By Darius McDermott, managing director of FundCalibre

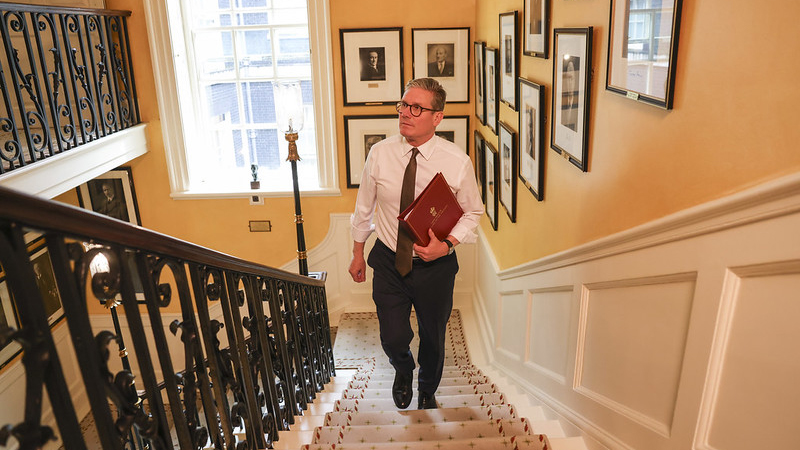

After one of the least surprising election results in history, Keir Starmer moved into no.10 Downing Street on 5th July. This had long been anticipated by bond, equity and currency markets, which barely moved in response, but markets will now start the long process of looking at Labour’s plans more closely, who will be the winners, and who will lose out.

At a macroeconomic level, the focus on growth is likely to be welcomed. Labour’s target of an annual 2.5% rise in GDP may look unambitious compared to the UK’s growth rate in the 1990s and early 2000s, but would be a lot faster than has been seen since the financial crisis. Economists remain sceptical that it can be achieved with the measures laid out in the Labour manifesto, but it is at least, a statement of intent.

Overall, stock markets greeted the result with equanimity. Incoming Chancellor Rachel Reeves has done much to quell investors’ fears over spending, while the chunky majority secured by Labour gives some welcome stability to UK politics. The election result comes at a time when UK markets were already showing signs of a turnaround.

Alexandra Jackson, manager of the Rathbone UK Opportunities fund, says: “The prospect of stability and economic growth in the UK should give a boost to UK business, as well as to company share prices and investor flows into our asset class. We have a bias to UK mid-cap companies. While they are mostly global in nature (less than half of our portfolio revenues are generated in the UK), our companies are often seen as highly correlated to the UK domestic picture.”

She believes that the recent run of strong performance from UK markets can continue: “Investors may look to the UK as something of a safe haven in a challenging global market, fraught with political uncertainty and highly concentrated returns.”

The impact on housebuilders

There are a number of specific sectors that may be impacted by a Labour victory. Housebuilding is top of the list. Labour’s housebuilding targets are for one and a half million new homes built within the first five years of its term, “delivering the biggest boost to affordable housing in a generation, creating new towns and ensuring first dibs for first-time buyers”.

This requires a ‘blitz’ of planning reform, including a‘planning passport’ for urban brownfield development. This sounds good for UK housebuilders, but may come with strings attached. Housebuilders sit on considerable land banks and Labour may force some quid-pro-quo on putting this land into use.

Rathbone Income co-manager Alan Dobbie says: “A combination of more clarity around the path of mortgage rates and greater political acceptance that the current system is not working could be enough to push housebuilder share prices on from here. Crucially, their balance sheets remain in very good shape, with many housebuilders holding more cash than any debts they have outstanding.

“And with many dividends rebased at a more sustainable level, there’s increasing clarity around the investment case.” The share prices for housebuilders have spiked higher since Labour’s victory.

Renewed focus on energy infrastructure

From what we know so far, energy infrastructure remains a priority, particularly for green energy. After some rolling back on the UK’s energy transition ambitions in recent years, Labour has laid out plans to make the UK a “clean energy superpower”. It says it will build new infrastructure to help address greenhouse gas emissions from heating, transport, agriculture and industry.

It also plans to create a long-term strategy for transport and is committed to the creation of a National Infrastructure and Service Transformation Authority. Its infrastructure plans also include digital infrastructure, including the rollout of 5G and high speed broadband connections across the UK.

The previous government had similar plans, but found them difficult to implement. The reforms to the planning system could help to ensure that these infrastructure plans do not get stuck in the same way as, for example, HS2.

The government has said it will need private sector investment to support these initiatives. It may create a more predictable investment environment than the one that has prevailed over the past few years. This should be a boost for the infrastructure sector, which has had a difficult period. Funds such as the VT Gravis Clean Energy Income fund, which is 47% invested in the UK, may be beneficiaries.

Other managers are looking at this area in more detail. Alex Wright, manager on the Fidelity Special Values fund, says: “The UK election is one of the many inputs to our investment process, but one area of interest is Labour’s commitment to speeding up the UK’s transition to renewable energy. Infrastructure will be an essential part of that build out.”

What about oil companies?

Labour has been keen to burnish its business credentials. However, this largesse does not extend to the oil majors. Labour is proposing to raise just over £6bn across the next parliament through increasing and extending the Energy Profits Levy. This started life as a ‘windfall’ tax on the profits of oil and gas companies, but will continue even though the high oil and gas prices from Russia’s invasion of Ukraine are now in the past.

Elsewhere, the party has said it plans to stop the development of any new oil and gas fields in UK territory if it forms the next government. This was inevitable if the UK was going to stick to its commitments under the 2015 Paris Climate Agreement, because the UK’s existing oil and gas reserves will already produce more than the UK’s fair share.

That said, the oil and gas sector has shown itself reasonably immune to the windfall tax to date. There is still enormous demand for fossil fuel and many oil and gas companies are generating sufficient cash to pay good dividends to shareholders, and undertake multi-billion pound buybacks. Their pariah status has ensured that valuations are relatively low.

Fidelity’s Wright says that the commitment to remove the North Sea investment allowance will “clearly hurt” that part of the oil and gas sector, but fund managers remain polarised on whether to invest or not. Groups such as Evenlode avoid oil and gas and extraction industries. In contrast, funds such as Rathbone Income have BP and Shell in the top 10 holdings.

Ultimately, the winners from this change of government are likely to emerge over time. The King’s Speech and Autumn Statement will give a clearer indication of the policies ahead. That said, there are a few sectors in the spotlight of a new administration and investors should stay alert.