The gold price has come within whispering distance of $2,000 (£1,534) an ounce in recent days while funds investing the the precious metal topped the performance charts in July, but how high can gold go?

Received wisdom is that this rise has been prompted by investor fear over a second wave of Covid-19. While this is undoubtedly a factor, the real picture is more nuanced and will influence whether gold can continue to make progress from here.

Panic not enough of a motivator

Certainly, there is plenty of pessimism around. The IMF is currently projecting a 4.9% contraction in global growth for 2020, plus widespread unemployment.

As lockdowns are eased and cases rise, governments have an uncomfortable trade-off between economic growth and the spread of the virus.

There are also fears emerging over US/China trade tensions. Both countries recently shut down their respective consulates and analysts suggest China has now alienated its biggest ally in the US – the business community.

Any hope of a thawing in the two countries’ frosty relations after the presidential election also seems unlikely with US Democrats just as hostile to China’s ongoing influence in the US.

However, panic alone might not necessarily send investors scurrying to gold were there not other factors at play.

Perhaps the first problem is that relatively few safe haven alternatives exist. As of 28 July, the US 10-year treasury yield now sits at just 0.58%, according to MarketWatch. With US core inflation at 1.2%, this is an expensive hedge. Blackrock estimates that the US 10-year real rate is now at -0.9%.

Fewer ports in the storm

In its latest update, the Gold Council also points out that equity valuations look high given the fundamentals, while corporate bond prices have also increased, which are driving investors towards gold markets.

Importantly, US/China trade tensions and lower bond yields have weakened the dollar, which might otherwise have been a port in the storm for investors.

Jason Hollands, managing director at Bestinvest, says: “There is a well-established relationship between the US dollar – the world’s number one reserve currency – and gold prices.

“A rising dollar is usually accompanied by a weakening of gold prices and vice versa. The dollar has recently been weakening in expectation of further US stimulus measures which are in the process of being hammered out in Congress, which would see US debt continue to rise, as well as US-China tensions.”

Low yields also mean the opportunity cost of holding gold is lower. Gold does not pay an income, so tends to have less appeal at times of high bond yields. With yields at rock-bottom, these pressures are removed.

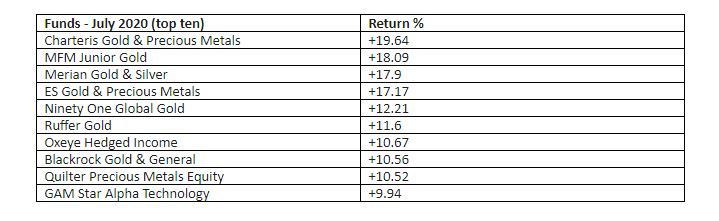

Gold and precious metals dominate July top fund performers list

Gold and precious metal funds dominated the list of 10 best-performing funds in July. Eight of the top 10 were gold funds with Charteris Gold & Precious Metals on top with a 19.6% return during the month. The MFM Junior Gold fund delivered 18.1% followed by the Merian Gold & Silver fund with 17.9%.

Source: Fairview Investing using FE Analytics, returns 30/6/20 to 31/7/20

The best-performing investment trust sector during the month was the Commodities & Natural Resources sector with a 13.8% return.

Fairview Investing investment consultant Ben Yearsley says: “Is it any surprise that gold has had an excellent run recently? QE has been on steroids in recent months, which could be inflationary at some point and may well have a debasing effect on currencies.

“Added to that is the lack of any yield on cash and government bonds and for once the opportunity cost of holding gold is nothing. Many are suggesting gold powers on to $2,500.”

Devaluation solution?

In a recent white paper, Crossborder Capital attributed much of the recent rise in gold to excess global liquidity, which in turn debases paper currencies.

It says: “Large-scale debts have typically been the triggers for monetary instability. When debts are so large that they cannot be repaid in current money, they must be either reneged or devalued. Yet, mass default is not a realistic option in a credit-money economy.

“Devaluation is the more likely solution and this involves undermining the standard of value and denominator of debts by excessive issuance, ie printing money to notionally repay debts.

“This potential liquidity expansion ultimately determines the price of gold, which is an expression of the amount of paper money.”

The independent fund management firm says the US Federal Reserve and the People’s Bank of China (PBoC) are the principal players in determining the gold price.

“Both the US and China are now easing liquidity, with latest Chinese data showing broad liquidity over the latest three months rising at a 20% annualised clip.

“Gold is the ultimate stable, long-term standard of value. Hence, debt, liquidity and gold should move in-step over the long term.”

Drivers are still in place but is there more to come?

Perhaps more importantly, Crossborder Capital says that looking at these three variables today suggests there is further upside for the gold price.

It says that in order to get back to historic norms, the gold price would have to increase to around US$2,500/oz.

Certainly all the variables that have driven the gold price higher are still firmly in place: there appears little likelihood of global central banks turning the tap off with the economic situation so precarious, for example, nor of investor fear abating.

For those who believe the gold price has limited upside at these levels, gold shares may be another option. They haven’t rallied to the same extent and may be in a position to catch up.

Blackrock World Mining investment trust manager Evy Hambro says companies only benefit from a higher gold price when it is not accompanied by cost inflation.

In the last gold boom in 2011, costs were rising: currencies were moving in the wrong direction, there were labour shortages and there were higher materials prices. As such, gold shares underperformed.

He says: “Today, there is no cost inflation, so rising price should be captured by gold equities.” He points out that gold mining companies have learnt the lessons from the previous boom when there was, “overinvestment in new capacity, crazy M&A, leverage on their balance sheet.

“The lessons were very painful and cost huge amount of returns for investors […].Today, we have a very different investment universe with capital discipline at the forefront.”

That said, the recent rally should remind investors of the importance of holding ‘insurance’ plays such as gold through the cycle.

Often when investors realise they need it, the price of insurance has already risen. The time to buy is before the roof falls in.

For more insight on continental European investment, please click on www.expertinvestoreurope.com