Fundsmith’s scrutiny of transaction fees on rival behemoth funds, including Aberdeen Standard Investments Gars, has received pushback from asset managers who say it is making an “apples and pears” comparison.

In his latest annual letter to investors, Terry Smith said too many investors get caught off guard by transaction costs, which are not accounted for in funds’ ongoing charges figure (OCF) or annual management charges (AMC). The industry is too focused, and in some cases “obsessed”, with these charges even though they do not tell the full story, Smith said.

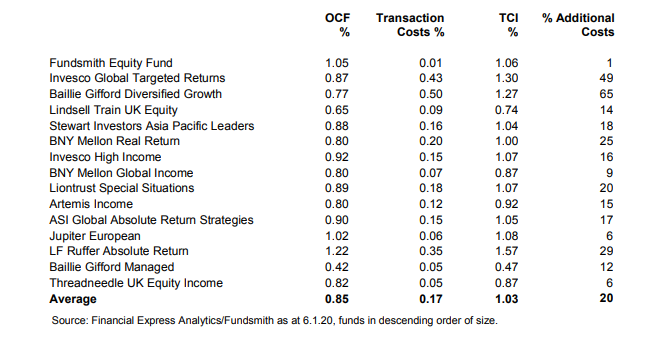

In a table of the “the 15 largest equity and total return funds in the UK”, Fundsmith Equity came second only to the LF Ruffer Absolute Return fund for its ongoing charges figure, which is 1.05% compared to 1.22% on the latter.

Transaction cost in the largest equity and total return funds in the UK

But Smith urged investors to pay more attention to dealing costs, where his buy and hold strategy meant Fundsmith Equity had the lowest transaction fees of the 15 funds analysed at 0.01%. That made the total cost of investing in Fundsmith Equity 1.06%.

Baillie Gifford Diversified Growth had the highest transaction fees at 0.50%, which, when added to the OCF of 0.77%, took the total cost of investing in the fund to 1.27%. Invesco Global Targeted Returns had the next highest transaction fees of 0.43%, which took the total cost of investing to 1.30% once added to the OCF of 0.92%.

Baillie Gifford hits back at comparison

But Baillie Gifford argued Fundsmith wasn’t making a fair comparison.

“Fundsmith is a global equity fund and Baillie Gifford’s Diversified Growth Fund is a multi-asset targeted absolute return fund,” a spokesperson told Portfolio Adviser.

“This is a case of Fundsmith comparing apples with pears and the choice of Diversified Growth is disingenuous and a better comparison might be with global trusts such as Scottish Mortgage Investment Trust or Monks.”

Both sit in the investment trust equivalent of the IA Global sector and have transaction costs of 0.03% and 0.04%, according to Association of Investment Companies data. Investment trusts generally have lower transaction fees compared to open-ended funds as they do not have to manage flows.

A spokesperson from Invesco said “the cost of transacting each position is embedded within each investment decision and return forecast” on the Invesco Global Targeted Returns fund.

LF Ruffer Absolute Return had lower transaction costs than the Baillie Gifford and Invesco funds but the largest overall cost of investing at 1.57%. It did not wish to comment when approached by Portfolio Adviser.

Transaction costs on global versus absolute return funds

Fundsmith Equity was the only fund in the Investment Association Global sector to feature on the list with the BNY Mellon Global Income fund the closest fund in terms of its investment universe. Nick Clay’s fund had an OCF of 0.80% and transaction costs of 0.07% meaning its total cost of investing was 19 basis points cheaper than Fundsmith Equity.

In contrast, four funds from the IA Targeted Absolute Return sector featured in the list, including the Baillie Gifford Diversified Growth and Invesco Global Targeted Returns funds alongside ASI Gars and the BNY Mellon Real Returns funds, both of which have lower total investing costs than Fundsmith Equity at 1.00% and 1.05% respectively.

The average transaction costs in the IA Global sector are 0.18% compared to 0.44% in the IA Targeted Absolute Return sector, according to Morningstar data. The average transaction costs in the Investment Trust Global sector is 0.17%.

Funds picks that can get away with higher transaction costs

GDIM investment manager Tom Sparke says he will tolerate higher transactional costs if a fund can demonstrate additional value, pointing to Man GLG UK Income as an example.

The fund has transactional costs of 0.99% but Sparke argues it “demonstrates an elevated level of alpha from its process”.

In contrast, he points to Baillie Gifford Emerging Markets Leading Companies as a fund that has “pleasingly low” transaction costs of just 0.04%.

Willis Owen head of personal investing Adrian Lowcock also pointed to Henry Dixon as a fund manager who he likes despite his funds, which also include Man GLG Undervalued Assets, having high transaction costs.

Value and small-cap sectors likely to spend more on dealing

Lowcock reckons Fundsmith is right to shine a spotlight on transactional fees but said it would be wrong to take a one-size-fits-all approach to charges as “some strategies warrant more transactions and therefore more costs”.

Small-cap funds tend to trade more due to swings in valuations and be more diversified to spread risk, he says. He pointed to the Marlborough Micro Cap fund as a fund he would expect to take this diversified approach and therefore incur higher transaction costs.

Both the Man GLG Undervalued Assets and Marlborough UK Micro Cap Growth funds have been previously singled out for their strong sell disciplines, which academic research has argued can be a stronger contributor to alpha than stockpicking.

Morningstar director for manager research ratings Jonathan Miller says while Fundsmith Equity benefits from low turnover its investment universe of large-cap companies will also keep its transaction costs low thanks to smaller spreads. Morningstar ranks Fundsmith Equity in the middle quintile of funds when it comes to fund charges.

Lowcock adds that value funds may also incur higher transaction costs due to a more valuation sensitive approach and stricter sell disciplines.

Industry still needs to standardise transaction fees

Investors assessing transaction costs across funds still need to beware that there is no set standard for their calculation, says Sparke. “I would strongly support a standard process, enforced by the FCA, to represent this on a comparable basis.”

Invesco likewise noted transaction cost calculations often proved particularly unreliable for funds with large concentrations of derivative instruments, like the Invesco Global Targeted Returns fund.

Transaction cost disclosure has been a requirement under Priips changes introduced in 2018.

But the method used to calculate costs has come under fire for presenting a confusing picture, including negative transaction charges. In the IA Global sector there are 19 funds with negative fees.

The Russell Investments Global Listed Infrastructure fund has the highest transaction fees in the sector at -0.71%.

Priips rules currently require funds to include the arrival price – the difference in a security’s price between order submission and execution – in transaction cost calculations, which can result in a negative charge depending on market movements.

Fundsmith Equity currently ranks 37 out of 314 funds in the IA Global sector for transaction costs.