Since 2010, the number of rough sleepers in the UK has more than doubled, with an estimated 2,688 people sleeping on the streets in a single night, according to government figures.

The charity Shelter believes the figure is much higher. Its latest report calculated that 253,000 people in England alone are homeless or in temporary accommodation.

Although the government’s ‘Everyone In’ scheme, launched at the start of the pandemic, has helped some 33,000 individuals find a place to stay as of November 2020 – with 23,000 of these having since moved into longer-term accommodation – there is still a long way to go to tackle homelessness in the UK.

In December 2019, HSBC, in partnership with Shelter, launched the ‘No Fixed Address’ initiative in 31 branches to help people with no fixed abode open a bank account. The scheme now operates in more than 100 branches across the UK.

The idea is simple. HSBC allows people to open an account without the photo ID and proof of address usually required. Instead, if accompanied by a caseworker they can supply the address of the charity supporting them. It is hoped this will help break the vicious cycle many people without a permanent home find themselves in.

Without a bank account it is almost impossible to get back on your feet. You are unable to receive benefits, pay bills, get a mobile phone, apply for jobs or own or rent a property. HSBC’s scheme could be life-changing for the thousands of people who find themselves struggling.

Head and heart

Often, as soon as you hear about an initiative like this, you assume there has been a PR misstep or a recent scandal to recover from. But this doesn’t seem to be the case.

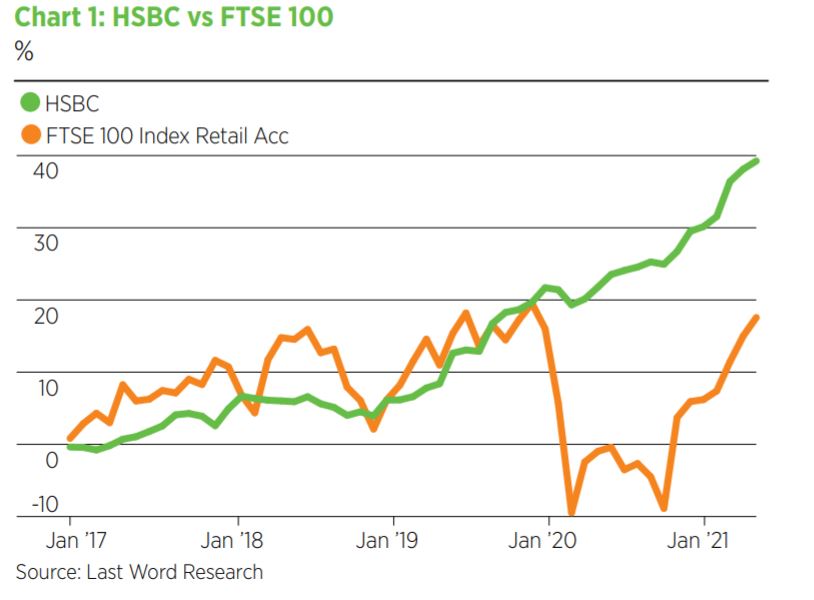

Data shows HSBC has, in fact, been doing rather well. The majority of the UK’s top 100 companies took a significant hit to returns during the pandemic, most noticeably in March 2020 and October 2020. Comparing HSBC’s performance with the FTSE 100 (see chart 1), the bank experienced very little downwards movement before continuing its steady upward trend.

So why has HSBC launched this service? Perhaps because it is the right thing to do and the bank can make money at the same time. In fact, this ‘feel-good’ factor is becoming more common within investment.

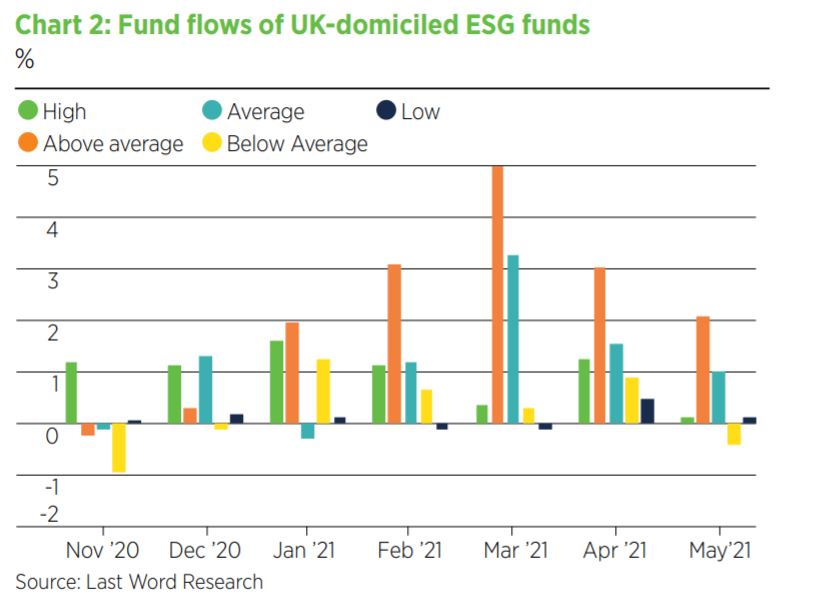

In general, funds that are environmental, social and governance (ESG) compliant produce greater net inflows. Since January 2020, funds with a Morningstar sustainability rating of ‘high’ have amassed an impressive net inflow of £6.6bn (see chart 2).

To dig deeper, only 12.5% of all strategies with a sustainability rating are awarded the top score of ‘high’. Yet during this same timeframe, those accounted for 39% of the inflows. Investors are opting to put their cash where it will make a difference.

Funds with a ‘low’ sustainability score, meanwhile, experienced net outflows of £21bn in the same period. This highlights the fact that ESG is no longer a box-ticking exercise. In order to see the cash, you have walk the walk. Greenwashing no longer fools anybody.

The data doesn’t lie

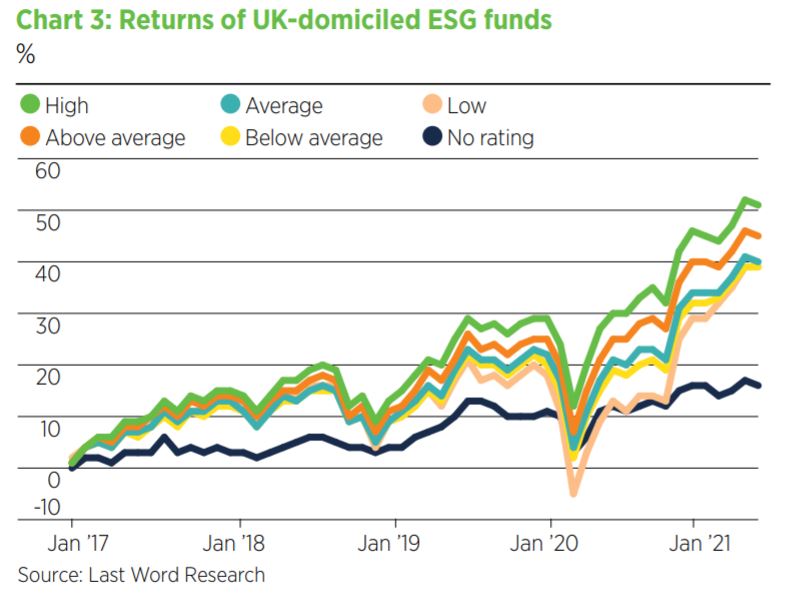

While there may be money flowing into these funds, the real question is how they are performing. Chart 3 reveals funds with a higher sustainability score are performing better than those rated lower.

In 2017, we saw little difference between the returns from ESG-compliant funds, regardless of rating – but that has now changed. For example, in March 2020, when the first UK lockdown was announced, all funds took a hit to returns. However, those with a low sustainability score were hit harder than those rated high. Meanwhile, even funds with a low ESG score performed significantly better than those with no ESG rating at all.

The data says it all. It is possible to do good and get rich doing it.

This article first appeared in the July/August 2021 issue of Portfolio Adviser magazine