“The UK is under-owned, under-priced and facing neither recession nor a regional banking crisis nor another populist election campaign.”

So states Alexandra Jackson, manager of the Rathbone UK Opportunities Fund, as she argues the current gloom surrounding UK equities could be misplaced and investors are overlooking significant potential upside as they focus too much on the UK’s – admittedly woeful – economic record.

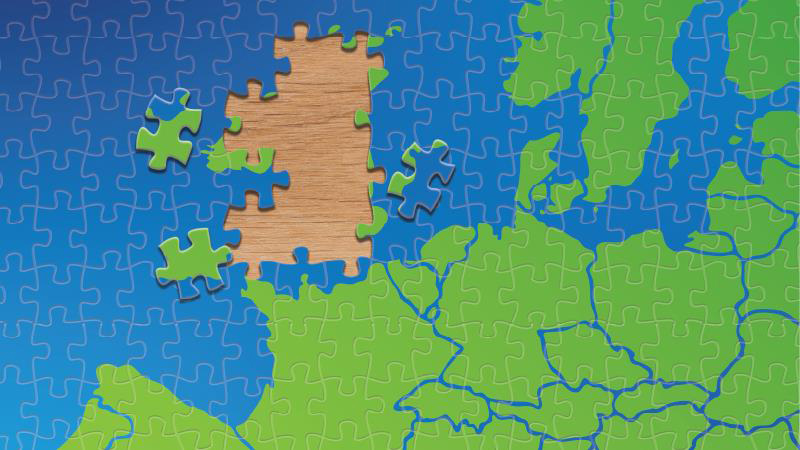

Such a view flies in the face of prevailing wisdom on the UK. Domestic and international investors have progressively fallen out of love with the UK stock market.

The UK All Companies Fund grouping has been the worst-selling IA sector in six out of the past 10 years. Of the four others, one year was UK Equity Income and another UK Corporate Bonds. UK assets have been at the bottom of everyone’s Christmas list.

It is also worth noting this weakness was apparent before Brexit or ‘Trussonomics’ took their toll on sentiment – though neither has helped.

2022 was hailed as a turnaround for the unloved UK equity market as the FTSE All-Share Index outpaced the tech-heavy S&P 500 by 13.8% (4.3% versus -9.54%). Much of this gain, however, was attributable to the large energy stocks, which were given an unexpected boost by the war in Ukraine.

See also: Takeovers are a double-edged sword for UK equities fund managers

These companies may dominate the FTSE 100 but they are less well represented in the portfolios of active managers, who tend to ply their trade in small and mid-cap companies.

“The strong performance of the UK market was dominated by 12 to 15 stocks,” says John Monaghan, research director at Square Mile Consulting. “They are large stocks where it is very difficult for active managers to go overweight. Mid and small caps were down significantly.”

Certainly, the recent recovery in the UK market does not appear to reflect any revival in sentiment towards UK equities. Money continues to flood out of the sector, with £12bn pulled from UK-focused funds in 2022 and another £835m leaving in March. The UK may be cheap, as plenty of domestic fund managers argue – investors just remain unconvinced there is value there.

Read the full article in Portfolio Adviser’s June 2023 magazine.