It would be difficult to ignore the impact Greta Thunberg has had in recent months. In September, seven million people took part in a global protest inspired by the young environmentalist. Later that same month, Thunberg was credited for inspiring a political reshuffle in Austria in which the Austrian Green Party won an historic 14% of the vote and support for the party tripled.

In October, members of the global environmental movement Extinction Rebellion took over central London and, in a film that has now gone viral, Jane Fonda recorded her Bafta acceptance speech for the Stanley Kubrick award while being led away in handcuffs by police at a climate change protest in Washington DC.

Fonda had earlier acknowledged Thunberg had inspired her to return to civil disobedience. The ‘Greta effect’, as it has been dubbed, can be seen across the globe.

Spike in engagement

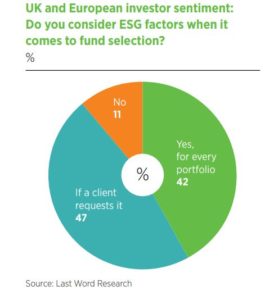

The finance industry has also felt the impact. Last Word Research has conducted an extensive annual study into ESG investing and fund selection during the past two years. Taking a cross section of wholesale, institutional and fund of fund investors, from across continental Europe and the UK, we have tracked the changing attitudes of the top fund selectors and their clients towards ESG.

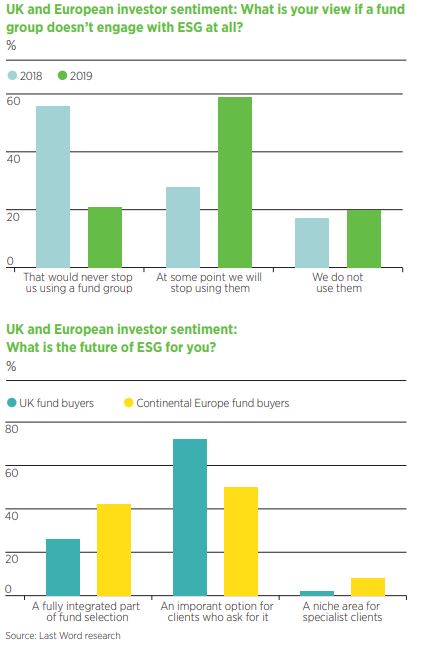

Even in this short period of time there has been a sharp spike in engagement with ESG investing. During the past 12 months, attitudes towards fund groups who do not engage with ESG has shifted significantly.

In 2018, 35% of fund selectors across Europe and the UK reported that if a fund group did not engage with ESG they would eventually stop using them. In 2019, this number has jumped to 59%.

In fact, three-quarters of fund selectors say ESG is an important option for clients, with only a handful of respondents believing it is a niche area for specialist clients.

Fad or tipping point?

But is ESG the latest investment fad or has demand been matched by supply from the fund management industry?

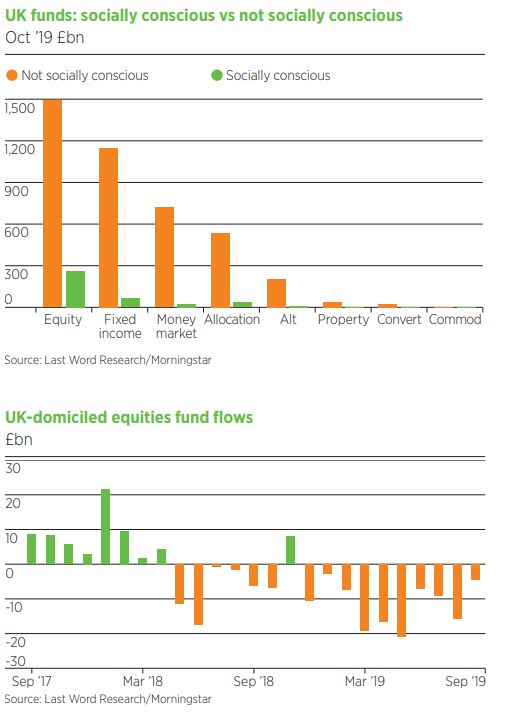

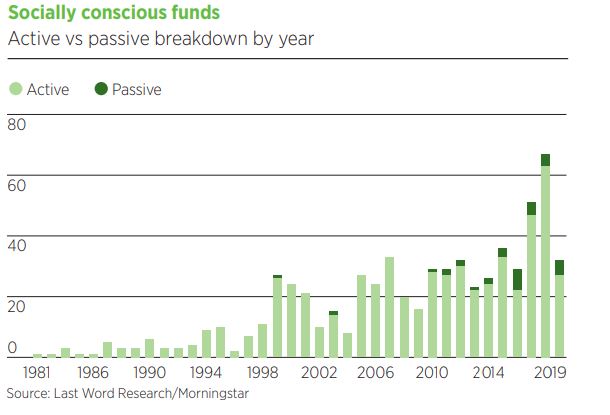

During the past three decades, there has been a sharp uptick in appetite for socially conscious funds. At the same time, the number of UK-domiciled funds deemed by Morningstar to be socially conscious has increased from only one in 1981 to 67 in 2018. However, there is still plenty of room for growth.

The latest data from Last Word Research reveals that many fund selectors believe there still isn’t enough choice when it comes to investing in ESG, and this lack of choice makes it harder to pick good funds.

When asked which assets classes don’t have enough ESG funds to choose from, ESG-compliant emerging market fixed-income came out on top, with 52% of respondents agreeing they would like more funds to be launched in the space.

This was closely followed by commodity funds, hedge strategies and emerging market equities, with just under half of respondents (48%) agreeing there are still not enough ESG versions of these funds on offer.

The issue here is whether enough assets are going into these funds to warrant more launches. As the chart above shows, the overwhelming amount in UK-domiciled funds is still in regular funds.

Bucking the trend

In the past 12 months, there have been significant outflows from nearly all the major asset classes. Between Sep ’18 and Sep ’19, there have been constant net outflows from equities, with the exception of Nov ’18, totalling a substantial £118bn.

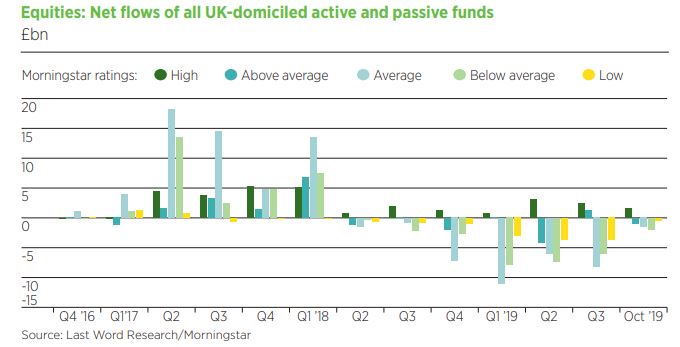

However, it is interesting that despite significant net outflows from equities in recent months, funds rated ‘high’ in Morningstar’s sustainability rating have experienced consistent net inflows since 2017.

In the past three years, there has been a whopping £30bn of net inflows into these funds, whereas there has been net outflows of almost £14bn from funds rated ‘low’.

In the space of just 12 months it is clear ‘the Greta effect’ has had a big impact on investors and has taken hold of the finance industry. As demand for ESG compliant funds rises, it will be interesting to see how fund groups and asset management houses react. For now, however, ESG is on the march.

This article was written by Lottie McGurk, a quantitative researcher at Last Word Research