Allocation to actively-managed global small-cap funds, tilting US equity exposure towards growth stocks, and increasing fixed income duration via US treasuries are some of the ways Invesco’s David Aujla is navigating an increasingly uncertain market environment.

Multi-asset fund manager Aujla, who has been at the Henley-based firm for 11 years, heads up its risk-targeted Summit Growth multi-asset range, and is co-manager of its model portfolio service and managed funds.

“At the end of 2021, we were worried about duration and therefore fixed income, for obvious reasons. Yields are pretty low. So, we came into 2022 with lower duration, which helped us,” he tells Portfolio Adviser. “The issue with being a multi-asset investor is that, no matter what you do, you always wish you had done more or less of it. But we were pleased to have reduced our duration.”

Aujla did so through exposure to one-to-three-year US treasury ETFs. Then, at the start of 2023 when yields were higher, he increased duration through adding a 10-year-plus treasury ETF.

“We weren’t totally convinced that there was no risk in duration at all, but it became more of an insurance policy for the multi-asset portfolio than it had been in years,” he explains.

“A lot of investors think the sole benefit of investing in ETFs is the cost, but on the fixed interest side there are implementation benefits, because it allows you to choose exactly where you take your duration.”

ETFs also allow multi-asset investors more control of their currency exposure, according to the manager. For instance, when the sterling tumbled from 1.35 to 1.06 relative to the US dollar last year, he hedged one third of the fund range’s US equity exposure back to sterling, via a hedged share class of one of the ETFs he already owned.

“Our view was that sterling has fallen by a lot and that this was not sustainable. If it were to go back up, it would have been a big headwind for our overseas US equity returns,” he reasons.

“As it transpired, sterling went back up from 1.06 to 1.25 rather recently. Of course now, I wish we’d hedged 100%, but it was more of a risk-mitigation decision than an alpha generation decision.”

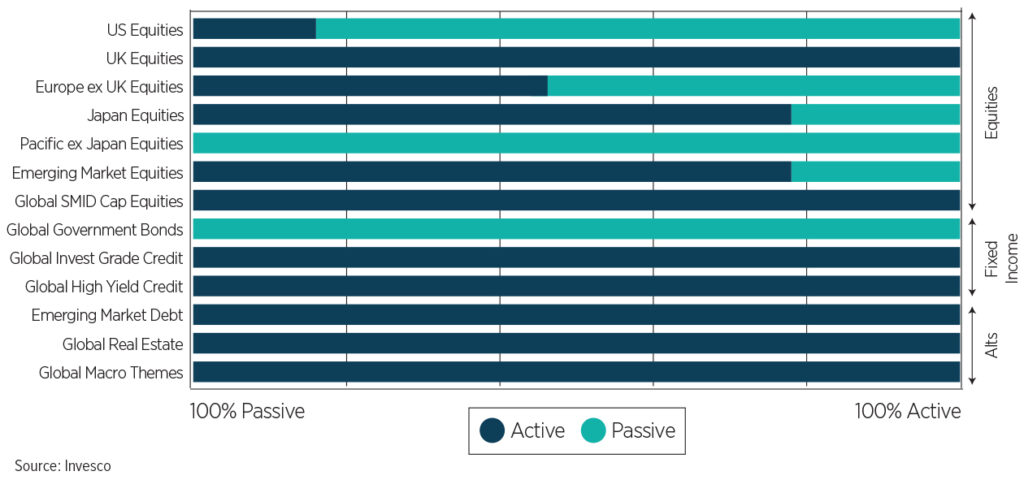

The Summit Growth multi-asset team will invest in a blend of active and passive funds, all of which are housed at Invesco. However, the manager emphasises that investing in passive instruments is not the same as passive investing, given they provide access to active allocation decisions.

“We do not have any kind of intellectual preference for active versus passive investments, necessarily. It’s more about how you use them, in which market area and why,” he says.

See also: “Consumer Duty impacts active-passive debate“

For example, approximately 80% of the Summit Growth range’s US equity exposure is currently passive, given the efficiency of the market, with 20% being held via a Nasdaq 100 tracker.

However, given the tech-focused index is already up 32.3% year to date, according to data from FE Fundinfo, Aujla is now “considering what to do next”. That being said, he believes there is “still a leg to go” in terms of returns to be had, given the index has performed so strongly without any interest rate cuts, and individual companies’ structural benefits.

“We want to be underweight the US on valuation terms, but an area we have more confidence in is the growth-orientated stocks,” he says. “The overall style exposure for the equity part of our portfolio is relatively neutral overall, but we wanted to take the growth where we thought it made sense.”

This year has seen a complete reversal in fortune for US growth stocks, with the Nasdaq having fallen an eye-watering 23.9% during 2022, compared to an 8.1% fall from the global MSCI ACWI index. Now, 10 months into the year, it has comfortably tripled the global index’s total return.

See also: “Brooks Macdonald’s Cady: Inflation slowdown and AI boosts case for US equities“

Aujla explains there are “a number of reasons” why investors may have become more bullish on growth-orientated US large caps.

“One reason is if you think interest rates are going to come down; these types of stocks will benefit from that,” he says. “Another reason is that they are capable of ‘self-help’ and are more in control of their own destiny in terms of revenues or earnings, compared to more economically cyclical industries.

“And of course, investors would have bought these stocks if they wanted to be a very early player in AI – a theme which has gone gangbusters this year. This could continue, but I think there is a fair amount of exuberance priced in there.”

See also: “To cut or not to cut: Are markets in for a ‘pleasant surprise’ from central banks?“

In contrast, Aujla opts for actively-managed funds in less efficient or under-researched market areas such as global small caps, which the Summit Growth portfolios have a modest long-term structural overweight to through Michael Oliveros’s £545m Invesco Global Smaller Companies fund.

“Around two-thirds to three-quarters of the global equity universe is made up of large caps. However, Apple and the whole of the Russell 2000 have a similar market cap. That is 2,000 stocks versus one. So, despite large caps taking the bigger market share in aggregate, there are far more individual offerings further down the cap spectrum,” he points out.

“Small caps do also tend to outperform large caps over the long term. And, if you invest in smaller companies globally, the diversification effect you get is far more powerful than what you can achieve with large caps.

“Finally, the domestic nature of them means they are less driven by global factors.”

Aujla also upped exposure to UK small caps earlier this year, so that they now account for approximately 10% of the portfolios’ small-cap exposure overall. He did so through Invesco’s £492m UK Smaller Companies Equity fund, run by Jonathan Brown and Robin West.

“I have lots of doubts over the UK economy, of course, and there is a lot of negative investor sentiment, but valuations on a three-year-plus view look quite attractive. There is a lot of bad news baked into valuations.”

He takes a more granular approach to emerging market equities, holding actively-managed global emerging market, emerging market ex China, and China funds. However, he also holds an emerging market ETF and toggles the exposure across all of these.

“we see China as a separate entity between EM and DM, and we want the tools to be able to access that. As a multi-asset investor, sometimes you want to take control of these aspects yourself,” the manager explains.

“Sometimes when investors think about having an in-house universe they think of the old-fashioned, 1990s-style fettered fund-of-funds. But in practical terms, it means we have an in-house universe of more than 800 funds to choose from with better access to the managers, and without having an enforced house view from Invesco. We also don’t have the charges to contend with.

“We are only investing in 25 to 30 funds, so hopefully we are giving our clients the best of both worlds: active management through our asset allocation and fund selection, but without the cost this typically incurs, and for a variety of risk appetites.”