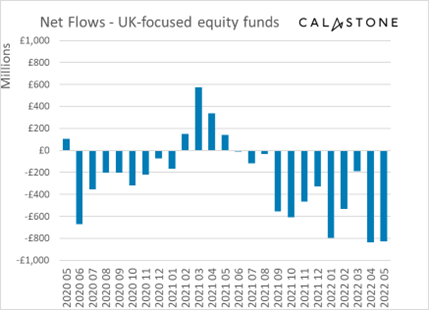

The three worst months on record for UK equity fund outflows have all been in 2022, according to the latest Fund Flow Index from Calastone.

The year started badly for the asset class, with January saying farewell to £795m. The outlook had brightened somewhat by March, with outflows falling back to £190m after an earlier drop to £533m in February.

But things took a turn for the worse after that, with a record £836m pulled in April, an eye-watering sum that was very nearly bested by the £829m yanked by investors in May.

“May’s flight for the exits extended outflows from UK-focused funds to a record 12 consecutive months, longer than for any other segment of the market,” Calastone said.

Smaller companies bore the brunt out the souring sentiment, accounting for £1 in every £6 pulled by investors.

This was double their share of UK equity assets under management, Calastone added.

Edward Glyn, head of global markets, said: “UK-focused funds are taking particular punishment. In the short term, UK-focused funds are the largest category by assets under management, so they are an obvious first port of call for investors wanting to reduce equity exposure, even though the UK index has proved resilient this year.

“But this is also part of a long-term trend that has seen investors opt to diversify their holdings away from a UK stock market that is highly concentrated at the top end and exposed to a lacklustre UK economy at the bottom.

“Global funds solve both these problems – as a result they have absorbed $41bn since 2015 while UK funds have shed £1.2bn.”

Cash balances grew by £13.5bn in April

Collectively, all equity funds shed £310m of capital in May, taking the net outflow, year-to-date, to £877m.

This is the worst start to a year in the Fund Flow Index’s eight-year history. For context, the same five months in 2021 saw net investment of £9bn.

Glyn described the situation as “unusual”.

“There is instead an in-built bias towards net investment simply because British investors steadily put away a portion of their incomes each month. Equity funds are facing a double squeeze at present, however.

“On the one hand conditions in equity markets are unfavourable – volatility is high and riskier segments have seen very large price falls this year: fear of losses is deterring investors from adding new capital.

“On the other, the squeeze on household incomes is growing, encouraging people to keep back more of their earnings as a cash cushion.

“Bank of England figures show household cash balances grew by £13.5bn in April alone, the highest figure since lockdowns were in force and there was very little to spend money on.”

ESG bucks the trend as inflation means good news for property funds

Outside of the UK, another woe-begotten sector was European equity funds, which recorded its worst month of the year, shedding a net £389m. Asia Pacific and regional funds also saw significant net selling.

The only geographical sector to see significant inflows was global funds, which pulled in £659m – of which £8 in every £10 was funnelled into ESG strategies.

ESG continues to be buck the trend, with ESG equity funds attracting inflows of £2.8bn, while their non-ESG counterparts bled £3.7bn. Calastone suspects there may be a “significant element of cannibalisation”.

Plus, after nearly four years of monthly outflows, property funds may finally be about to turn the corner, thanks to the perception they can act as a hedge against inflation.

Net redemptions dwindled to £8.1m, which is the lowest level since outflows began in 2018.

“The turnaround for equity income funds reflects the relative inflation protection that income-generating stocks provide.

“This has held true during 2022’s market convulsions – yield stocks have outperformed this year and investors are noticing. Signs that property funds may be coming back into favour are driven by the same forces,” Glyn added.