The financial advisory and wealth management sectors have increasingly been tasked and encouraged to focus on client journeys, outcomes and personalisation.

Regulations such as Mifid II and Prod have been spearheading the path towards greater suitability, but there are obstacles that can go beyond regulatory action and duty to clients doesn’t stop at providing the best planning solution or product.

The latest data from the UK’s Office for National Statistics (ONS) shows an increase in people with disabilities entering the workplace, with numbers now reaching 3.9 million, Tali Shlomo, people engagement director at the Chartered Insurance Institute (CII), told Portfolio Adviser sister title International Adviser.

But the difficulty for advisers lies in the breadth and depth of what constitutes a disability.

Be ready to help

“Whilst this is a positive shift, employers should be aware that we cannot always see a person’s disability,” Shlomo says.

“In fact, whilst less than 8% of people make use of a wheelchair in their day-to-day lives, 96% of illnesses are invisible, meaning that oftentimes one cannot see a person’s disability, and therefore would not know, unless they were told.”

So, how can advisers spot ‘invisible disabilities’ and make sure the additional needs they carry are met?

According to Sarah Waring, client and proposition director at Quilter Private Client Advisers, firms should have all the procedures and tools in place.

“We believe that financial advice should be accessible to everyone and, depending on the disability, we will tailor where and how we engage with our clients to suit their needs,” she says.

“When it comes to physical disabilities our advisers will work with them to ensure they are seeing them in an environment they are comfortable with.

“Face-to-face meetings are of vital importance in these circumstances, as it is easier to tell if a client with any sort of additional requirement understands the recommendation being made to them, as our advisers will be able to read their body language and see if it confirms their understanding.

“This format of meeting also gives clients more time to reflect on what is being said, and can be more conducive to creating an open forum in which the clients feel enabled to ask as many questions as they need to.”

An array of tools

It doesn’t stop here, however. If customers have trouble hearing, reading or seeing they should be able to have the same experience as any other client.

This is an area where technology, such as video calls or text-to-speech solutions, could come in handy.

“One of our bigger challenges is for those that have trouble hearing, reading or writing. If, for example, someone has difficulty with hearing, our advisers might choose to conduct their face-to-face meeting in a room with a hearing loop,” Waring adds.

“Similarly, if an adviser is talking to a client outside of the formal advice process, they may choose to use different technologies, such as Skype, so that the client can lip-read rather than rely on the telephone.

“It’s also imperative that our clients can clearly understand any documentation we give them. We therefore work with an outside organisation which, if needed, will help us produce documentation which ensures a customer with a visual or aural disability has equal access to our services.

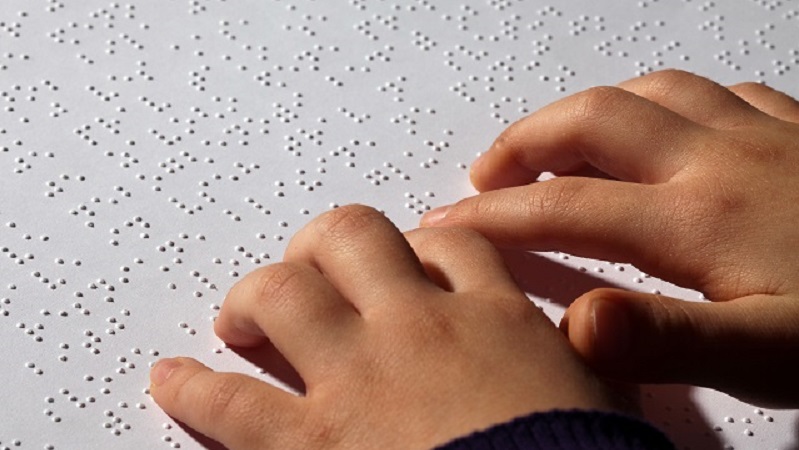

“This might mean that we provide our customers with audio documents, Braille, Moon (a Braille alternative), large print or in specific types of font known to be more readable.”

With an increasing number of people with disabilities entering the workforce, the financial services industry has a duty to develop alongside them and their needs.

The CII’s Shlomo adds: “We must consider this as we continue to engage, learn, and evolve our strategies so that we can continue to see a positive shift, with better access to work for all people.”

For more insight on international financial, planning please visit www.international-adviser.com