For PGIM Fixed Income manager Greg Peters, the macro backdrop is the strongest it has been in the past 20 years, but he argues the “hyper speed” at which markets are moving means credit cycles are playing out over months rather than years.

“There’s a situation where you have extremely accommodative central banks, a tremendous fiscal impulse, particularly in the US, and the global economy improving dramatically,” says Peters. “Timing is uncertain, of course, given the vaccine rollout, but nonetheless, we’re getting to the light at the end of the tunnel. You put those three factors together and, setting valuations to one side, it is a powerful macro backdrop for investing.”

‘Golden age of credit’ will be short lived

The sheer speed at which markets are moving was illustrated by how rapidly bond markets reacted to the arrival of the coronavirus pandemic in March 2020. At the time, Peters and his team hailed a ‘golden age of credit’. They argued this came about because of decimated credit valuations coupled with the belief that companies will be forced finally to prioritise debtholders.

According to Peters, credit often does well when companies are highly levered after a recession or a shock and the markets and rating agencies force them to de-lever, while equity investors focus on balance sheets. Companies can be rewarded for being less aggressive and more conservative, and therefore more focused on the balance sheet and bondholders.

According to Peters, this type of cycle would typically last several years at least, but not this time round. “Everything is happening at hyper speed,” he says. “Companies are already looking to jettison their conservative balance sheet focus in favour of more growth-oriented strategies. The golden age of credit is going to be shorter than I’d hoped, because the cycle is so accelerated.”

He says credit is still in “a reasonably good spot” but that the popular press has misunderstood the market dynamics, referencing a recent article that noted the triple-C part of the high-yield market had issued a tremendous amount of debt since the start of the year, suggesting an imminent pop.

“The story here is that companies issuing debt today are taking out higher-coupon, shorter-maturity debt and adding it with longer-maturity, lower-coupon debt. They are actually repairing their balance sheets by issuing debt,” says Peters. “They are also building liquidity to fight to live another day, so I think the popular press has missed what’s happening here.”

A go-anywhere credit strategy

Peters is a managing director and head of multi-sector and strategy at PGIM Fixed Income. He oversees about $170bn (£120bn) of assets under management across core, long government/credit, core plus, absolute return and other multi-sector fixed-income strategies. He is keen to point out it is very much a team-based operation, however, and that he runs the Multi Asset Credit and Absolute Return portfolios alongside Michael Collins and Richard Piccirillo.

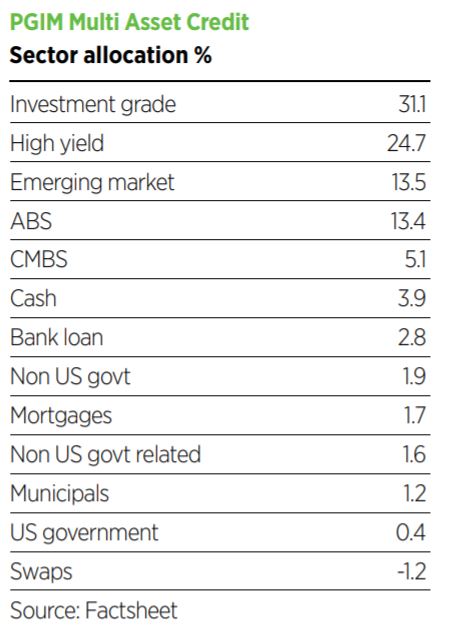

The Multi Asset Credit Fund is a go-anywhere credit strategy for which the team can “pull the levers” within credit markets to access a broad swathe of opportunities, including anything from global high-yield and investment grade through to emerging markets and structured products. It targets in excess of 350 basis points of annualised gross excess return above the ICE BofAML 3-Month Libor Index during a full market cycle.

The portfolio holds about 30% in investment grade, 27% high yield, 3% bank loans, 12% emerging markets and about 20% in structured products.

The bigger, the better when it comes to team size

Team size is everything when it comes to global fixed-income management, Peters argues, because the market is so segmented by geography, market and client type. As such, they rely heavily on what the firm calls “sleeve managers”.

“These are the experts in each market that not only work on their individual trading desk, but work with us on the multi-sector side,” he says. “It’s a very collaborative process and we assign each of those areas risk units and then it’s incumbent upon them to garner alpha.”

He adds: “When scouring the globe for opportunities, the three of us are not going to have the level of detail that can create alpha. For example, is that seven-year bond of UBS cheap relative to the five-year bond? You can’t do that on your own.

“The process of matching the fundamental research person to portfolio managers of each of the sleeves really helps to drive the process; it is a broad, research-driven team approach.”

But does each idea have to pass by one of the portfolio managers before making its way into the portfolio?

“There is autonomy because we’ve worked so closely together so we all know what names we like. You have to rely on the individual processes to drive the top line strategy,” he says.

Portfolio changes

The team added across high yield, investment grade and emerging market debt in April, but Peters says valuations are such now that risk/reward isn’t as great as it was. “We’re trying to be disciplined and so we cut our spread risk down from 100% of our operating budget to 85%.”

Peters is less enthusiastic about investment grade than he was in March last year when Covid struck. He says valuations have recovered, particularly in the higher quality end of the market.

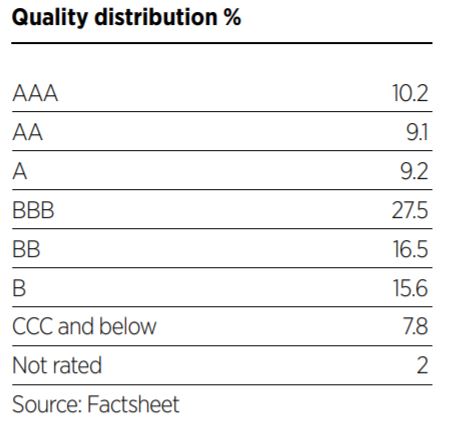

“Long-duration single-A is an area we have not liked historically because of the negative credit migration, as these are the companies that are more apt to do things that are disadvantageous to the bondholder,” he explains. “But last year they were really beaten up, so we added exposure to long-duration single-As. We’re now starting to unwind that as the area has probably run its course.”

One area the team is focused on is what PGIM Fixed Income terms the “crossover corridor”, namely the triple-B and double-B parts of the market. “We’re whittling down our single-As and looking more at triple-Bs. I see rising star potential for some of the high yield names.”

Markets getting ahead of themselves over inflation

In response to the rhetoric around increasing inflation, Peters believes markets are getting ahead of themselves. “I think over the near term there will be pressure on interest rates and inflation breakevens, but I don’t foresee a world where inflation is going to be sustainably high.”

In fact, Peters predicts forward inflation might be one of the more mispriced assets out there. This is in large part due to the secular issues of demographics, too much debt and the cost of the economic rebound.

On the cost of the rebound specifically, he says: “It’s absolutely astounding and that’s going to pull down growth, ultimately, and pull down inflation.”

Peters and team have the least amount of duration in the portfolio in years, 0.82, according to the latest factsheet, but this is about to change.

“People have an auto-correlated mindset that because rates are going up, they will continue higher; and when they are going lower, they will continue downwards. In fact, it’s supposed to be that when rates are higher you should be excited to own rates and less excited when they’re low. Because of this we are getting close to adding duration back to the portfolio.”

A growth story with emerging markets

Elsewhere, Peters sees emerging markets as an area that should benefit as the global economy starts to improve and with the backdrop of a subdued dollar. But he does think there are structural issues with some emerging economies.

“The backdrop is good, so you’ll have this continued moderate dollar regime, which I think is helpful. Valuations of emerging markets versus US and European credit look attractive, so I think the return potential is higher.”

He also doesn’t think there are the same kind of inflationary forces in emerging markets as in other parts of the market. “Emerging market central banks don’t have to be as proactive or aggressive in hiking rates, which is kind of a growth killer.”

Summing up the outlook on emerging markets, Peters says: “It’s a growth story. It’s a lack of inflation story, and the valuations look attractive relative to developed markets.”

Typically, however, Peters doesn’t like to run a large allocation to emerging markets in relation to high yield.

Structured products offer good ballast for the portfolio

He also describes structured products as a good tool for achieving the portfolio’s objective, to “create a barbell type of strategy that pushes us up and out the efficient frontier”.

He adds the combination of, for example, AAA collateralised loan obligations (CLOs) and high-yield bonds helps achieve that objective. “CLOs are highly supported instruments, where the risk of credit loss is extremely remote. A good ballast for the portfolio, offering a decent spread of Libor plus 110 or 120 basis points.”

Peters adds that commercial mortgage-backed securities used in a multi-asset credit context are attractive, particularly what the team terms “single asset single borrower” deals, which are essentially loans on a specific property.

Summing up, Peters says having the overall ability to move across the spectrum of fixed income into these more esoteric asset classes offers a greater breadth of diversification to portfolios.

“What you have is kind of a manager style that might lean a little more on the structured side, maybe it leans a little more on the EM side or high-yield side, and so what I think is different about us is the ballast we have, and the ability to rotate across these different segments with a broad swathe of expertise.”

This article originally appeared in the March issue of Portfolio Adviser. Read more here.