Our asset class research has been tracking the forward-looking investment sentiment of fund selectors across the UK for the past decade. Each quarter, we ask investors for their buying intentions towards 20 asset classes.

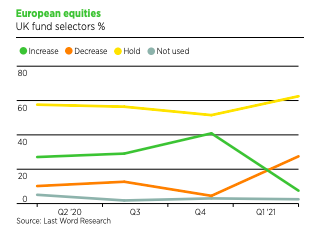

Last Word Research’s Asset Class Report noted a sharp drop in appetite for European equities this quarter. After having been firmly in the green since October 2019, with plenty more buyers than sellers, in April 2021 there was a sudden fall in demand for the sector.

Some of our respondents attributed this lack of appetite to the mishandling of the vaccine rollout. With no clear plan or end date in sight for many European countries, this is being viewed as a sign that Europe is a long way off getting back to any kind of ‘normality’.

Other investors believe there is no longer as much opportunity as there once was here, and they are turning their attention to the UK. Although investors acknowledge that some economies in Europe are more attractive than others, on the whole many fund selectors are underweight when it comes to European equities.

US equities back in favour

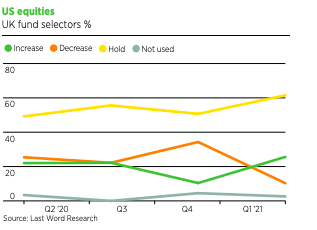

In sharp contrast, there has been a sudden spike in interest for US equities from our UK respondents.

Having been unloved for many years, and after a dip last quarter, roughly a quarter of investors are now planning on upping their allocation to this asset class.

The change in president, coupled with the successful rollout of the vaccine across the country, means the future is looking a bit brighter for the US. However, for many of our respondents it is recent economic events that have contributed towards this uptick in appetite.

As so-called ‘Faang’ stocks continue to dominate, many large US companies are also reporting positive stories, contributing to the overall health of the economy.

While there continues to be trouble in the US on a social level, from a financial and investment point of view there seems to be plenty of opportunity for those who are looking to take a chance.

The future’s bright?

At the beginning of the year, Last Word Research reported that 2021 was all set to be an improvement on 2020. While we were not wrong, with plenty of optimists about and UK investors ready to take greater risks, it seems there are still some surprises in store.

We look forward to reporting how these trends play out over the next few quarters, as more people get vaccinated and we start to leave the pandemic behind us.

This article first appeared in the May 2021 issue of Portfolio Adviser magazine. Read more here.