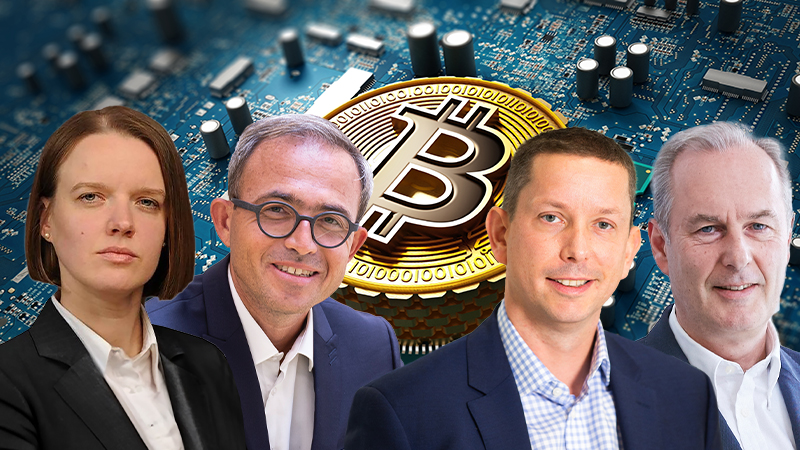

The specialist’s view

Dovile Silenskyte, director, digital assets research, WisdomTree

This year has been a historical marker for cryptocurrencies. The launch of US spot bitcoin exchange-traded funds (ETFs) in January has been the most successful ETF launch ever, bringing in just over $15bn since launch (source: Bloomberg, as at 18 Jun ’24). We could be scratching the surface when thinking about growth potential after such an impressive start. We’ve also seen listings on the London Stock Exchange, which is a significant step in the legitimisation and relevance of the asset class for UK professional investors.

The market also expects spot Ethereum ETFs to be listed in the US in July. While the adoption rate is expected to be lower than what we saw for the spot bitcoin ETFs, the liquid supply is also lower due to a large portion of ether being locked up in smart and staking contracts. We see a combination of higher demand and lower supply, which should be positive for pricing in the future.

Investor appetite has increased this year, demonstrated by net inflows across crypto exchange-traded products (ETPs) of nearly $15bn globally year to date. Since January, total assets in crypto ETPs have grown from $30bn to more than $60bn, due to these flows and overall market moves. Higher demand, with increasing institutional interest, and lower supply, due to the bitcoin halving, are positive signals that bitcoin is also pricing in the future.

Central bank policy should play a role in the medium-term price potential for cryptocurrencies. We recently witnessed the seventh consecutive Federal Open Market Committee meeting with no action on the interest rate front. The overall sentiment from major central banks remains ‘higher for longer’, and we expect uncertainty to remain elevated as we get closer to the US presidential election in November. This could weigh on the performance of the asset class until markets have more clarity around interest rates cuts.

The CIO’s view

Charles-Henry Monchau, CIO, Syz Group

Investments and transactions in bitcoin are becoming increasingly popular but its integration into everyday transactions is crucial to mainstream adoption. According to Chainalysis, more than 460 million bitcoin wallet addresses have been created. However, around 90% of these wallets are inactive, leaving just over 46 million wallets with at least $1 (£0.79).

Bitcoin remains notorious for its wide price fluctuations, posing a major problem for its use in everyday transactions. For bitcoin to be considered a unit of account, its value must be predictable and stable, similar to traditional currencies such as the dollar. Increased liquidity and adoption of bitcoin should reduce its volatility.

And while Layer 2’s Lightning Network has improved the speed and scalability of bitcoin transactions, also making the process more environmentally friendly, instant processing of billions of transactions remains out of reach for the time being. What’s more, as the network grows and transaction volumes increase, so do transaction fees.

Governing a decentralised financial system also poses unique regulatory challenges. Governments will need to develop new laws or modify existing ones to manage a currency that transcends national borders and operates outside the traditional banking system.

Whether bitcoin will become the universal currency remains uncertain, yet its enduring growth positions ‘hyperbitcoinisation’ as a plausible future. As the saying goes, ‘necessity is the mother of invention’, and we find ourselves in the heart of a failing fiat experiment and a growing necessity to use bitcoin as a medium of exchange, store of value and potential unit of account.

The fund selector’s view

Ryan Hughes, interim managing director, AJ Bell Investments

The broad theme of digital assets encompassing cryptocurrencies fits firmly in the Marmite camp at the moment, with those loving it seemingly positioning themselves as evangelists and those on the other side saying they won’t touch such investments with a 10-foot barge pole.

On topics such as this, it’s important to remove the emotion from the thought process and try to assess such divisive investment opportunities rationally. At AJ Bell, we have an investment framework that we use to assess all investment opportunities as that provides us with a consistent application process to judge investments equally and take emotion out of the equation.

As it stands, these digital assets do not fit that framework, as key elements include being able to model future returns as well as understand the long-term volatility and correlation against other asset classes.

While investors’ understanding of digital assets continues to increase, they still seem some way off from being considered genuinely mainstream, with their return profiles looking more like speculation tools than credible long-term investments. One only has to look at the recent boom and bust on non-fungible tokens to be reminded of the risk of such assets.

However, it’s also important not to pretend these assets don’t exist. While they may not fit our framework today, that will almost certainly change in the future and therefore it’s vital we have an awareness and understanding of what digital assets are and how they are evolving. As we a result, we currently sit on the sidelines as interested observers, happy to be prudent with our clients’ money while at the same time building our knowledge for when these digital assets can genuinely be considered mainstream investment opportunities.

The wealth manager’s view

Mark Northway, investment manager, Sparrows Capital

Digital and traditional assets are beginning to converge through several key processes – the adoption of Central Bank Digital Currencies (CBDCs), decentralised finance, tokenisation of physical assets and stablecoin issuance.

We are starting to see the development of decentralised autonomous organisations that parallel the traditional corporate ownership and governance structures.

Going forward, digitalisation is likely to fundamentally reshape the roles of custodians, exchanges and registrars, presenting a mix of new opportunities and challenges for investors.

For the allocator, these developments will, in due course, present attractive alternative investment classes with underlying economic engines, and the opportunity to diversify into a decentralised economy. But, in order for this to happen, there needs to be further development of trusted custody and trading processes and a reliable legal framework, a degree of recentralisation to foster convergence.

Today, according to CoinGecko, decentralised finance represents only 4% of the total $2.71trn crypto market and stablecoin (including CBDCs) just 6%. The vast majority of the digital asset market is therefore in the form of pure digital currencies, effectively an alternative exchange mechanism and store of value, unsupported by an economic engine or by intrinsic – as opposed to utility – value.

The investment – as opposed to trading – thesis for pure cryptocurrencies is primarily that such assets are impervious to the debasement that fiat currencies suffer through national inflation.

Voltaire is quoted as saying that paper money eventually returns to its intrinsic value of zero. He has a point, but there is no fundamental reason that pure cryptocurrencies should avoid the same fate. Importantly, investors and allocators don’t invest in fiat currencies but rather through fiat currencies, and into assets that provide a hook into an economic engine. Being seen as an investment in its owns right is a characteristic that cryptocurrencies share with gold.

For the allocator, the issue is that the ETFs and ETP which have appeared so far have focused on store of value digital assets – pure crypto. Allocators don’t diversity for the sake of diversification, but to access premium from uncorrelated assets. Bitcoin and ether tick one box by being largely uncorrelated, but there remains a lack of evidence justifying the existence of a persistent premium.

So, from an allocator’s perspective it is the next phase of development of digital assets, and the continued build out of a parallel decentralised economy, that will provide an interesting investment thesis. We’re not there yet.

This article originally appeared in the July/August issue of Portfolio Adviser magazine