keep the genie in the bottle, joining the rest of the world in ‘living with the virus’ was always going to see cases spike. And spike they did, with 40.4 million cases recorded on 19 December 2022 alone, and the number of daily deaths peaking at nearly 28,000 on 2 January 2023, according to the WHO (see figure 3).

‘It’s over, it’s done’

But the virus remains the elephant in the room, and concerns about another potential global wave or further mutation seem quickly glossed over. Is the euphoria of re-opening minimising genuine risks?

When it comes to concerns about the virus mutating, Fiona Yang, manager of the Invesco Asian Equity Income Fund (UK), and co-manager of the Invesco Asia Trust, says: “The re-opening has not caused any alteration of the Covid variant.”

Though she does caveat that statement with “yet”.

“China, like the rest of the world, is already living with Covid and we don’t think there will be disruptions to global re-opening.”

KraneShares’ head of international, Xiaolin Chen, still has relatives living in China and says, “almost everyone I know was infected, no-one was in a critical condition, and they have all recovered”.

There is a sense people have survived and built up some immunity, she adds. “It is a huge relief.” The removal of a lot of the testing centres, “psychologically, makes people feel that it is behind us”.

A lot of the economists that Pictet’s head of emerging market fixed income, Mary-Therese Barton, has been speaking to “feel more confident about the building of natural immunity”, she says. As a result, there is less talk about the impact another wave could have on growth.

Barton thinks the speed at which restrictions were lifted, “which was just astounding”, likely reduced the risk of successive waves of infection. “The big-bang re-opening, which was kind of unprecedented, saw so many unfortunately catch Covid. I think there is a sense that the risk of another wave has probably receded because a large proportion of the population has received natural immunity.”

“The rhetoric in China,” adds Juliana Hansveden, portfolio manager in the sustainable equity team within the multi-asset team at Ninety One, “is that they have beaten the disease. That it is over, it’s done.

“No one talks about it anymore. Whether you agree with that or not doesn’t matter. From a policy point of view, they are unlikely to change back to where we were.”

She says: “Ideally, there would have been a higher degree of vaccination uptake in the population before the opening-up. Also, ideally, the most efficient vaccines available globally would have been picked and distributed across the population. That would have been the best scenario. There is obviously a risk that comes from the low level of vaccination. There will be immunity developing now, but to what extent it lasts is hard for me, as a portfolio manager, to comment. But I acknowledge the risk.”

So, with the government embracing a ‘living with Covid’ philosophy and the subsequent surge in cases and deaths, so far, proving temporary – the question then becomes, what’s next for investors?

Home and away

The closure of China’s borders caused a multitude of headaches for global firms that relied on its attractively priced manufacturing capabilities. Diversification became the watchword as supply chains were branched out and production was sourced from/set up elsewhere. Do those businesses have sufficient confidence or interest in returning most, if not all, of their supply chains to China?

“Some companies will come back, some will not. That’s just a fact,” says KraneShares’ Chen, pointing to the lower-value chain manufacturers as least likely to return. “The labour force is no longer the cheapest in the region. A T-shirt that was manufactured in China is now made in Vietnam,” she adds.

The ones that will return are the “middle- to high-value chain” firms. “China has the most advanced infrastructure in Asia and emerging markets today and is offering the most supportive corporate packages,” Chen says, adding that this, combined with an upskilled workforce, is an appealing prospect.

She points to Tesla getting “a golden spot to set up in Shanghai” in 2018. A few months after talks began, a factory had been built. “Nowhere else can do that,” she says. The speed at which the government can move to entice and secure high-value brands to set up in China is one of the biggest draws for international firms, Chen adds.

While there are undoubtedly benefits for global firms and Chinese companies with international operations, Invesco’s Yang believes there is “a more positive view for firms with pure domestic exposure, as the re-opening economy has given policy certainty to firms’ decisionmakers”.

In contrast, “for companies with more international reach, the uncertainties related to global inflation and the [US Federal Reserve] funds rate make it difficult for senior managers to make long-term capital commitment”.

China-focused companies also have a key advantage, in that they are less concerned with searching for clients overseas because they have so many at home, says Chen. “I was at an event and people were talking about ChatGPT. In China, Baidu, the search engine, is also developing its own equivalent it plans to release in March.”

Questions were raised about it not being available in English and subsequent limitations for worldwide distribution, something Chen quickly dismisses.

She flags Tiktok-owner Tencent’s messaging app WeChat, the equivalent of WhatsApp but with inbuilt payment functionality, as a prime example of why that is not important. “WeChat has one billion daily active users, that’s more than enough for any company. Who cares about the language barriers when you have 1.4 billion people as a target?”

A little bit of luxury

Like most countries, the pandemic saw household savings in China climb considerably. How that money is deployed will have a significant impact on the companies that do well and those that don’t – both domestically and overseas.

Chen puts the household savings figure at $2.6trn (£2.17trn) for 2022 alone – an 80% uplift from the year before. She says the younger generations will take trips to Europe and other far-flung destinations, which will drive increased demand for luxury goods and services in those locations.

Older people, “who might not want to do a trip 13 hours away from home, will go to places like Hong Kong, Macau, South Korea, Japan, Thailand, Singapore and Malaysia”, Chen adds.

Gillian Diesen, client portfolio manager, Pictet-Premium Brands, concurs. The re-opening “creates tailwinds for global companies that have proved popular with Chinese consumers, specifically luxury goods producers”.

“Although they’ve weathered China’s recent turmoil reasonably well, the government’s policy shift is bound to release pent-up demand. The top end of the Chinese luxury market has been resilient throughout, but even where demand has been dented within China, wealthy Chinese have continued to buy such goods abroad, which has helped many brands to sustain global sales.

“In fact, in 2021 more than a fifth of global consumer spending on luxury goods was in China. At the same time, Chinese consumers are starting to take an interest in niche sporting and educational products and services – from kayaking to painting lessons – while also increasingly shifting their focus to domestic premium brands.”

She adds: “China is poised to boom over the coming year, and we even expect China to outperform developed economies over 2023. Our economists estimate that, by the end of 2022, Chinese cumulative excess savings accounted for some 8.1% of disposable income and household excess savings nearly 20% of GDP. This should help support Chinese retail consumption and, with it, spending on luxury goods. Mere moderation of the zero-Covid policy or signs that the pandemic is no longer a health crisis could release some pent-up demand, potentially boosting global turnover in the sector by up to 10%.”

Diesen’s Pictet colleague, Barton, is a bit more cautious in her outlook. “A lot of this reopening has been focused on consumption services, which has historically been one of the weakest areas of growth for China. So, we’ve got to temper our positivity to some degree.”

After three years of disruption and pessimism about globalisation, she says: “I think there’s still a long way to come back and I feel that could be more prolonged than people are anticipating.”

Structural trends

Beyond buying luxury items/experiences, what other areas of the economy look attractive?

For KraneShares’ Chen it’s stocks she describes as “oversold”, offering Alibaba as a prime example, which she says suffered on the back of the internet regulations introduced by the government in 2020.

The online marketplace was fined an eyewatering $2.8bn in 2021 for failing to comply with anti-monopoly rules on the disclosure of transactions.

“It is oversold because of the internet regulation, geopolitical risks, macro factors, the pandemic and people disregarding the quarter-over-quarter earnings. They paid the fine, they moved on. The earnings keep going up, but performance keeps going down because of macro effects. That is a classic example of oversold.”

It has been nearly a year since the government or competition authority raised the prospect of further regulation in the sector, “so it’s safe to say they are done”, Chen adds.

Tech is also a key theme for Ninety One’s Hansveden, whose Emerging Markets Sustainable Equity strategy seeks to identify companies that capture structural growth opportunities in underserved areas.

“Individuals and companies in China have not yet been able to adopt some of the services we are used to in developed markets. There is an early stage of development that creates opportunities.”

She adds: “A large proportion of corporate entities in China and in emerging markets are SMEs, much higher than in developed markets. And, typically, they are poorly served in terms of financial and digital services. They have also been disproportionally impacted by the pandemic. There is the short-term potential, but also the long-term structural trend.”

A lack of insurance coverage is another area of note, Hansveden believes. “It is very low and my ownership of Ping An Insurance, for example, addresses the lack of, among other things, life and health insurance. The lack of a social welfare net, an ageing population and rising incomes all support the adoption of insurance.”

Investing in property has been prioritised by Chinese investors “rather than mutual funds, stocks and bonds”, she adds. “So, the diversification of savings is an interesting area.”

Troubled waters

A pivot away from property has followed a spate of negative headlines generated by the sector in recent years. The country’s second-largest developer by sales, China Evergrande Group, fell from dizzying heights to become the world’s most indebted firm, severely shaking international and domestic investor confidence in the sector.

Evergrande borrowed more than $300bn to become one of China’s biggest companies, but efforts by the government to curb how much debt property developers carried triggered a crisis for the company.

Its share price plummeted to zero in November 2020 having been a fraction below $4 per share just two months previously. It currently trades at $0.03, a drop of 85.7% from a year ago.

Given her sustainable mandate, property is not a natural fit for Hansveden’s portfolio. “A company that has a business model that is carbon-intensive is a problem. Most of these companies don’t meet my [investment] criteria, so I have never been an investor in Chinese property.”

But she has other reasons for giving the sector a wide berth. “The reason I don’t own any property companies is I don’t believe there is any structural growth. I think it is pretty well developed and it’s heavily regulated by the government, meaning it is not as strong on the value-creation side.”

The capital-intensive nature of the sector also means it requires a lot of investment, yet “doesn’t have the history of actually compensating investors enough for that”, Hansveden adds.

Invesco’s Yang agrees “the sector that might take longer to get back to meaningful growth could be real estate, despite the government’s recent change of policy direction. ‘Houses are for living and not for speculation’ is a long-term goal set by the government. We are unlikely to see another rosy cycle of property price inflation in China”.

Another area generating headlines for all the wrong reasons recently was online education, which was turbo-charged during the pandemic, as schools were closed and parents slowly lost the will to live. So the decision by the Chinese government to crack down on after-school education companies took many by surprise.

The ‘double reduction’ policy was intended to alleviate the pressure on parents of pre-high school aged children. The guidelines sought to force tutoring businesses to restructure as non-profits and only offer classes on weekdays for a limited number of hours.

“Online education is an area I have looked at,” says Hansveden. “It meets my structural growth criteria because consumers in China have prioritised education. It has been one of the absolute highest priorities when it comes to discretionary spending.

“But if you look at what some of these companies have actually been doing, a significant portion of their revenue comes from the very young. So, the idea that you have children who should be playing or exercising, not just sitting still and learning something that might not even be needed at their young age, is not really something I have ever found particularly sustainable in terms of a business model that should be encouraged.

“And it came through in the regulation in terms of the government also not being very keen on that either. I have never owned the space. I understand why it has been regulated and I think most of the regulation has been sensible.”

That doesn’t mean Hansveden and her team will never invest in education in China. “There will be other providers that address a sustainability problem or an underserved cohort really well. So, it’s not education as a whole, it would just be on a case-by-case basis.”

Mind the gap

Pictet’s Barton describes the past few years as “quite existential for many emerging market investors”.

“Not only is China the second-largest economy in the world, it is also the second-largest bond market,” she adds, and its re-opening “has led to a refocus on the emerging market growth premium”.

“What we’re seeing is the growth gap between developed and emerging markets going back to levels not seen since at least prior to the taper tantrum in 2013. We are anticipating that growth gap is likely to be above average for quite a prolonged period and that fits into the resilience of emerging market growth.

“That gap has been a very good indicator of capital coming into emerging markets. On many measures, positioning in emerging markets, particularly the local markets, is close to historical lows. Foreign ownership in emerging market local bonds is really very low at this juncture.”

She points to the attractive yield differential, “which we believe is going to be a driver of inflows”.

When it comes to her current positioning, Barton says she is underweight duration.

“That’s a re-opening trade for us and is a statement of our conviction in the prospects for this re-opening theme to continue. Plus, we want to be underweight Chinese bonds because we think rates will need to be moving higher in that market.”

On the credit side, there is appetite to “selectively” venture back into property, where the team has been “relatively light for the past 18 months”. With the help of onshore analysts, “we have started to step back into high-quality names where we are confident of policy support and which we feel will be a beneficiary from re-opening”, Barton says.

Yang’s strategies at Invesco have been “very aggressively” adding to Hong Kong and China over the past 12-18 months. “We moved from a meaningful underweight position in 2021/early 2022 to a six percentage point overweight,” she adds.

“In terms of valuation, China is still trading below the 10-year average PE multiple. It shows the continued pessimism on the Chinese market outlook despite the removal of Covid restrictions. We are likely to see earnings re-rate in China as the benefit of re-opening feeds into corporates’ profits.”

Another positive element, Yang adds, is improving geopolitical tensions between China and the US.

“President Xi Jinping has used the opportunity afforded by the G20 gathering in Bali to re-iterate China’s stance that it remains a believer in the win-win from globalisation. China has continued to resist the temptation of retaliating against US provocations, such as the recent effort to stop the supply of advanced semiconductors to China.”

Fractured relations

Geopolitics has overtaken the virus as the top story on the 10 o’clock news, with Russia’s invasion of Ukraine in February 2022 deepening existing fault lines between the east and west.

It is difficult to predict how warm relations between China and the US can become, especially in light of the re-emergence of speculation that Covid-19 was manufactured in a laboratory.

Federal Bureau of Investigation director Christopher Wray recently told Fox News: “The FBI has for quite some time now assessed that the origins of the pandemic are most likely a potential lab incident.”

This, combined with the appearance of a suspected spy balloon over US skies earlier this year, makes improving relations incredibly challenging.

There is no doubt that the re-opening of China is a shot in the arm for the global economy. It is also, however, laden with risk. But, if current thinking prevails, and the big bang re-opening turbo-charged immunity in the population, the emergence of further waves or a more dangerous mutation is less likely.

Additionally, governments – globally – would struggle to re-introduce strict lockdown measures.

However things ultimately pan out – China’s re-opening feels like the final piece of the global puzzle when it comes to getting things back, as much as is possible, to ‘normal’.

See also: Ask the experts: Might China’s consumers rescue the global economy?

This article first appeared in the March edition of Portfolio Adviser Magazine