As the world deals with the impact of coronavirus, in the last two weeks of February and the first week of March, Last Word Research looked at how this may be affecting the future allocations of the UK’s top fund selectors.

Each quarter, we conduct an asset class survey in order to track the forward-looking buying intentions of wholesale investors. The latest survey asked them for their macroeconomic outlook and how they expect their allocation to cash/money market funds to change in the next 12 months.

Last Word Research has examined whether the recent events have had a significant impact on UK fund selectors.

Few pessimists

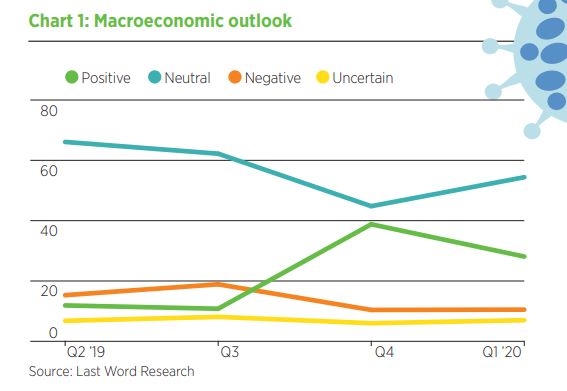

As chart 1 below shows, there are very few pessimists about this quarter, with only one in 10 having a negative macroeconomic outlook. Instead, the majority of respondents take either a positive or neutral view.

Although the number of optimists has fallen by about 10 percentage points, UK investors appear on the whole to be more positive than negative in their macroeconomic outlook.

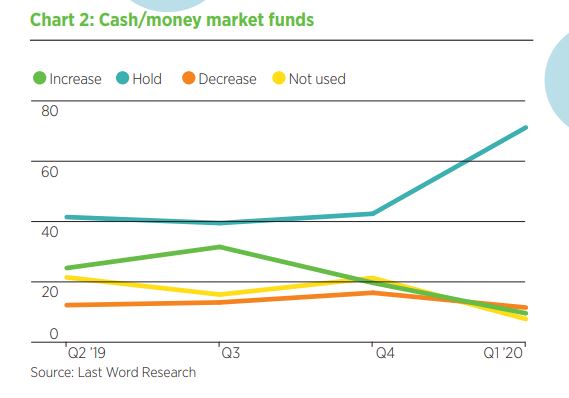

Attitudes on cash/money market funds are revealed in chart 2 below. There has been a steady decline in the number of fund buyers intending to add to their cash holdings during the past three quarters, suggesting investors are instead looking to move their assets right back into the market.

Although we have seen a sharp uptick in the number of fund selectors planning to hold their current allocation – just over 70% of respondents – this can still be seen as a positive, with fewer than one in 10 aiming to increase their allocation to cash/money market funds.

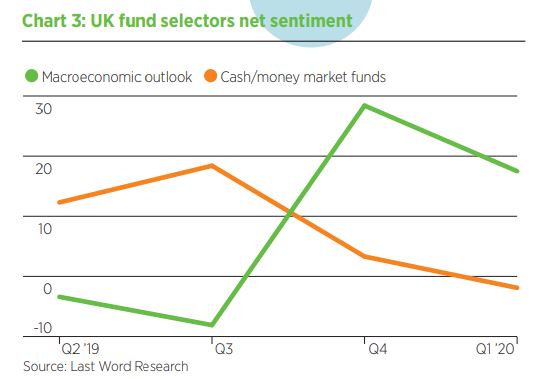

So, is there a correlation here? Last Word Research has taken the net sentiments of UK fund selectors towards macroeconomic outlook, and their forward-looking investment intentions for cash/money market funds, and overlaid them, as can be seen in chart 3 below.

As investors’ macroeconomic outlook becomes more positive, their allocation towards cash/money market funds begins to decline.

Fear for the future?

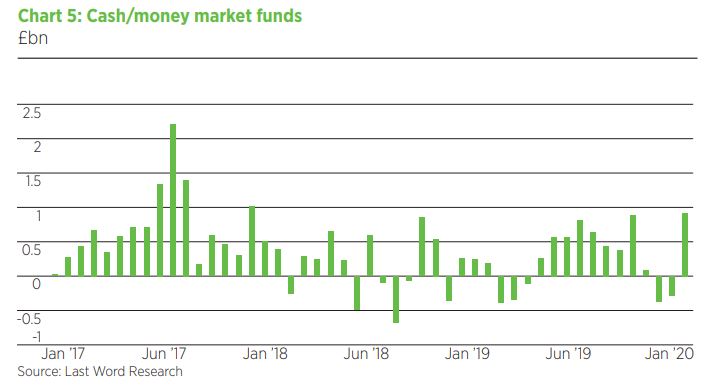

As previously mentioned, allocation to cash/money market funds is often an indicator of an investor’s risk appetite. Chart 5 below shows the fund flows of UK-domiciled cash/money market funds from January 2016 until January 2020.

It is noticeable how UK investors are less apprehensive now than during other times of uncertainty, such as following the Brexit vote in 2016 when the pound crashed to a 31-year low.

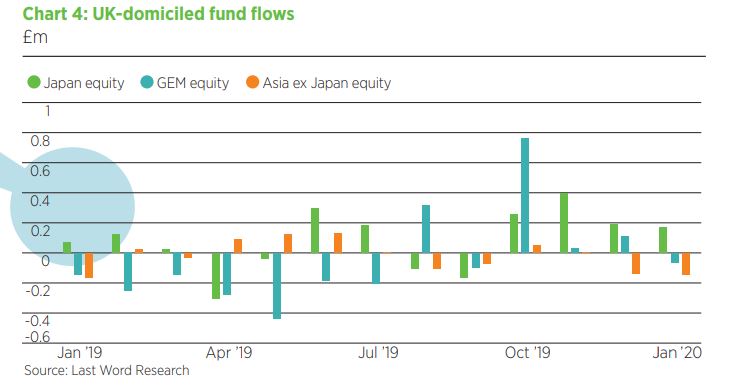

There is still plenty of concern about coronavirus as many countries have been forced to close their borders and quarantine their populations. As is to be expected, this concern can be seen in the most recent fund flows, with net outflows from Asian and GEM in recent weeks. However, these outflows are no worse than throughout the rest of 2019, in a coronavirus-free time (see chart 4 below).

Looking at all data available to us, it seems UK fund selectors are not expecting this crisis to have a long-term impact. For the majority of them, the future seems bright. Of course, this is all subject to change. As coronavirus spreads across the globe and has more of an impact on day-to-day life, it will be interesting to see how this attitude changes in coming weeks.

This article was written by Lottie McGurk, a quantitative researcher at Last Word Research

If you wish to see the full results of our research, or discuss any of this further, please contact lottie.mcgurk@lastwordmedia.com