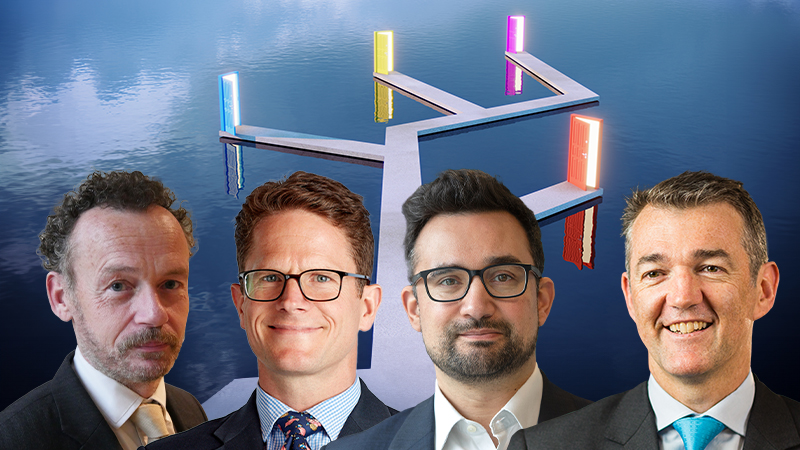

The wealth manager’s view

Jon Cunliffe, head of investment office, JM Finn

Notwithstanding gold’s 35% rally in sterling terms since the start of 2024, we continue to like the metal as both a return-seeking asset and a diversifier with defensive properties.

In the US we are seeing an aggressive policy pivot to embrace a strongly reflationary fiscal and monetary policy stance. With real rates likely to fall significantly over the next 12-18 months, reflecting further US rate cuts and sticky inflation, we anticipate a continuation of last year’s favourable macroeconomic tailwinds for the precious metal.

Elsewhere, the creeping bearishness of fiat currency, which has manifested itself in the strong run up in bitcoin and other cryptocurrencies, remains another positive driver of the gold price. The US has been running a current account of roughly 4% GDP for some time now and long-term estimates of debt-to-GDP under Trump are as high as 140%.

Against this background, and notwithstanding the market’s current confidence in the US dollar, we feel that we are entering a world where the fear of currency debasement will see investors – including central banks – increasingly favour ‘hard’ currency over what are effectively paper promises.

Finally, and on a much more basic level, we have entered a year which is likely to be characterised by elevated US-driven macro policy and geopolitical uncertainty – again, another reason to hold gold.

The fund selector’s view

Peter Dalgliesh, CIO, Parmenion

Consensus expectations are over-whelmingly for a soft landing in the US, with trend-like growth and inflation only marginally above the US Federal Reserve’s 2% target. The risks therefore are that either of these turn out differently – which should not be underestimated, especially given US president Donald Trump’s pro-growth ‘America first’ agenda.

So how do we protect against these risks? First, to protect against an inflation shock we include real asset exposure through a combination of commodity and infrastructure funds, as well as inflation-linked government bonds. With break-evens on treasury inflation-protected securities at 2.4% and a real yield of 2.3%, these seem attractive attributes in case the disinflation narrative does not materialise.

Second, to protect against the risk of a growth shock we include global government bond exposure in conjunction with uncorrelated absolute return funds.

This approach blends the longer-duration characteristics from government bonds, which typically benefit from lower interest rates that tend to come with slower growth, with a variety of long/short positioning aiming to deliver a steady absolute and therefore uncorrelated return.

Given the concentrated investor positioning in growth assets so prevalent today, we believe adopting this deliberately diversified approach may forego some short-term returns, but in the long run generate more stable and consistent client outcomes– which will help keep them invested for the long term.

The strategist’s view

Alex Harvey, senior portfolio manager and investment strategist, Momentum Global Investment Management

At Momentum we remain alert to new strategies and emergent asset classes that can provide an alternative return – and diversification benefits – in a liquid and readily tradeable vehicle. The often-complex nature of the risk premium being exploited may require some kind of structuring and/or leverage to generate a return high enough to make it attractive to potential investors.

Any dependence on leverage would likely make such a strategy more susceptible to higher rates – something we have clearly been exposed to in recent years – but with rates slowly moving lower that should support these types of alternative strategies.

We also like to see persistence of a risk premia, which is usually the result of human behaviour and an asymmetric risk bias. Humans will overpay for insurance, so a risk premium can be extracted from options markets and more traditional insurance markets (insurance-linked securities). The return streams can be more complex to extract, but that will be part of the reason it both persists and exists in the first place. It should also be somewhat intuitive as if you can’t explain where the return comes from, then it’s probably a non-starter.

Readers will likely be aware of the significant discounts available in the UK investment trust market today.

While these trusts do carry some directional market risk, they offer access to alternative return sources which span renewables, leasing, infrastructure, property, leasing and royalties, to name a few.

In 2024, we launched the Momentum Real Assets Growth and Income fund to provide investors with diversified blend of some of the best opportunities in this sector today.

We blend this fund with several other liquid alternatives strategies that invest in hedge fund-type risk premia and which exhibit long volatility characteristics. We have invested in the Neuberger Berman Uncorrelated

Strategies fund pretty much since launch in 2017, and while annualised returns are modest, it does provide good ballast during periods of elevated market risk – and not just risk-off periods: it is up around 10% over the past six months.

The portfolio manager’s view

Peter Fitzgerald, CIO, macro discretionary, Aviva Investors

Any diversifying position in a portfolio should satisfy several criteria. It should have a low correlation to the rest of the portfolio, an expected return that is positive and it should be liquid so that when circumstances change, the investments change.

First, correlations, while useful, should not be the sole criteria as they can change. Second, there is little point in having a position that is going to lose money while claiming it is a diversifier. And finally liquidity, which is effectively investors’ ability to change their mind, is regularly underappreciated.

Most investors today will have exposure to US equities – approximately 70% of a global equity benchmark – and will therefore also be exposed to certain factors, whether by explicit choice or not. These factors will be biased towards growth and momentum. So, by default one should not consider these factors to be diversifying.

While government bonds could offer protection to a portfolio, they are only likely to be effective if growth and inflation both fall more than expected. In a world where inflation remains sticky and central banks are unable to cut rates (and may even have to consider hiking), government bonds will not help.

I would argue that investors should consider allocations within equities to value stocks, oil & gas and potentially smaller companies. In 2022, which was the nightmare scenario for a traditional balanced portfolio, allocations to this part of the market would have helped. Allocations to out-of-favour energy companies fared well. US energy stocks rose some 60% while European oil & gas stocks rose around 30%.

While the future may pan out differently, my argument remains: diversify your equity allocations.

This article first appeared in the February issue of Portfolio Adviser magazine