Despite reporting a nearly 20% drop in assets under management during the first six months of 2022, Gam’s share price was up nearly 4.5% to CHF 1.08 (£0.93) by midday.

Year-to-date, Gam’s share price is down 25.3%, having traded at CHF 1.44 (£1.24) at the start of 2022. However, the current price is a marked improvement on the CHF 0.79 (£0.68) low recorded at the end of June.

A trading update, published on 18 July, alerted the market to the impact the tough trading environment was having on the Swiss asset manager. At the time, it revealed it would report a net loss of CHF 275m (£236m) for the first half of 2022, a staggering rise from the CHF 2.7m loss it incurred during the same six-month period last year.

But forewarned is forearmed, as they say, and that seems to have been the case with investors who appear to have taken the results news in their stride this morning.

The official half-year results confirmed that AUM had dropped from CHF 99.9bn (£85.8bn) as of 31 December 2021 to CHF 83.2bn (£71.5bn) by 30 June 2022.

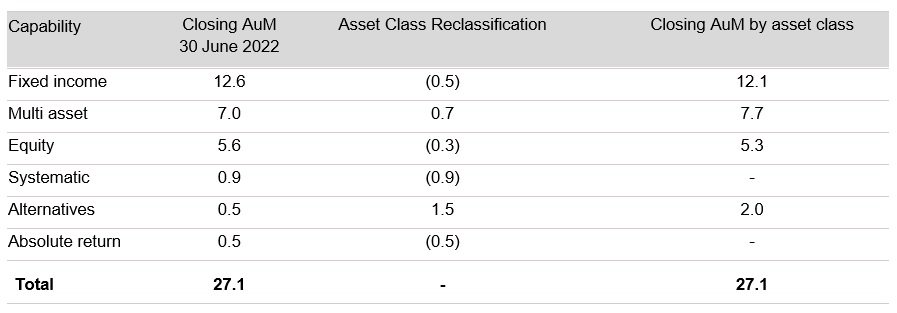

Gam’s fund management services ended the first half of the year with CHF 56.1bn (£48.2bn) in AUM, down from CHF 68bn (£58.4bn), while its investment management division dropped from CHF 31.9bn (£27.4bn) to CHF 27.1bn (£23.3bn) over the same time frame.

Of the CHF 16.7bn (£14.3bn) decline, CHF 12.4bn (£10.7bn) was due to negative market movements. FX headwinds saw assets shaved by an additional CHF 700m (£601m).

Investment management outflows

Just CHF 1.1bn (£945m) of the total AUM decline can be attributed to net outflows, with fixed income funds losing CHF 600m (£515.4m) and equity strategies bleeding CHF 300m.

In fixed income, the majority of outflows were from the Gam Star Credit Opportunities and Gam Local Emerging Bond funds. The firm’s CAT bond strategies saw “strong net inflows”, it added.

“Other fixed income strategies attracting client interest and net flows include mortgage-backed securities,” Gam said.

In equities, net outflows were mainly driven by the Gam Star Disruptive Growth, Gam Star Continental European Equity, Gam Japan Equity, and Gam Star Japan Leaders funds. Inflows into Gam UK Equity Income fund, Gam Emerging Markets Equity and Gam Swiss Equity funds helped soften the outflows.

Gam’s multi asset and alternative strategies bucked the trend, each recording net inflows of CHF 100m (£85.9m).

Peter Sanderson (pictured), CEO of Gam Investments, said: “Gam’s business performance was resilient in the face of the extraordinary economic and geopolitical conditions during the first half of 2022. Despite clients being cautious in the face of market volatility, we are encouraged to see them allocating to a number of our diverse, high conviction active strategies.

“We continue to take action to reduce our costs given the decrease in our revenues. We are confident that our approach to active management is well placed to assist our clients in the current market environment.”

Shifting asset class umbrellas

Gam announced it is making changes to the way in which it reports its investment management and fund management services AUM and net flows.

This is to “reflect how our clients engage with our strategies and how we manage the business”, the asset manager said.

The current six capabilities in investment management will be reduced to four, with some fixed income and equities strategies moving to multi asset and its systematic and absolute return strategies combined under alternatives.

As outlined in the table below:

People Move

In a further development, Gam announced that Sally Orton has been promoted to group chief financial officer, having previously been deputy CFO since joining the company in May 2022. She will also become a member of the group management board.

It follows Richard McNamara’s decision to step down from his role, after seven years. He will leave the company at the end of 2022. McNamara joined Gam from Henderson, where he served as managing director, finance.

Orton was previously group CFO for Zedra Group for four months in 2022, having served as interim finance director at River and Mercantile Group between May and November 2019. During her 25-year career, she has worked at KPMG Australia, PwC and EY.