By Stephen Anness, head of global equities and manager of the Invesco Select Trust – Global Equity Income Share Portfolio

Investors still have plenty of reasons to be cautious – high-for-longer interest rates, wars in Ukraine and the Middle East, energy worries… But anxiety can sometimes make investors overcautious.

This may be a factor in the lack of performance persistence in the markets and the extreme divergence in valuations we have seen this year.

Persistence

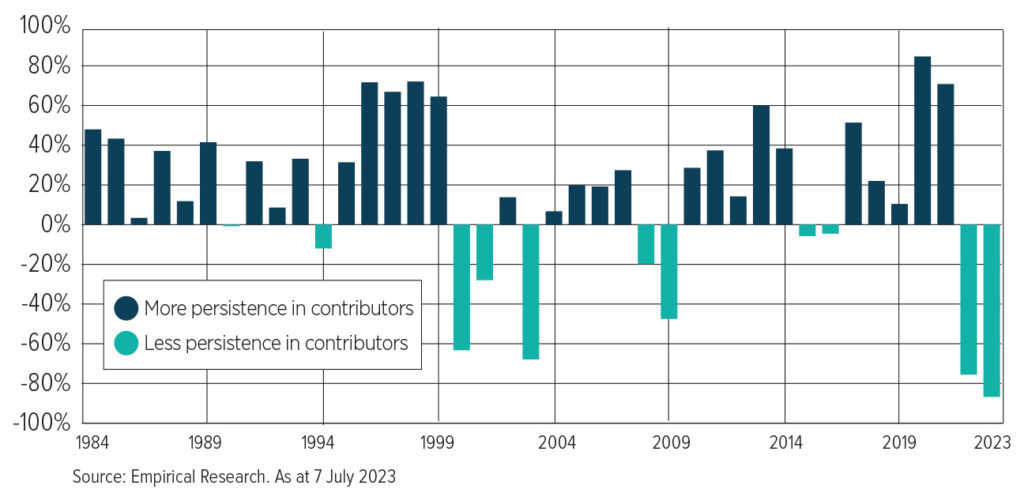

Outside of times of high stress, good stocks tend to grow persistently, year after year. That has not happened recently. Many of the stocks that did well in 2021 performed badly in 2022. The stocks that did well in 2022 have performed badly this year. It is a warning to those that hold the “Magnificent Seven” – the big tech companies that have driven the US market so decisively this year. We do not see this abnormal volatility disappearing soon.

A new regime…uncertainty in today’s markets. Persistence of prior year’s contributors (S&P 500)

This brings us to valuations. If you look at the headline multiples for the S&P 500, for instance, they really hide the bifurcated nature of the US market. The S&P 500 is currently on an average multiple of around 21.19x.

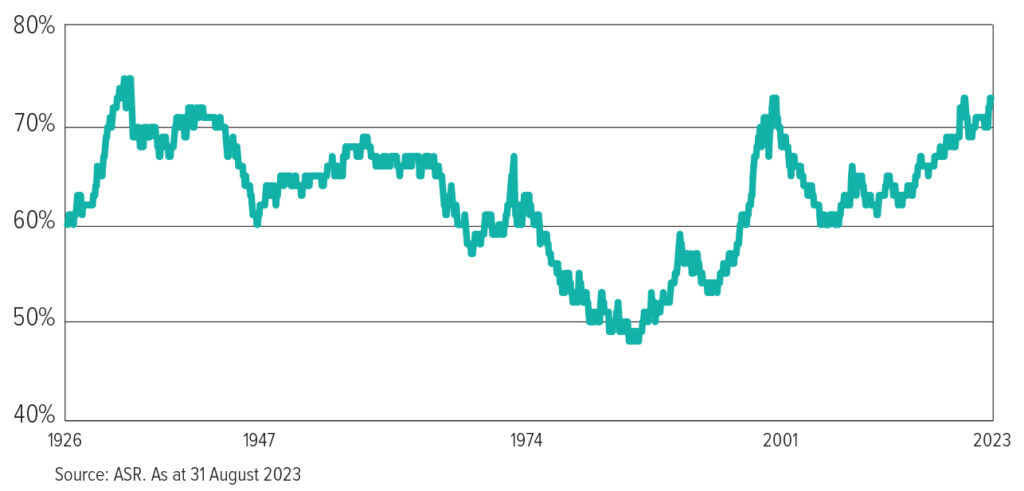

A relatively small number of very big companies on elevated valuations and some on frankly extreme multiples are skewing the numbers. It means the share of US market cap coming from the largest 50 companies is pretty much as high as it has ever been.

Share of US market cap from the largest 500 companies, top 10% market share

On the other side of the equation, it means there are many – very many – companies in the US on attractive, low valuations of between 10x and 14x earnings. This is a fertile hunting ground for the patient investor focused on quality, cashflow and price. If you concentrate on the things you can control, these are arguably what matters most. Ultimately, these three factors are what deliver growth in income and capital.

Quality businesses that are growing and have competitive advantages and strength should thrive through the cycle. Cashflow is the best measure of a company’s health. It is what pays the dividends, pays down debt or buys back shares, enhancing shareholder value. And price governs how well you will be rewarded – ideally, you want to pay a price that represents a significant discount to intrinsic value.

What if?

This is the rational approach. But we are human. Our thinking is coloured by what we read and hear and by our mood and our fears. I believe that in times of uncertainty it can be helpful to try to reframe your view. Ask yourself: “What if things go right?” “Going right” might mean a soft landing and economic recovery.

In that scenario, those resilient utilities with strong, profitable revenue streams which have done well this year might now look expensive. In fact, this sector is at its most extreme valuation relative to consumer and bank stocks in 70 years.

I do not want to underplay the risks the global economy faces, but those seven decades have included the OPEC oil crisis, the early ’90s recession, the dot-com crash, the global financial crisis and the Covid pandemic. And yet now we are at the peak?

The contrarian in me feels pockets of valuation are emerging in some of the more cyclical and consumer-exposed areas as a result of panic-selling.

Globally, seeing through the fear that China is leading the Asian economies into an abyss can help investors recognise some of the fabulous companies in Asia. They have decent levels of growth, very strong balance sheets, good cash generation and are fairly valued – if not cheap.

We see attractive valuations in the mid-cap universe, too. By “mid-cap” we are still talking about companies in the $3bn-to-$20bn range, but the market has somehow viewed many of these on a par with small companies barely beyond start-up and loaded with debt.

Balance

I would argue that the sensible investor takes a balanced approach. Some call it diversification and usually think across geographies and industries. But diversification can embrace diversification of thought, too. For us this balance is reflected in our approach to running a global income fund that can include 20% higher growth stocks – companies that tend to deliver little income but generate strong total return.

It can also apply to a view of the markets. If all investors can conceive is that the world is going wrong, they risk finding the portfolio overloaded with overpriced defensive stocks and lacking contrarian bargains with the potential to surprise.

It is worth having some insurance in your portfolio against things going well in the world. And right now the cost of that insurance looks good value.