The coronavirus pandemic has brought about uncertainty for just about every industry, and UK wealth management is no exception. While DFMs have continued recruiting new talent throughout the lockdown period, tension around job security is running high.

A recent study from CFA UK found that nearly one-third of investment professionals are concerned they could lose their job over the next 12 months, with two-thirds of respondents anticipating major restructuring at their firm in the next two years.

The number of professionals worried about job security is higher now than when CFA UK polled the industry for its 2019 Brexit survey and 22% of respondents revealed they feared for the future of their job.

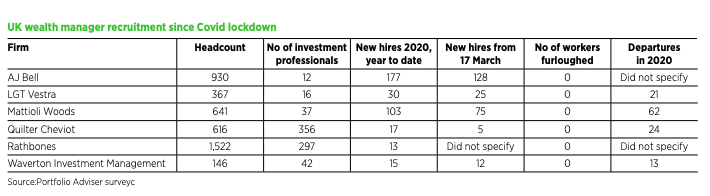

Six wealth firms provided Portfolio Adviser with a detailed breakdown of their recruitment activity during 2020, including a snapshot of hiring since the national lockdown began on 17 March. Some firms were only able to provide data for the first half of the year ahead of their next results being published.

AJ Bell sees huge spike in hiring activity while established players press pause

Of the firms Portfolio Adviser analysed, AJ Bell recorded the biggest spike in hiring activity, with 177 people joining the wealth manager and platform group year to date. Around 128 of those new starters were hired after the national lockdown came into effect and around a third, 42, were hired in June alone.

“The growth of our business has continued throughout the pandemic and, in fact June was our busiest month of the year for new starters,” says AJ Bell chief investment officer Kevin Doran (pictured).

Mattioli Woods also reported a flurry of hiring activity, although these numbers were inflated by its recent acquisitions of chartered financial planner The Turris Partnership last December and Hurley Partners, which completed at the end of August. Excluding staff members absorbed as part of the recent buyouts, it brought 37 people onboard from the start of lockdown, in line with smaller boutique LGT Vestra, which added 25 people during this period.

Some of the largest, most established players have reported a slowdown in recruitment since the pandemic hit.

Quilter Cheviot, which provided data up until 30 June 2020, took in the lowest number of new employees over the period, with just five staff members recruited since 17 March. A Quilter Cheviot spokesperson says Covid has not made a direct impact on recruitment and reiterates that the firm’s “focus remains on looking for strong, diverse talent”.

St James’s Place, the UK’s biggest wealth manager, with £115.7bn in funds under management at the end of June, says recruitment has continued over the year but exact figures on the number of new joiners were not supplied. However, its interim results reveal the army of advisers that make up its partnership only grew by 1.2% during the first half of the year, to 4,324.

According to SJP, this was a deliberate attempt to ease up on its outbound activity at the height of the crisis given the “difficulties many experienced financial advisers will have been facing”, as well as social distancing restrictions making it harder to attract new partnership members.

None of the companies Portfolio Adviser spoke to made use of the government furlough scheme.

DFMs seeing ‘definite slowdown’ in turnover

Turnover for the year has been unsurprisingly low. Rathbones says the number of employees leaving the business has fallen by more than half, while AJ Bell has seen turnover drop by more than a quarter.

“Our employee turnover has always been typical of financial services, however this year we have seen a definite slowdown,” says Doran.

DFMs admit that recruiting has been tougher during the pandemic as lockdown and social distancing measures to halt the spread of the virus have meant wealth firms have had to forego face-to-face meetings with prospective employees in favour of video conference interviews via Zoom and Microsoft Teams.

Waverton head of HR Karen Davis says the boutique manager has adapted, switching to an almost entirely virtual recruitment and onboarding system, creating a more flexible culture that embraces remote working.

But Davis notes prospective hires have been far more cautious about deciding whether to switch jobs and join a new business during the pandemic.

Doran says the Covid crisis has resulted in AJ Bell changing its selection processes entirely. “One of our key strategies has always been to recruit people direct, and with more people now looking for work, sadly as a result of Covid, we’ll be focusing our efforts on finding those candidates and using our employer brand, and other advertising, to attract them to apply for a role at AJ Bell,” he says.

Senior investment hires few and far between during lockdown

It would appear that investment manager and senior executive hires have made up a relatively small proportion of new recruits joining DFMs this year.

Quilter has added six people to its investment team so far this year, including the former head of Brown Shipley’s Edinburgh office Paul Embleton, who joined in March, and Brooks Macdonald duo Poppy Fox and Jonathan Fletcher, who arrived at the height of the lockdown in April.

The new recruits on the investment side make up a small fraction (2%) of its total investment management team, which stands at 356. Last year, it made 16 hires to its investment team in total.

AJ Bell appointed ex-LGIM boss Paul Pugh as head of strategic partnerships in October, its sole hire to the 12-strong investment team this year.

Waverton and Mattioli Woods have each made two hires for their respective investment teams and lured a single senior executive to the business, though Waverton CEO Nick Tucker joined the business prior to the lockdown period.

Rathbones was an outlier in this area, hiring 11 investment professionals in the first six months of the year, as well as an interim chief people officer and COO, though it did not specify how many hires were made post-lockdown. A Rathbones spokesperson says the firm expects to make a similar number of additions to its investment team in the second half of the year.

LGT Vestra recruited for six professional roles, including a business development director and several investment managers. In the beginning of the pandemic it says only “crucial roles” were brought on board, but it has since resumed its original recruitment strategy.

Mediolanum cashes in on hiring slump

Over in Dublin, multi-manager investment house Mediolanum International Funds is another firm that has been bucking this trend. CEO Furio Pietribiasi has embarked on an aggressive recruitment drive to boost headcount by 20% by the end of 2020.

Pietribiasi says the pandemic has provided a rare opportunity to snap up seasoned investment professionals and senior executives at a time when appetite for hiring is low.

Early into the pandemic several titans of the investment industry, including Blackrock, Amundi, JP Morgan and Barclays, implemented hiring freezes as the Covid-led sell-off wiped trillions of dollars from markets.

“We had less competition in the market, from a hiring perspective, so at that stage we said, ‘Let’s accelerate our investment journey and take advantage of identifying and attracting the talent we currently need’,” says Pietribiasi.

Since the start of the year the firm has appointed 37 people, taking its total headcount to 140. Among its top hires are chief information officer Barry Noonan, who has held senior IT positions at Hostelworld, Ryanair and Paddy Power, as well as equities boss Terry Ewing, who was the former head of North American equities at Ignis Asset Management and most recently a senior portfolio manager at the Abu Dhabi Investment Authority, where he managed the second-largest sovereign wealth fund in the world.

While Mediolanum is almost entirely known as a multi-manager house, Pietribiasi has plans to expand and diversify its in-house investment capabilities in equities and fixed income with the goal of having 30% of AUM managed internally.

AJ Bell and SJP targeting graduates

Many UK-based DFMs have also been focusing on the opposite end of the hiring spectrum by targeting graduate trainees and interns.

Despite the disruption from Covid, Doran was able to run AJ Bell’s annual summer internship programme, taking six new recruits under his wing. He says it was rewarding to “welcome bright young talent to the investment teams” and show them the ins and outs of the research and analysis process.

“We have had to adapt to the socially distancing measures but that was quite easy given the new protocols we had already introduced in the Manchester head office,” he says.

AJ Bell has also continued with its apprenticeship programme for 2020, with six investment operations and four digital degree apprentices starting in September.

SJP also pushed forward with its summer internship programme, albeit remotely. In the middle of September, it welcomed its 2020 annual intake of early careers graduates, apprentices and industrial placement students who will work across all areas of our business, including the investment division.

Elsewhere, LGT Vestra told Portfolio Adviser it is working to enhance its hiring function and “actively recruiting” for this area of the business to execute its hiring plans for next year, which include appointing more people in client-facing, research and operational roles.

Waverton is currently in the process of scouting for a variety of front and back-office positions in its private clients, managed portfolio service, funds and performance and risk divisions.