Fidelity has pulled ahead of rival fund groups and enjoyed its strongest quarter for sales on record, despite a volatile start to the year in which investors fretted over the war in Ukraine and rising inflation.

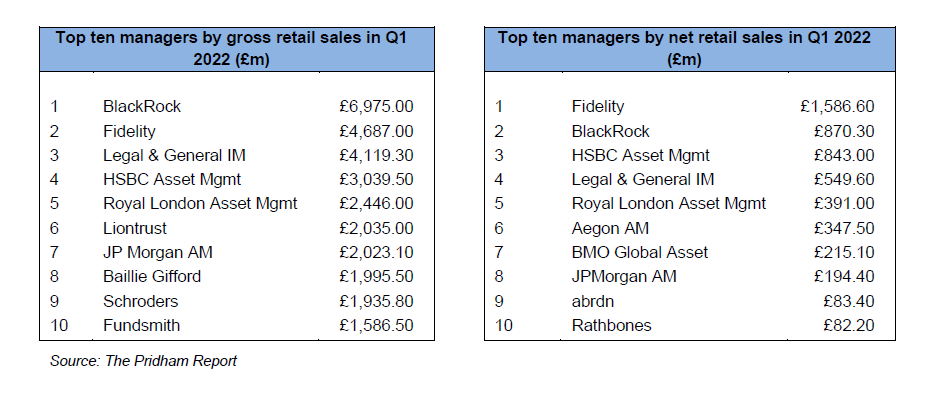

The fund group raked in £1.6bn of net sales in the first three months of the year, the latest Pridham Report shows. This was nearly twice as high as Blackrock, the second highest net seller, which brought in £870.3m.

Fidelity also saw its highest ever quarterly gross sales of £4.7bn, putting it second on the leaderboard behind Blackrock with £7bn.

Paula Pridham, deputy editor of the Pridham Report, noted gross sales of Fidelity’s equity funds are up 60% compared to the previous quarter. Its £2.5bn Global Dividend fund was the fourth best-selling retail product in the whole of the UK fund market.

Abrdn also had a strong start to the year, Pridham highlighted, with inflows across both active and passive equities, fixed income and multi-asset funds. With £83.4m in net retail sales, it came in at number nine on the leaderboard after not featuring at all in Q4 2021.

Baillie Gifford and Fundsmith in the top for gross retail sales despite growth sell-off

Despite Russia’s invasion of Ukraine and the prospect of higher inflation and interest rates unsettling markets, Pridham said the top fund groups saw resilient sales during the period.

Passives giants HSBC Asset Management and Legal & General Investment Management were also among the strongest sellers in Q1, taking in net retail flows of £843m and £549m respectively.

Royal London Asset Management climbed into fifth place for both gross and net sales, which Pridham attributed to ongoing demand for its sustainable equities and fixed income funds, as well as inflows into its short-dated vehicles.

Demand for sustainable products also likely helped Liontrust remain among the top 10 firms for gross retail sales, which also included Baillie Gifford and Fundsmith. But unlike the previous quarter, the trio were absent from the net retail sales leaderboard.

Demand for North American equities heats up

Pridham singled out the Baillie Gifford American fund as one of the biggest drivers of the Edinburgh manager’s £2bn gross sales, a somewhat surprising state of affairs, considering it was one of the worst performing funds in Q1.

JP Morgan Asset Management, which was in the top 10 for net and gross sales, also benefited from investor demand for North American equities, with the JPM America Equity fund and onshore US Equity Income fund responsible for the bulk of inflows.

“Despite interest rates being at a 13-year high, investing in funds with a strong track record remains an attractive proposition for long term investors against a backdrop of increasing inflation and the war in Ukraine,” Pridham said.