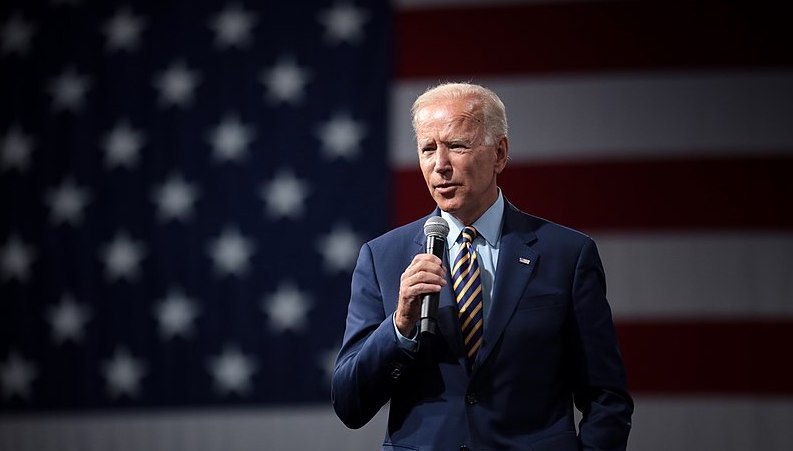

President Biden’s first few months in office were characterised by grand spending plans and the pandemic, and he remained only lightly troubled by geopolitical events.

There are signs that this is changing, as relations with Russia deteriorate, Middle Eastern tensions flare and China seeks to flex its muscles on the world stage.

The pandemic has, to some extent, reduced geopolitical tensions as policymakers have got on with the arduous job of protecting their populations from Covid-19.

However, as the world reopens, so are some old wounds.

Geopolitics to the fore

Biden has been forced to condemn Russian interference in the US election, saying “efforts to undermine the conduct of free and fair democratic elections” constituted an “unusual and extraordinary threat to the national security, foreign policy and economy of the US”. Russia itself appears to be increasingly unstable with Putin’s popularity waning and tension in surrounding states.

The Middle East is also worryingly fragile. Israel/Palestine tensions have reared up. There are also likely to be tensions around the upcoming US/Iran nuclear negotiations. The type of problems that might occur were demonstrated by the alleged Israeli sabotage of Iran’s Natanz nuclear facility this month.

Israel doesn’t want a nuclear-enabled Iran as its near-neighbour.

With China, the tensions are more subtle, part of an ongoing jostling between the two superpowers for global economic and political power. Amid skirmishes such as semiconductors or battery technology, the biggest problem may ultimately be Taiwan. BCA Research identifies China’s military intimidation of Taiwan as the most ‘market relevant’ of the major political threats today.

Significant reduction in concern

In spite of this, the Blackrock’s Geopolitical Risk Dashboard is showing the lowest score since 2017, suggesting investors may be unprepared for any acceleration in geopolitical risk.

It says: “The indicator has been trending down in the past year because of fading market attention to risks such as US-China strategic competition, Covid-19 resurgence and Gulf tensions.

“Overall, our global BGRI shows a significant reduction in concern about geopolitical risk since the change in US administration. The gauge has been hovering in negative territory this year meaning investor attention to geopolitical risks is below the average of the past four years. As a result, geopolitical shocks could catch investors more off guard than usual.”

This is worrying.

However, history suggests that geopolitical risks don’t tend to have a significant influence on markets. Research from Schroders looked at the market reaction to three major geopolitical events – the Gulf War, the 9/11 attacks and the Iraq war.

In each case the MSCI World dropped – by 9.6%, 14.7% and 9% respectively – but recovered relatively quickly afterwards. This is a pattern seen across geopolitical events as diverse as the WannaCry ransomware attack and the Arab spring.

Commodities caveat

The only time that markets have reacted very strongly to geopolitical shocks, falling and staying low, has been when it has involved oil: most notably on the oil price shock of 1973. The market appears to be able to shrug off geopolitical tensions as long as they don’t affect energy prices. For the most part, this makes sense: oil is an important and potentially expensive input for many companies. Higher oil prices act as a drag on economic growth because they leave consumers with less money in their pockets.

This doesn’t appear to be a significant problem today. Oil prices have been rising as the global economy has recovered but is not inflated by historic standards. It is possible that problems in Iran disrupt supply, but there are other options that could come on stream to stabilise pricing.

War for water

However, this does raise some longer-term questions about climate change, energy supply and water. If the most impactful geopolitical tensions tend to arise from a battle for natural resources, there are risks ahead. This may explain why the Biden administration is so keen to tackle climate change.

The most recent Global Trends report from the US Director of National Intelligence said: “During the next 20 years, the physical effects from climate change of higher temperatures, sea level rise, and extreme weather events will impact every country. The costs and challenges will disproportionately fall on the developing world, intersecting with environmental degradation to intensify risks to food, water, health, and energy security.”

In his essay ‘The Great Convergence’, former UK foreign minister Lord Hague, says that the move to renewables won’t necessarily solve the geopolitical tensions over energy supply – it may simply move the pieces. He says the optimism that a move to renewables could reduce conflict and weaken many authoritarian regimes is almost certainly misplaced: ”Anyone who thinks that the transition to renewables will usher in a more peaceful world might well be in for a nasty shock.”

He argues that the transition to renewables is unlikely to weaken many of the world’s authoritarian regimes and in the short-term could actually benefit many petrostates.

He adds that the move will bring “a strategic shift from competition on fossil fuels to different natural resources, rather than end it altogether. Already competition over the supply of critical minerals required for green technology has become part of the wider rivalry between China and the West”.

Water could be another source of tension. By 2035, around 40% of the world’s population will live in areas facing water scarcity, according to the UN. This could displace populations, create health crises and inflame cross-border tensions.

Geopolitics creates a lot of noise and countries will always be in conflict. While these can have vast human and political ramifications, investment markets tend to be more self-serving. They are only likely to react when these geopolitical issues look set to affect domestic economic health. That means tensions over natural resources are always likely to hit hardest.

For more on pan-European funds and investing, please visit expertinvestoreurope.com