By Camilla Esmund of Interactive Investor

It has been two years since I became a founding sponsor of Money Movers (run by Huddlecraft), a peer learning initiative helping women embark on their investment journeys. The genius of the organisation’s work is in its simplicity; women of all ages and stages of life coming together in informal spaces to talk about money.

At II, we advocate for more open conversations about money – after all, it helps inspire, inform, and build confidence. Without investment confidence, it is harder to build the long-term financial futures that all investors deserve.

The conversations within Money Movers sessions are lively and animated – I have witnessed it first-hand! It is encouraging that participants are not afraid to ask the ‘silly questions’ which, if more of us were honest, many of us would like to ask.

But it got us thinking – would the questions raised in these sessions be vastly different if they were male peer groups? After all, there are plenty of generalisations made about female investors, and male investors for that matter. These assumptions can sometimes frame how investment products and services are marketed towards male and female investors. With International Women’s Day upon us, it is an apt time to investigate these assumptions, and whether they are helpful or more of a hindrance for end-investors.

Let’s kick off with a very broad, but common, assumption – men and women behave very differently when it comes to investing.

In short – our data paints quite a different picture.

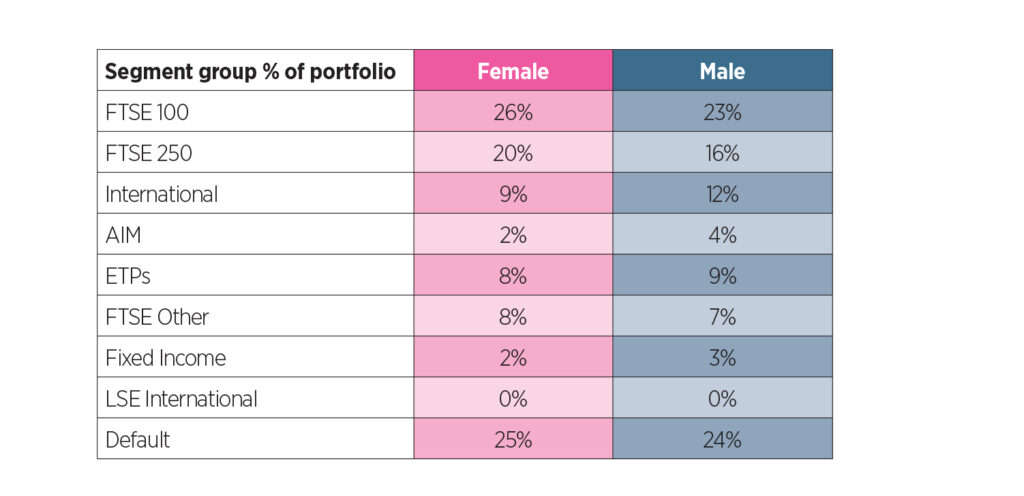

Taking our quarterly Private Investor Performance Index as an example, the portfolio breakdowns for both our male and female customers are often very similar. Any differences are subtle. And performance is similar, too. In fact, most recently, our female investors slightly outperformed.

Although you can see our customers run their portfolios across similar lines, one of the few differences is that women tend to have a higher exposure to investment trusts (22.6% versus 17.9% for men) – this may well have helped drive that slight outperformance.

Assumption 2: Women are risk averse (and need more handholding) when it comes to investing

Let’s take a deeper look at portfolio differences, as risk appetite and exposure to riskier assets is a key theme which often comes up when discussing male and female investors.

We looked at exposure to AIM on interactive investor – a risker area of the market. We can see that men on ii have 4% exposure compared to 2% of women. Therefore, they do have double the amount of exposure, but 4% is still a small allocation overall.

We can also see from the data below that male customers on ii also appear to have more diversification overseas. But are there standout differences that prove a cautious approach from female investors, and a high risk strategy from male investors?

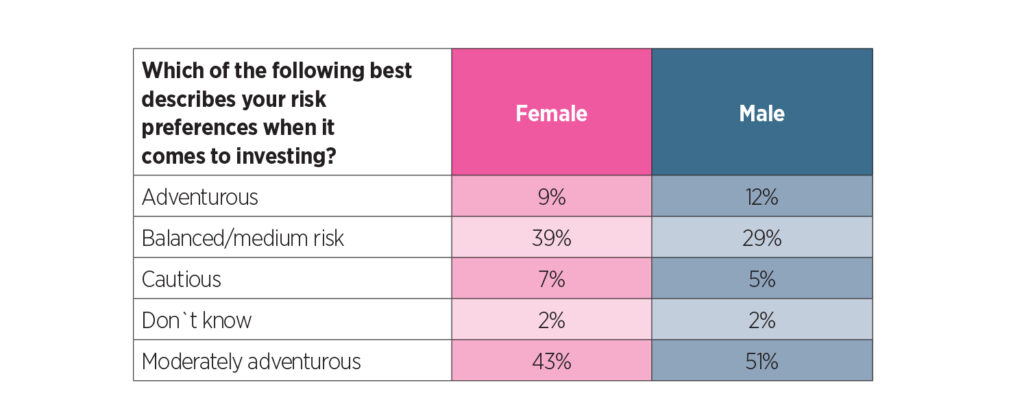

This data tells one part of this story, but we also wanted to ask investors how they would describe their risk approach to see if it reflects what we see in our numbers. We asked men and women in a poll what term most accurately describes their investment approach, and the results are thought provoking.

‘Moderately adventurous’ was the most popular answer for both male and female respondents – with 51% of male respondents describing themselves as such, and 43% of female respondents. This is a 10% difference, which is quite significant, but not a colossal variance. At the top end of the risk scale, 9% of female respondents said they are ‘adventurous’ with their investment approach, and only 3% more – 12% – of male respondents said the same. Across the broad, we can see that results look quite similar, and the exact same amount of male and female respondents (2%) said they were not sure. This suggests that the risk gap identified by our poll is not as significant as the common perception.

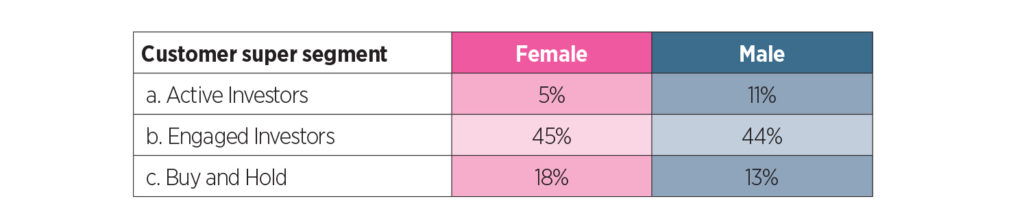

Assumption 3: Men are active traders but women ‘buy and hold’

We also wanted to assess whether there are vast differences when it comes to male and female behaviour towards active trading versus a more ‘buy and hold’ approach.

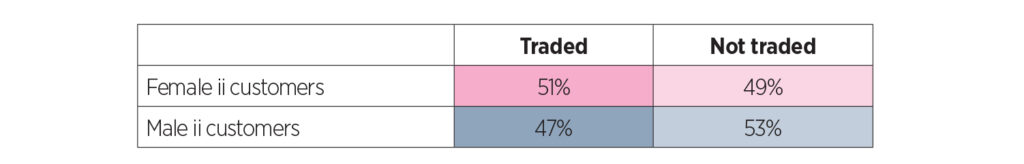

From our analysis below, II’s female customers have indeed been happier to buy and hold whereas male customers tend to trade more regularly. When we also looked at the ratio of female and male II customers who have traded in the past 12 months however, there was less disparity. Over the past year, II’s male customers traded slightly more frequently than our female customers, but you would expect the differences to be much more staggering if they are to live up to the stereotype more broadly.

Ratio of female and male customers who have traded on II (12 months to 29 January 2024)

Active investors and ‘buy and hold’ on II

So – are we ‘babying’ women when it comes to investing?

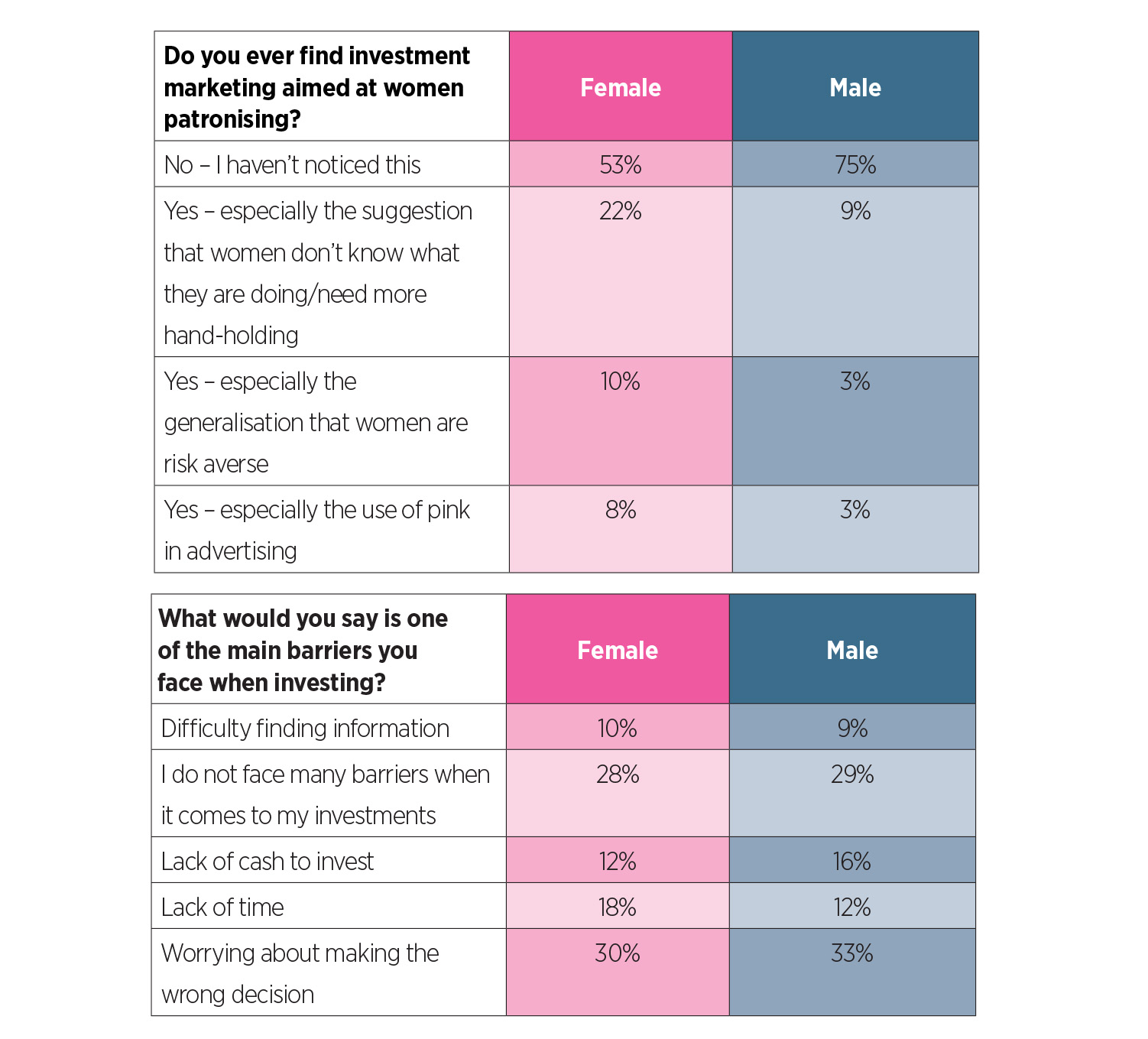

Data only tells us part of the story, so in the same poll we asked how men and women felt about some of these assumptions, and how they are used in financial marketing. It really stands out that 40% of women find investment marketing patronising, compared to 16% of men. If women are noticing this more, it potentially emphasises the importance of female writers and commentators in this industry and the influence they have voicing these stereotypes which do not resonate with end-investors.

The poll found that 22% of female respondents felt patronised by the assumption that women do not know what they are doing, or need more handholding. Indeed, 10% pointed to the generalisation that women are risk averse (which goes back to the points made earlier around risk), and 8% noted the use of pink in advertising.

All tables: Interactive Investor

We also asked about barriers to investing. Are women truly facing greater challenges than men when it comes to confidence in making the right decision, or finding the most useful information for them?

Our poll data suggests not. We know our industry is not always the easiest for end-investors to navigate. It is something that ii is particularly passionate about – breaking down jargon, which is a key barrier to investing.

Both men and women pointed to the difficulty finding information – with only 1% difference. This helps debunk the idea that women need greater hand-holding in making the right decision. And when we look at confidence, 33% of men said ‘worrying about making the wrong decision’ was one of the main barriers they face when it comes to their investments. That is a higher number than the female respondents (30%), which is significant.

Time to ditch the generalisations

Of course, the data outlined here is just a snapshot, but it is indicative of how the assumptions that women are fundamentally more risk averse and need more help in understanding investment are ones we need to move away from.

Tackling the persistent pension gap and investment gap is absolutely vital, but the reasons for these gaps are not necessarily due to fundamental differences between men and women. There is a plethora of well-researched and documented reasons for this gap which needs closing, but it is not because of capability or even necessarily approach.

If our industry continues to market investment products along these generalisations, we may not be allowing investors to truly find the investment products that meets their goals and expectations. And this is what all investors deserve.