It’s been a tough few years for active equity fund managers. Having to navigate headwinds like Brexit and the US-China trade war, struggling to cope with a market that increasingly diverged away from fundamentals to instead be spurred by political movements fears have wrong-footed many active managers. Meanwhile, passives have managed to do well in rising markets: a trend we have also seen within the multi-asset space.

But is the tide starting to turn for active multi-asset this year?

To answer this, we will look at all the funds that sit within FE’s Risk-Targeted Multi-Asset universe (RTMA). While the IA mixed sectors would normally be a good point of call, these sectors lump together both funds which are volatility-targeted and those who simply happen to have a certain level of volatility attributed to the fund but may not have a risk process embedded in their investment approach. In comparison, the RTMA universe will have funds with risk controls in place meaning comparing the funds becomes a little fairer.

Within this universe, we can also add further granularity to these funds by breaking them into groups: passive and active multi-asset funds. Within the active bucket we can also distinguish between managers who either invest into external or internal fund managers, or those who simply buy directly into the markets.

Over the long-term passives dominated. Looking at the risk levels from 2-6 (excluding risk level 1 and 7 due to the limited number of funds available) over a three and five year basis, six of the top-10 spots were occupied by passive funds.

That’s not to say that active managers haven’t been able to generate good returns as shown in the table which shows both the best and worst performers per risk bands). Zurich’s Horizon Multi-Asset range managed by Threadneedle, who create the portfolios from a collection of their own funds, have done consistently well over a long-term basis. On the lower end of the risk scale, Janus Henderson Core 5 Income and FP Luceo 4 also managed to generate good performance.

Best and worst multi-asset performance in each risk band

| Fund Name | Multi-Asset Breakdown | UK RTMA Sector | Three Years % |

| L&G Multi-Index 4 | Passive | UK RTMA Risk 2 – Cautious | 16.1% |

| MI Momentum Focus 3 | Actively managed – External | UK RTMA Risk 2 – Cautious | 3.4% |

| Zurich Horizon Multi-Asset II | Actively Managed – Internal | UK RTMA Risk 3 – Moderate | 21.6% |

| Margetts Providence Strategy | Actively managed – External | UK RTMA Risk 3 – Moderate | 9.5% |

| Close Balanced Portfolio | Actively managed – Direct | UK RTMA Risk 4 – Balanced | 26.7% |

| Invesco Balanced Risk 8 (UK) | Actively managed – Direct | UK RTMA Risk 4 – Balanced | 11.4% |

| Architas MA Passive Progressive | Passive | UK RTMA Risk 5 – Growth | 27.4% |

| Invesco Balanced Risk 10 (UK) | Actively managed – Direct | UK RTMA Risk 5 – Growth | 13.7% |

| Close Growth Portfolio | Actively managed – Direct | UK RTMA Risk 6 – Adventurous | 32.9% |

| 7IM Adventurous | Actively Managed – External | UK RTMA Risk 6 – Adventurous | 15.8% |

Source: FE Fundinfo

Architas on the up while Myfolio struggles YTD

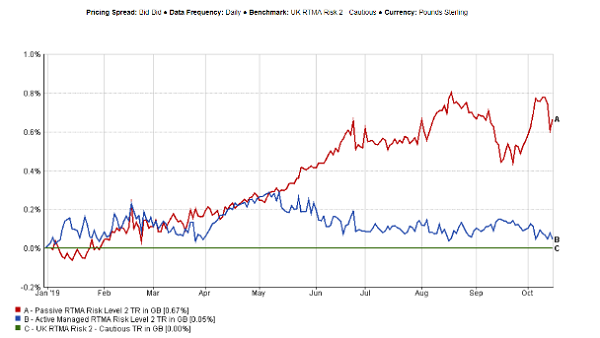

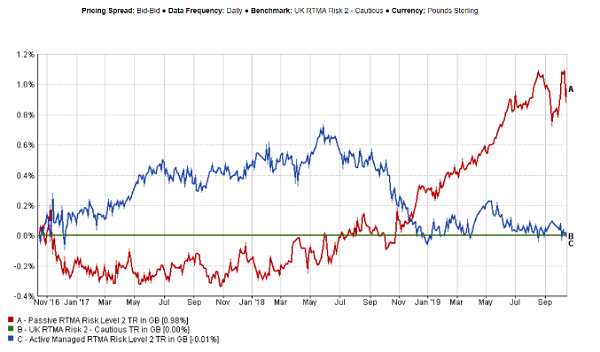

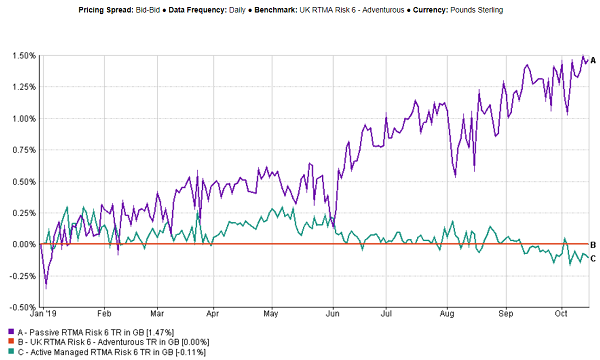

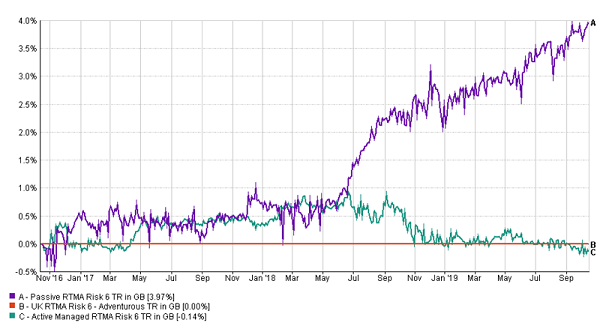

Not really. By splitting the active and passive funds into customs sectors per risk band we can chart the performance and year-to-date the dispersion between them remains high. Given that we have yet to see any significant market rotations and the incredible long running bull market continues to carry on despite the rising noise, it isn’t that surprising to see the gap widen and passive multi-asset funds peel off.

Figure 1: YTD passive versus active relative adjusted performance (Risk level 2)

Figure 2: 3-year passive versus active relative adjusted performance

Figure 3: YTD passive versus active relative adjusted performance (Risk level 6)

Figure 4: 3-year passive v active relative adjusted performance (Risk level 6)

In terms of the active managers who tended to perform well year-to-date, Architas’ active and blended range whose stringent external fund manager selection process coupled with the ability to tactically deviate in both investment style and region have helped drive returns. Fund houses who invested directly into the market like Rathbone Strategic Growth Portfolio and Close Growth portfolios also ranked highly. On the contrary, a lot of active managers continued to struggle such as the likes of ASI’s Myfolio Multi Manager and Managed range whose domestic orientation and European value tilt limited upside.

Should we just stick to passive multi-manager portfolios instead?

While it seems to be wise given the disparity in performance numbers over the last few years, there remains active funds who are managing to navigate a tricky environment well. Nevertheless, I think the market environment has noticeably shifted. We are in an era where central banks are supporting the economy while governments drag their feet, interest rates remain ultra-low and negativity continues to remain high. In turn fund managers and subsequently fund allocators have to keep up. Rather than simply blaming the market conditions, adapting to the “new normal” and making the right fund selections will become increasingly more important for fund allocators.

Ahmed Mohamoud is a research assistant at FE Fundinfo