Many asset management firms and strategies are keen to show their commitment to ESG, but without the expertise and proper integration, some, including American Century Investments and Vanguard, are lagging behind their peers.

In a new report, The Morningstar ESG Commitment Level: Our first assessment of 100-plus strategies and 40 asset managers, the research firm has applied its new ESG methodology to 107 strategies and 40 asset managers, finding some are further along their ESG journey than others.

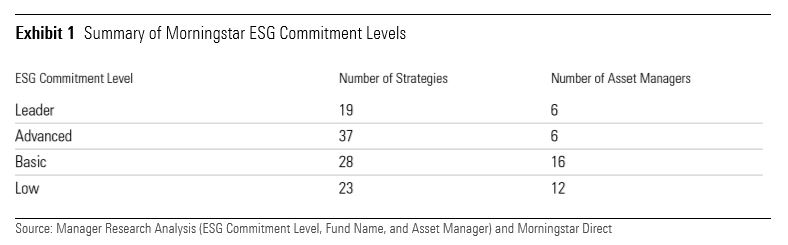

Morningstar has rolled out a new qualitative measure for assessing the levels of ESG integration of both funds and at asset managers. The Morningstar ESG Commitment Level assigns one of four levels – leader, advanced, basic and low – to strategies and asset managers.

For funds, analysts decide the commitment level by analysing their process, resources, and the asset manager behind the strategy. For asset managers, the analysts assign a commitment level by assessing each firm’s philosophy and process, resources, and active ownership activities.

“In an increasingly confusing area of investing with different approaches, standards, disclosures, and more, the ESG Commitment Level will help investors discern funds and asset managers that truly focus on sustainable investing from those that incorporate ESG factors but in a limited way,” said Hortense Bioy (pictured), director of sustainability research for Morningstar in EMEA and APAC.

Calvert fund range praised

The report found 19 strategies and just six asset managers to be leading on ESG, and considered 23 strategies and 12 asset managers to have a low level of commitment to ESG.

An example of a leading strategy is Calvert Balanced, although most of the Calvert funds analysed received the ‘leader’ designation. The report noted the team takes a “more nuanced” approach to negative screening, taking sustainable investing “one step further” when engaging with companies.

“Calvert funds have the latitude to invest in such sectors provided company management is taking active steps to mitigate their negative effects. In this way, Calvert provides investors the opportunity to benefit from the sustainability transition across industries, a step above the blunt approach employed by some peers,” it said.

At the other end of the scale, Fidelity Total Bond and Fidelity Total Bond ETF have been determined to have a ‘low’ commitment to ESG. “In addition to the firm’s overall resources devoted to ESG being thin, this team has not made use of them to a noteworthy degree,” the report said, adding there is no minimum ESG score in order to be included in the portfolio.

It said although Fidelity Investments has made some steps towards ESG awareness, such as signing the UN-supported Principles of Responsible Investing (PRI) in 2017 and proxy voting that favours ESG, “it does not submit such resolutions itself and, furthermore, rarely engages with companies on ESG issues beyond one-off issues material to businesses’ financial success”.

Pam Holding, asset management head of ESG and co-head of equities at Fidelity Investments, told Bloomberg in a statement she doesn’t think the rating adequately reflects the firm’s “long-term commitment to ESG investing”.

Which asset managers are the ESG leaders and laggards?

It may not come as a surprise, then, to see Fidelity Investments in the ‘low’ commitment bucket at a firm level too, along with American Century, Loomis Sayles, Lyxor, Vanguard, BetaShares, Dimensional, Dodge & Cox, Geode, Greencape and Harris Associates.

The report said American Century Investments was “behind some peers”, with ESG issues “on the fringe” at Fidelity Investments, where no monitoring of the ESG integration process is currently in place. It noted Dimensional has “no plans” to integrate ESG considerations, given its investment philosophy is rooted in market efficiency meaning these should be reflected in stock and bond prices.

BlackRock, DWS, UBS, Pimco, Royal London and Wellington Management are among those assigned the ‘basic’ level of commitment.

Leading the sample, however, are Robeco, Calvert, Impax, Stewart Investors, Parnassus and Australian Ethical. Long ESG investing track records and experienced teams are common among ESG leaders, as well as comprehensive integration across all strategies.

For example, the report said, at Impax “ESG considerations are incorporated at every stage of the investment process and rely on the firm’s robust proprietary ESG research and tools”. Transparency and strong proxy voting are also key.

Morningstar will begin to roll out the equity research rating enhancements on 9 December 2020 and apply to Morningstar’s global equity research coverage universe of more than 1,500 companies. The incorporation of ESG factors will update on a rolling basis through 2021.

For more insight on responsible investment, please click on www.esgclarity.com