Speculative-grade debt is expected to account for a growing share of upcoming maturities, rising by more than four times between 2024 and 2028 to $1.1trn, according to S&P Global’s latest credit trends report.

Funds in the IA Global High Yield sector enjoyed an average return of 14.3% in dollar terms last year, but investors raised concerns in the second half of 2023 over a potential maturity wall building in the sector, particularly in the European and US high yield markets.

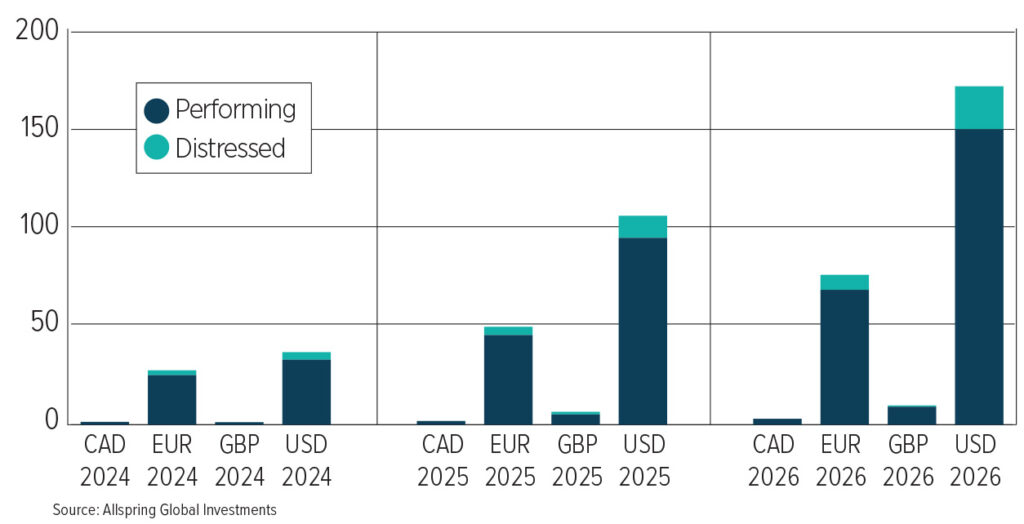

Speculative-grade debt is forecast to make up 12% of the $2trn in debt maturities this year, but should account for a fifth (20%) of the £7.3trn maturing in 2026. Now that we are one month in to the new year, do investor’s worries around this approaching maturity wall persist?

Sarah Harrison, global high yield manager at Allspring Global Investments, said the risks associated with a possible maturity wall are “over-egged”. She believes the build-up is associated with central bank interest rate rises, which have led to issuers holding on to lower coupon debt for longer, whereas previously they would have used their ‘call option’.

“40% of European high yield and 25% of US high yield comes due over the next three years, which is significantly higher than usual,” she said. “Taking a step back, high yield bonds have a nifty feature called call ability, meaning issuers can redeem their bonds prior to maturity if it makes financial sense for them to do so.

“In an environment where rates have been trending down, it made sense in most cases for issuers to call and refinance at the earliest opportunity because they were getting lower interest rates. Now that we’re in an environment where rates have gone higher, our view is that issuers are being savvy around hanging on to low coupon debt for as long as possible.

“The proportion of distressed debt in the high yield market is quite low, and only slightly higher than market-wide distress. Our view is that this isn’t the sign of impending doom for the high yield market that some might think it is.”

According to Ee-Yung Yip, senior portfolio manager of global credit at Nikko Asset Management, investors were more concerned about the maturity wall in mid to late 2023, but those worries have eased since the turn of the year.

“The potential implications included risks of a liquidity crunch for a number of issuers who might be unable to refinance their high yield debt, a significant deterioration in credit metrics as a result of high cost of funding, spread volatility spiking, and credit spread widening to levels well above the long-term average. I would say that these concerns have faded somewhat since the start of the year,” he said.

“The cost of fixed-rate debt including for high yield bonds has fallen meaningfully over the past 3 months. For example, the USD BB credit curve has come in 70bps to 75bps and the equivalent EUR curve has come in around 80bps, making it a lot cheaper now for HY issuers to refinance their near-term debt.

“This is even before the key central banks embark on their well anticipated rate cuts in 2024. There is an expectation that volumes in HY primary markets will rise in 2024 (vs 2023), as borrowing costs continue to decline and refinancing conditions become increasingly more favourable.”

Guillaume Paillat, multi-asset portfolio manager at Aviva Investors, said the maturity wall is more of an issue for 2025 and beyond, although it will certainly require actions this year.

“The improving trend in corporate leverage should provide some support, although interest coverage will continue to deteriorate as the impact of past rate hikes start to take effect.

“Having said that, the rally in rates and the sharp spread compression experienced in Q4 mitigates that refinancing burden somewhat. This maturity wall is more pronounced in the European High Yield space but also focused on better quality BB credits, and hence it should be manageable.”

The outlook for the asset class is positive over the year ahead due to a higher-quality ratings mix, with 56% of issuers boasting a ‘BB’ credit ratings. Less aggressive new issuance, fewer near-term maturities, and an energy sector that is far healthier than previous cycles also paint a rosier outlook, according to Neuberger Berman senior portfolio manager for non-investment grade credit Simon Matthews.

“With attractive yields, generally stable fundamentals and default rates in the US, Europe, other developed markets and EM expected to remain around average in 2024, the outlook is favourable for global high yield. While Emerging Markets corporate high yield defaults have risen from the lows, investors would be better served to focus on select opportunities away from the higher risk regions and sectors such as Eastern Europe and China Property.

“In EM high yield corporates, we see receding default risks, with default rates expected to decline to 4.8% in 2024 from 7.8% last year. Excluding the China property sector, which is likely to remain the main driver of corporate defaults this year, the expected default rate drops to 3.3%, which is lower than the historical average. Risks from a further slowdown in earnings are mitigated by strong corporate balance sheets on average, with liquidity buffers near decade highs following years of corporate deleveraging.”