Gresham House Strategic has seen its share price rattled after the board expressed disappointment over lead manager Richard Staveley’s resignation.

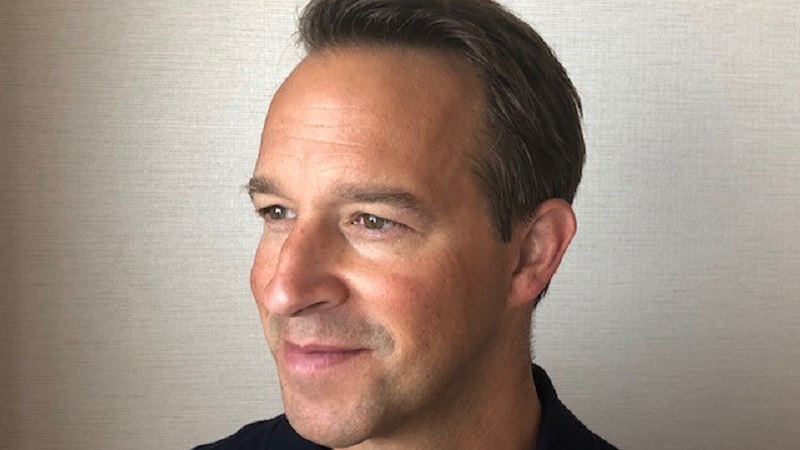

Gresham House revealed in a stock exchange announcement on Tuesday afternoon that Staveley (pictured) had resigned from the firm, effective immediately, and would be stepping down from the £58m trust.

Deputy manager and associate director Laurence Hulse will continue to oversee the trust alongside co-manager Tony Dalwood with support from Gresham House’s strategic equity team.

See also: River and Mercantile founding partner resigns from Gresham House after less than two years

Shares in the trust slid 3% from their previous high of £15.40 as markets digested the news of Staveley’s departure on Wednesday morning.

They continued falling further after the board responded to the news in a fresh RNS filing published at 10am.

The board said it was “disappointed” to learn the trust’s lead manager had left and was “considering the implications for the future management of GHS’ portfolio” with a further announcement to be made in due course.

By noon GHS’ shares had slumped 6% to £14.50, a one-month low.

GHS board highlights Staveley as driver behind trust’s NAV growth

Since joining Gresham House in September 2019, Staveley’s investment decisions have driven “significant NAV growth” for the portfolio, the board stressed, which in turn has helped boost the trust’s share price.

Two thirds of GHS’ current portfolio is made of up stocks acquired during his tenure, seven of which are up over 50% since purchase, it noted.

“Richard is a named key person for the purposes of the investment management agreement, and as such the board of GHS is ready to consider and respond on any replacement personnel proposed by Gresham House, that would form the basis of any ongoing management of the investments of GHS.”

In a statement provided to Portfolio Adviser Gresham House said the core team behind GHS, supported by the UK strategic equity team, will continue to run the portfolio as they have done to continue delivering on the trust’s “excellent long-term track record”. Over the past five years it has returned 111.3% versus the IT UK Smaller Companies’ gains of 86.2%.

Deputy manager Hulse has been directly involved with the trust since Gresham House won the mandate, while Dalwood chairs the GHS investment committee which also includes Graham Bird and Ken Wotton.

GHS discount widens

Wednesday’s RNS filing is the latest in a series of back-and-forth exchanges between the trust’s manager Gresham House and the board of directors since the start of the week.

On 21 May Gresham House requisitioned an emergency general meeting, calling for the immediate removal of GHS chairman David Potter due to governance concerns over the length of his 18-year tenure.

In response, the board of GHS served a 12-month protective notice against Gresham House on Monday and launched a strategic review of the trust. It also announced Potter would be retiring as chairman at the trust’s AGM in September.

The board said Potter’s retirement provided a “timely” opportunity to take a look at the trust which it claims has struggled to attract assets due to its persistent discount.

Amid the ongoing saga between GHS’ fund manager and the board, its discount has continued to widen from 6.4% on Monday to 7.5% Tuesday afternoon.