An end-of-the-cycle feel and heightened levels of stock dispersion have spurred asset managers to launch a flurry of long/short equity products in recent months – but fund selectors are not easily sold on their merits.

Man GLG, Schroders, Franklin Templeton and Neuberger Berman have all launched long/short strategies this year and, characteristic of this group strategies as a whole, all the funds have different objectives.

In September, Man GLG poached RWC’s US long/short team with a view to launching a strategy, while in October, Schroders partnered with US manager Nuveen to offer two existing strategies to UK investors via its alternative Ucits platform.

Elsewhere, K2 Advisors launched a suite of liquid hedge fund Sicavs that included equity long/short products, and, in February, Neuberger Berman unveiled a strategy for Steve Eisman (pictured), the manager immortalised in the film The Big Short after successfully shorting the US sub-prime market prior to the financial crisis.

The term ‘long/short’ can cause confusion because not all such products slot nicely into the same Investment Association sector, making comparisons difficult. For example, James Clunie’s Jupiter Absolute Return Fund falls into the Targeted Absolute Return sector, whereas Chris Kinder’s Columbia Threadneedle UK Extended Alpha is in the UK All Companies peer group. Eisman’s Neuberger Berman Absolute Alpha Fund, meanwhile, is sited in the offshore FO Absolute Return sector.

Kinder says of his fund: “It’s a long/short fund but it’s not absolute return, meaning it doesn’t sit within the absolute return universe. It will sit within a long asset allocation, most of which are benchmarked against the All-Share. So beating the All-Share is the ultimate deliverable.”

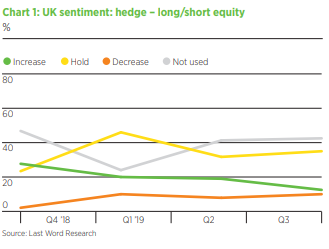

According to Last Word Research, fund selectors are rebuffing equity long/short and absolute return strategies. Between Q2 and Q3 this year, the number of investors looking to decrease their exposure increased from 8% to 10%, while those looking to increase fell from 19% to 13% (see chart below).

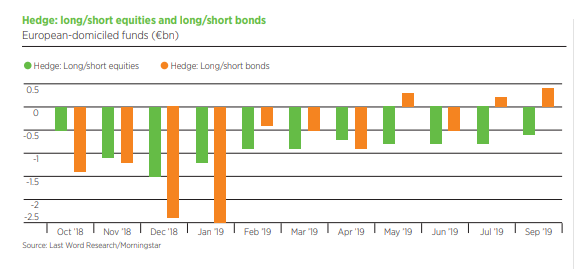

When it comes to absolute return, those planning to add to their exposure during the next 12 months increased marginally, from 15% to 16% between Q2 and Q3, but those looking to cut exposure increased from 17% to 25%. According to Morningstar data, there have been net outflows from long/short equities every month for the past 12 months, amounting to a €10.3bn (£8.8bn) loss for the asset class (see chart below).

Short shrift

Eisman describes recent market conditions as having a “frenetic” feel, as illustrated by the short-lived rotation into value stocks in September. “In August, it was buy growth stocks, short cyclical, short financial; and in September, it was buy cyclicals and financials and short growth stocks,” he says.

“It’s become very volatile, and correlations have gone up enormously in the past several months. It hasn’t been a year where you’ve been paid for stockpicking; you’ve been paid for positioning.”

Eisman has adopted a more cautious stance since the Neuberger Berman fund launched, reducing long exposure and adding to short positions. “We’re flatter than we were, probably about 15-20% net long right now, which is pretty low,” he says. “We were over 40% at one point during the year.”

Psigma Investment Management head of investment strategy Rory McPherson believes now might be a popular time for managers to roll out long/short products as there is increased stock dispersion in the market and because we are now more than 10 years into a bull market.

“There’s probably a fair amount of investors looking to take down risk, evidenced by the outflows from stocks we’ve seen recently,” he says.

Kinder’s Columbia Threadneedle fund has been running since 2010 but the manager says wide levels of stock dispersion in the current market are creating an opportunity.

“When you compare this with most other active funds, it will have a much greater percentage of stock-specific risk, which is exactly the risk I think we identify well.

“That is the risk that is very monetisable. The gap between the haves and the have nots on a stock-specific basis is probably as wide as it has ever been.”

Bucket list

City Asset Management has changed how it classifies these strategies. Previously, products would be placed in geographical buckets – UK or Europe, for example – but they are now housed within a separate alternatives section.

Research director James Calder believes long/short strategies can be further classified. First, there are market-neutral products that have low beta to equity markets and are more absolute return in their orientation. Second, these can be separated from the directional offerings that have a long-only bias and take short positions to dampen volatility and protect on the downside.

City Asset Management uses both styles but leans towards market-neutral products because they hedge out market risk, target low volatility and are lowly correlated to equity markets.

Calder describes market-neutral as a “hide under the bed” approach when it comes to returns. “You’re unlikely to see a manager down 2% in one month and up 5% the next month, for example,” he says. “Market-neutral funds should just be grinding it out: a softly, softly approach.”

It is also important to look at the level of return a manager is targeting for the amount of volatility they say is on the tin. “Most market-neutral funds are low volume, and there are more reasonable levels of return for the risk one takes, so they tend to get used in all portfolios,” he says.

But Calder also warns that when things do go wrong and sustained underperformance kicks in, “it’s something you want to be getting out of quickly because the chances of you actually recouping your losses are going to be limited”.

He also warns it is crucial to distinguish between strategies in such a wide-ranging sector, especially in different markets where there are varying levels of stock dispersion.

“More recently it’s Europe, where the market is inefficient and there are several good long/short managers operating in the space,” says Calder.

“However, in the US it is very difficult to find a long/short manager that is consistently giving you the level of return you want.”

Calder also notes the UK as an example of a market where inefficiencies exist.

This dispersion is something McPherson says Jupiter’s Clunie is exploiting. “His view is that the US is now overvalued, particularly tech stocks, while the UK is unloved. It ends up as being a short on equity markets as well, so it’s a nice diversification.”

Psigma struggles to find good ideas in this space because it feels that most managers move in tandem with the equity market and there is little value to be had after fees. Clunie’s fund is an exception, however, according to McPherson.

“James’s product offers something compelling in that he has negative correlation to equity markets, a proven edge in shorting and he tends to do well when the market sells off, hence providing good portfolio ballast.”

Testing times

According to Calder, while the second half of 2018 was a good opportunity to look at whether these products protected investors over the short term, because markets rallied quite quickly afterwards, it wasn’t a prolonged drawdown. “That’ll be the real test,” he says.

In theory, performance of a market-neutral manager shouldn’t depend on what’s happening in the market. But where some of these strategies fall short, says Calder, is when they veer from their process. For example, if they take a bet on binary macro events such as the Brexit referendum.

“In our experience managers have dropped the ball when they’ve gone off the reservation or the system becomes fundamentally flawed,” says Calder.

McPherson notes that while the end of Q4 last year was not a prolonged downturn, it did test some managers. However, he says Clunie has made modest positive returns from shorts in some of the more “glamourous” stocks such as Aston Martin.

“Last year was a horror show for pretty much all asset classes, so Clunie did well then,” he says. “This year has been more or less one-way traffic as well, but he made a little bit back in mid-August when markets started to pull back.”

According to FE Fundinfo data, Jupiter Absolute Return returned 1.76% in Q4 2018, compared with the IA Targeted Return Sector’s -2.39%. The fund was the ninth-best performing in the sector during Q4.

During the 2018 calendar year the fund returned -0.68% compared with the sector’s -2.81%. Year to date it has returned -6.84%.

The Neuberger Berman Absolute Alpha Fund has returned -5.5% in sterling terms since launch on 20 February compared with the FO Absolute Return peer group’s 1.3%, according to FE Fundinfo data.

City Asset Management uses the Absolute Alpha Ucits Fund, run by boutique manager CZ Capital, and also recently added Bodenholm Absolute Return to its buylist. Another manager Calder rates highly is Ennismore, which runs a global and European fund, and Blackrock UK Emerging Companies. “You have to find people that are truly dedicated to what they’re doing,” says Calder.

The fee factor

Calder says it pays to be mindful that you are paying for what you get with these strategies “but at the end of the day, we’re not dealing with charities”.

“I do raise my eyebrows at some of the hurdle rates. Ideally, we’d like to see inflation, but no one’s ever going to be that gutsy about it.”

McPherson also believes a big part of why Psigma struggles to find ideas in this space is down to the fees attached. The 15% performance fee on his favoured Jupiter Absolute Return was axed in November 2013, a few months after Clunie took the helm.

The Threadneedle UK Extended Alpha Fund has an ongoing charges figure of 0.83%, plus a performance fee of 20% when the relative return exceeds the FTSE AllShare Index – with income re-invested – by more than 2% during a calendar year. Kinder accepts the fund is perceived as a high-fee product among investors but Columbia Threadneedle is reviewing this.

“We know many clients are uncomfortable with the concept of the performance fee and one of the things we are working on as a family is to eliminate it going forward, which in my mind is a good thing. It’s going to enhance the returns and might remove a barrier for people investing.”